Outline ·

[ Standard ] ·

Linear+

Credit Cards Citibank Credit Cards V4, Everything About Citi Credit Cards

|

chonghe

|

Jun 25 2019, 07:39 PM Jun 25 2019, 07:39 PM

|

|

QUOTE(basSist @ Jun 25 2019, 11:30 AM) Received my boost RM500 redemption code. After almost 2 months of spending. QUOTE(WinterDays @ Jun 25 2019, 11:44 AM) They send the Citi Cyber Sale RM500 Boost redemption code via email, I just received today. So far did anyone received RM30 Boost redemption code for first 2,000 applicants who submit all documents within 7 business days? That's quick, still haven't received mine. Btw did you top up Bigpay to achieve the RM1k spend? Edit: I also didn't receive the RM30 neither This post has been edited by chonghe: Jun 25 2019, 07:39 PM |

|

|

|

|

|

chonghe

|

Jul 6 2019, 03:12 PM Jul 6 2019, 03:12 PM

|

|

Received boost RM 500 redemption code but when I tried to redeem in boost app, it says invalid code. Anybody encounters this issue?

Edit: although it says invalid but I saw my balance increase anyway

Thanks Citibank!

This post has been edited by chonghe: Jul 6 2019, 03:13 PM

|

|

|

|

|

|

chonghe

|

Sep 15 2019, 06:03 PM Sep 15 2019, 06:03 PM

|

|

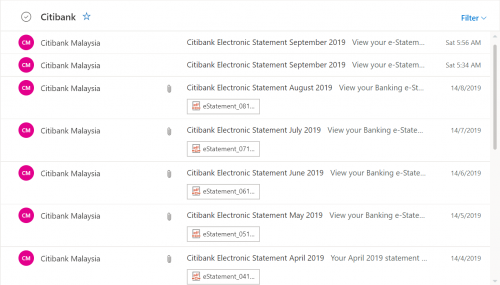

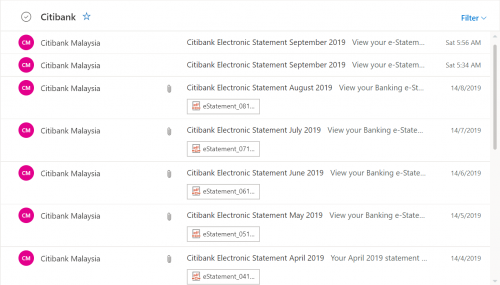

QUOTE(#Victor @ Sep 15 2019, 04:51 PM) anyone have issue where electronic statement email sent from Citibank for month of September without the pdf attachment?  I received SMS a while ago saying that starting some time this month will have to log in website to download statement |

|

|

|

|

|

chonghe

|

Oct 6 2019, 09:10 PM Oct 6 2019, 09:10 PM

|

|

QUOTE(realitec @ Oct 5 2019, 02:44 PM) RM0 Citi: Turn your credit limit into cash @ 3.14%pa by 31Oct19 (EIR 5.9%pa). Book online now at (T&C) Received message of the above. Anyone can explain what is EIR? 3.14% pa seems good, but what is EIR? Can I know how long are you with Citibank? This is a pretty good rate in the market (though sometimes some banks promotion got better rate) |

|

|

|

|

|

chonghe

|

Oct 7 2019, 04:53 PM Oct 7 2019, 04:53 PM

|

|

QUOTE(realitec @ Oct 6 2019, 10:36 PM) Like 2 years plus. Is it good? The EIR scared me though. Although the rate per annum seems pretty good. I mean if you don't need urgent cash of course don't take it, but for some people sometimes they need urgent cash, so 3.04% flat interest considered not bad |

|

|

|

|

|

chonghe

|

Feb 9 2020, 11:51 AM Feb 9 2020, 11:51 AM

|

|

If I understand correctly, I can start topping up now (Feb) until June (5 consecutive months) then I should qualify for max cash back?

