QUOTE(Hansel @ Sep 17 2015, 01:27 PM)

Did RM strengthen today ??? I saw the exchange rate from RM into the SGD is at the highest point on record now.

Still at rm3.1 USD/MYR drop, V2

|

|

Sep 17 2015, 01:35 PM Sep 17 2015, 01:35 PM

|

Senior Member

11,554 posts Joined: Aug 2009 |

|

|

|

|

|

|

Sep 17 2015, 01:59 PM Sep 17 2015, 01:59 PM

|

Senior Member

10,001 posts Joined: May 2013 |

In fact, USD/MYR strengthen from 4.3060 on 15/9 to 4.2585 now

|

|

|

Sep 17 2015, 02:04 PM Sep 17 2015, 02:04 PM

|

Junior Member

340 posts Joined: Jun 2011 |

USD-MYR 4.2425 0.0035

My machinery are all quoted in USD Regret didnt buy earlier. Ooh well... |

|

|

Sep 17 2015, 02:07 PM Sep 17 2015, 02:07 PM

|

Senior Member

9,354 posts Joined: Aug 2010 |

Tq for the replies, gentlemen,...

|

|

|

Sep 17 2015, 02:35 PM Sep 17 2015, 02:35 PM

Show posts by this member only | IPv6 | Post

#345

|

Senior Member

808 posts Joined: Apr 2009 |

QUOTE(Hansel @ Sep 17 2015, 01:27 PM) Did RM strengthen today ??? I saw the exchange rate from RM into the SGD is at the highest point on record now. Usually I refer to this live rate money changer in SG.http://arcademoneychangers.com.sg/ratesbiglogo.asp highest rate so far recorded at 3.04 a couple days ago. |

|

|

Sep 17 2015, 04:18 PM Sep 17 2015, 04:18 PM

|

Senior Member

9,354 posts Joined: Aug 2010 |

QUOTE(yck1987 @ Sep 17 2015, 02:35 PM) Usually I refer to this live rate money changer in SG. Then your rate is better than what I see in the banks for TT purposes. I am not surprised though,.. usually the money-changers offer better rates than the banks, but you must be onsite with cash to exchange.http://arcademoneychangers.com.sg/ratesbiglogo.asp highest rate so far recorded at 3.04 a couple days ago. |

|

|

|

|

|

Sep 17 2015, 04:29 PM Sep 17 2015, 04:29 PM

|

All Stars

24,454 posts Joined: Nov 2010 |

zeti has some advice:

falling rm, gst, weak economic outlook. cars, houses, food included, i suppose. in short, she is saying we are all poorer, accept it and make adjustments. QUOTE Amid a challenging period of the economy, Bank Negara Malaysia governor Tan Sri Zeti Akhtar Aziz has advised everyone to start making adjustments. She said, in an exclusive interview with the New Straits Times, that this could mean forgoing overseas holidays and educate children locally or in local branches of foreign universities. - See more at: http://www.themalaysianinsider.com/malaysi...h.lw7iWspK.dpuf This post has been edited by AVFAN: Sep 17 2015, 04:30 PM |

|

|

Sep 17 2015, 06:56 PM Sep 17 2015, 06:56 PM

|

Senior Member

9,354 posts Joined: Aug 2010 |

|

|

|

Sep 17 2015, 09:39 PM Sep 17 2015, 09:39 PM

Show posts by this member only | IPv6 | Post

#349

|

Senior Member

10,001 posts Joined: May 2013 |

Invaluable advise from Governor to youngsters

|

|

|

Sep 17 2015, 10:02 PM Sep 17 2015, 10:02 PM

|

All Stars

18,411 posts Joined: Oct 2010 |

QUOTE(AVFAN @ Sep 17 2015, 04:29 PM) zeti has some advice: That's only half of the story, she also said:falling rm, gst, weak economic outlook. cars, houses, food included, i suppose. in short, she is saying we are all poorer, accept it and make adjustments. She told the daily that during the 1997/1998 financial crisis, Malaysia took 18 months to recover. “Our track record has shown us that every time we have been set back, time and again, we have been able to bounce back. It is more than once. We bounced back, and we bounced back quickly,” she was further quoted as saying. – September 17, 2015. - See more at: http://www.themalaysianinsider.com/malaysi...K.5EHYZWwn.dpuf |

|

|

Sep 17 2015, 10:23 PM Sep 17 2015, 10:23 PM

|

|

Elite

15,855 posts Joined: Jan 2003 |

QUOTE(MGM @ Sep 17 2015, 10:02 PM) That's only half of the story, she also said: MGM,She told the daily that during the 1997/1998 financial crisis, Malaysia took 18 months to recover. “Our track record has shown us that every time we have been set back, time and again, we have been able to bounce back. It is more than once. We bounced back, and we bounced back quickly,” she was further quoted as saying. – September 17, 2015. - See more at: http://www.themalaysianinsider.com/malaysi...K.5EHYZWwn.dpuf So, do you believe that Malaysia can recover in 18 months NOW without Extra Oil Money?? Dreamer |