|

|

|

|

|

|

chonghe

|

Feb 9 2020, 04:42 PM Feb 9 2020, 04:42 PM

|

|

QUOTE(alandhw @ Feb 9 2020, 01:25 PM) I have same the same understanding cool. Wait no more to top up  |

|

|

|

|

|

chonghe

|

Feb 22 2020, 11:57 AM Feb 22 2020, 11:57 AM

|

|

QUOTE(rarsgara @ Feb 22 2020, 11:28 AM) Sharing: RM0 Citi: Weekend bonus! Get RM80 cashback with cumulative min RM800 spend on Saturday/Sunday with Citi card till 23FEB20 @ www.citi.asia/wkend (T&C) QUOTE(neverfap @ Feb 22 2020, 11:47 AM) Received this too. Read the tnc while half asleep and use it on BigPay anyway. Haha Message says until tomorrow, but TnC says until 05 Apr? So not sure are we only eligible for this week or also the following weeks? |

|

|

|

|

|

chonghe

|

Feb 23 2020, 01:37 PM Feb 23 2020, 01:37 PM

|

|

QUOTE(tan_aniki @ Feb 22 2020, 12:01 PM) yeah but the message received says until 23feb (today) only, which contradicts with the tnc table |

|

|

|

|

|

chonghe

|

Mar 25 2020, 09:46 PM Mar 25 2020, 09:46 PM

|

|

QUOTE(tan_aniki @ Mar 25 2020, 07:38 PM) at least 90+ from our group didn't miss it as we already whack yesterday after received the info of the amendment just noticed the change, seem like late already  your group of 90+ is professional in credit card and finance? |

|

|

|

|

|

chonghe

|

Apr 8 2020, 04:42 PM Apr 8 2020, 04:42 PM

|

|

QUOTE(tan_aniki @ Apr 8 2020, 03:54 PM) we have started to whack since yesterday noon gou shou is here again  how you all know about this yesterday? I see people here only start receiving sms today |

|

|

|

|

|

chonghe

|

Jul 4 2020, 10:24 AM Jul 4 2020, 10:24 AM

|

|

QUOTE(kons @ Jul 4 2020, 09:55 AM) it is good if you really need cash and you are considering personal loan / cash advance already. loan over unsecured revolving credit will lower your ctos score but if you dont plan to buy house/car in the next 5 yrs it should be fine. i have taken citi quickcash 2x before and fully repaid them in 2 years with a bit of penalty. Penalty = 5% of outstanding amount, is there any other penalty/catch for this quickcash? I have a look that the first month of payment is much lesser, not sure what is that for? |

|

|

|

|

|

chonghe

|

Jan 1 2021, 10:40 PM Jan 1 2021, 10:40 PM

|

|

so today topup RM1k not entitled to campaign 1 of RM100 cashback, need to wait tomorrow

This post has been edited by chonghe: Jan 1 2021, 10:40 PM

|

|

|

|

|

|

chonghe

|

Jan 29 2021, 09:48 AM Jan 29 2021, 09:48 AM

|

|

QUOTE(reeve-826 @ Jan 29 2021, 09:13 AM) Received called for promotion at 3.7% fixed rate of quick cash from credit card. Worth for this interest rate ? any lowest so far? Normal, I have seen 3.14% in the past, but not always |

|

|

|

|

|

chonghe

|

Jan 29 2021, 10:02 AM Jan 29 2021, 10:02 AM

|

|

QUOTE(Wolgie @ Jan 29 2021, 09:59 AM) Citibank got Citi PayLite/ Citi FlexiBill. Just convert it to 1yrs will get around 3.12%p.a flatrate. I done that this month. u can try it  but this is about getting cash from cc limit |

|

|

|

|

|

chonghe

|

Apr 15 2021, 11:15 PM Apr 15 2021, 11:15 PM

|

|

that's a pity. Hope not so soon? We have 1-year ongoing online topup campaign cash back, lol

|

|

|

|

|

|

chonghe

|

Apr 29 2021, 02:37 PM Apr 29 2021, 02:37 PM

|

|

I got nothing. I top up morning time usually ~8 a.m. didn't expect have to do it within the first 5 mins

|

|

|

|

|

|

chonghe

|

Apr 30 2021, 05:45 PM Apr 30 2021, 05:45 PM

|

|

QUOTE(lowyat101 @ Apr 30 2021, 05:15 PM) May I know which merchant was your topup? Just to see if it's merchant related. Bigpay, don't think is merchant related, reading through the comment I realise I just got too late |

|

|

|

|

|

chonghe

|

Apr 21 2022, 09:43 PM Apr 21 2022, 09:43 PM

|

|

Recently receive so many marketing sms and calls from Citibank, it is getting a little annoying

|

|

|

|

|

|

chonghe

|

Apr 29 2022, 07:29 PM Apr 29 2022, 07:29 PM

|

|

|

|

|

|

|

Jun 25 2019, 07:39 PM

Jun 25 2019, 07:39 PM

Quote

Quote

0.0457sec

0.0457sec

0.61

0.61

7 queries

7 queries

GZIP Disabled

GZIP Disabled