|

|

Sep 17 2015, 10:43 PM Sep 17 2015, 10:43 PM

|

All Stars

18,411 posts Joined: Oct 2010 |

|

|

|

Sep 17 2015, 10:49 PM Sep 17 2015, 10:49 PM

|

Senior Member

9,354 posts Joined: Aug 2010 |

I am really glad that I have my foreign-currencies investment income now with which I can use to pay for my overseas-related expenses, eg, my travelling abroad.

|

|

|

|

|

|

Sep 18 2015, 12:16 AM Sep 18 2015, 12:16 AM

|

All Stars

18,411 posts Joined: Oct 2010 |

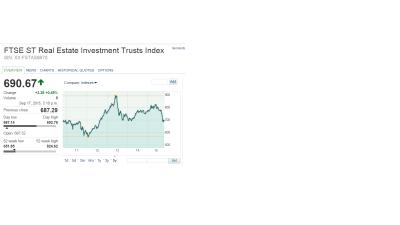

QUOTE(Hansel @ Sep 17 2015, 10:49 PM) I am really glad that I have my foreign-currencies investment income now with which I can use to pay for my overseas-related expenses, eg, my travelling abroad. Congrats Say if I had invested rm250k(SGD100k) in S-reit(instead of ASx) 3 years ago, would my present value in S-reit > SGD100k (rm300k)? My present value of the ASx is roughly rm250k+21%=rm302k. Based on the chart below, FTSE ST Real Estate Investment Trusts Index SIN: XX:FSTAS8670 was about the same level 3 years ago compare to now.~700. Does the chart includes dividend? Attached thumbnail(s)

|

|

|

Sep 18 2015, 01:03 AM Sep 18 2015, 01:03 AM

|

All Stars

24,454 posts Joined: Nov 2010 |

QUOTE(MGM @ Sep 17 2015, 10:02 PM) That's only half of the story, she also said: we all hope so for the sake of the younger generations.She told the daily that during the 1997/1998 financial crisis, Malaysia took 18 months to recover. “Our track record has shown us that every time we have been set back, time and again, we have been able to bounce back. It is more than once. We bounced back, and we bounced back quickly,” she was further quoted as saying. – September 17, 2015. - See more at: http://www.themalaysianinsider.com/malaysi...K.5EHYZWwn.dpuf but will probably be harder and longer this time with so much more debt now than before. and what sectors will be the "saviors"? palm oil does not look like it. oil and gas will certainly not be it given latest analysis from opec and goldman: QUOTE OPEC says no $100 oil until 2040: Reuters sources http://www.cnbc.com/2015/09/16/oil-prices-...stock-draw.html Goldman Sees 15 Years of Weak Crude as $20 U.S Oil Looms http://www.bloomberg.com/news/articles/201...l-looms-on-glut |

|

|

Sep 18 2015, 06:34 AM Sep 18 2015, 06:34 AM

Show posts by this member only | IPv6 | Post

#356

|

Senior Member

10,001 posts Joined: May 2013 |

|

|

|

Sep 18 2015, 06:35 AM Sep 18 2015, 06:35 AM

Show posts by this member only | IPv6 | Post

#357

|

Senior Member

10,001 posts Joined: May 2013 |

Federal Reserve kept its benchmark interest rate unchanged on Thursday

|

|

|

Sep 18 2015, 07:29 AM Sep 18 2015, 07:29 AM

|

All Stars

24,346 posts Joined: Feb 2011 |

|

|

|

Sep 18 2015, 07:52 AM Sep 18 2015, 07:52 AM

|

All Stars

12,505 posts Joined: May 2007 From: Triumph in the Skies Status:In LoV3 Again |

|

|

|

Sep 18 2015, 08:08 AM Sep 18 2015, 08:08 AM

|

Senior Member

4,258 posts Joined: Nov 2012 |

QUOTE(KTCY @ Sep 18 2015, 07:52 AM) Noob here. Just wondering if interest rate increase What will be the impact to market. If didn't then What will happen? I wish it was that simple. Interest rate increase --> then this happen, interest rate decrease --> then this happen. Interest rate increase, by convention, stock market should come down. Yesterday interest rate no increase, stock market should celebrate and rise. But DJ come down. Unpredictable |

|

Topic ClosedOptions

|

| Change to: |  0.0285sec 0.0285sec

0.25 0.25

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 7th December 2025 - 06:27 PM |