Outline ·

[ Standard ] ·

Linear+

Credit Cards Citibank Credit Cards V4, Everything About Citi Credit Cards

|

bowranger

|

Jul 2 2023, 07:40 PM Jul 2 2023, 07:40 PM

|

Getting Started

|

QUOTE(ericlaiys @ Jul 2 2023, 12:25 PM) check email. they already informed me Nope. Nothing about cashback quota is informed, if you know the Citi Cashback card. Allow me to elaborate: Scenario 1: Spend as usual for Citibank Cashback Card and UOB One Card separately. Spend minimum RM500 for RM40 cashback each for both cards, so I get RM80 for one last time in this Month. Scenario 2: Both card will be merged, so any spending starting this month will be merged. I can only get Max cashback RM40 even I spent RM500 each for both card. (Quota are merged this month) This post has been edited by bowranger: Jul 2 2023, 07:44 PM |

|

|

|

|

|

simonlee94

|

Jul 2 2023, 07:49 PM Jul 2 2023, 07:49 PM

|

Getting Started

|

QUOTE(bowranger @ Jul 2 2023, 07:40 PM) Nope. Nothing about cashback quota is informed, if you know the Citi Cashback card. Allow me to elaborate: Scenario 1: Spend as usual for Citibank Cashback Card and UOB One Card separately. Spend minimum RM500 for RM40 cashback each for both cards, so I get RM80 for one last time in this Month. Scenario 2: Both card will be merged, so any spending starting this month will be merged. I can only get Max cashback RM40 even I spent RM500 each for both card. (Quota are merged this month) Same situation as mine. Any alternative bank after citi cashback merge with uob one? Rugi la from rm 80 cashback become 40 😥 |

|

|

|

|

|

ericlaiys

|

Jul 2 2023, 09:48 PM Jul 2 2023, 09:48 PM

|

|

QUOTE(bowranger @ Jul 2 2023, 07:40 PM) Nope. Nothing about cashback quota is informed, if you know the Citi Cashback card. Allow me to elaborate: Scenario 1: Spend as usual for Citibank Cashback Card and UOB One Card separately. Spend minimum RM500 for RM40 cashback each for both cards, so I get RM80 for one last time in this Month. Scenario 2: Both card will be merged, so any spending starting this month will be merged. I can only get Max cashback RM40 even I spent RM500 each for both card. (Quota are merged this month) then terminate one of the card if same benefit |

|

|

|

|

|

leetan33

|

Jul 2 2023, 09:49 PM Jul 2 2023, 09:49 PM

|

|

|

|

|

|

|

|

freshinewbie

|

Jul 2 2023, 11:12 PM Jul 2 2023, 11:12 PM

|

Getting Started

|

Anyone facing the issue for redeem air miles ? The pop up msg mentioned facing delay…

|

|

|

|

|

|

pvateme

|

Jul 3 2023, 08:38 AM Jul 3 2023, 08:38 AM

|

|

QUOTE(contestchris @ Jun 29 2023, 12:21 AM) Have anyone attempted to cancel their Citibank cards recently? Any retention offer from CS? Yes, they just waived the annual fee for my cash back card on my second call to cancel the card. cancellation through first call is not successful due to payment not clear yet. This post has been edited by pvateme: Jul 3 2023, 08:39 AM |

|

|

|

|

|

thecurious

|

Jul 3 2023, 09:55 AM Jul 3 2023, 09:55 AM

|

|

Anyone know if the first 3 year annual fee waiver when signup Citibank card will continue when it becomes a UOB card?

Will the card be charged annual fee after converted to UOB card if it is still within the 3 years?

|

|

|

|

|

|

lowyat101

|

Jul 3 2023, 10:22 AM Jul 3 2023, 10:22 AM

|

|

I didn't noticed the due date for the mobile token registration, and now I cannot download the online statement as they don't sent SMS anymore. The app asked me to visit the branch or ATM to do this, may I know do I need to go for Citi ATM or UOB ATM also can?

And is it possible to activate this mobile token via ATM or need to walk-in to the branch?

Thanks

|

|

|

|

|

|

smartfreak

|

Jul 3 2023, 10:33 AM Jul 3 2023, 10:33 AM

|

|

IMPORTANT: Effective July 16, 2023, the Citibank Malaysia Facebook account will no longer be active. Please stay connected and continue to follow Citi on http://spr.ly/6184PDXdp. |

|

|

|

|

|

francis226

|

Jul 3 2023, 02:23 PM Jul 3 2023, 02:23 PM

|

|

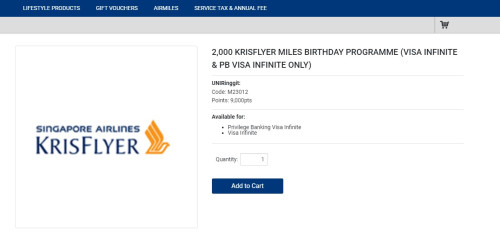

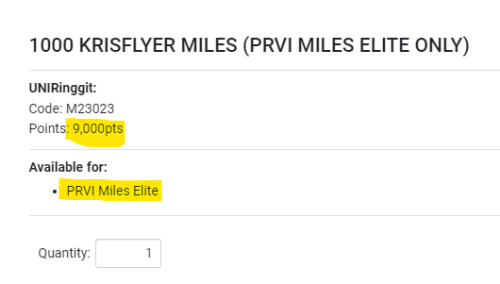

QUOTE(francis226 @ Jun 27 2023, 11:05 PM) UOB PRVI Miles Elite should be infinite tier card, the conversion rate should b 9000 UNIRM to 1000 KF. For UOB VI, conversion to miles on birthday month get 2000 KF. If PRVI Miles Elite point conversion follows UOB VI, then best card for oversea spending! Local spend still RM4500 to get 1000 KF (redemption on bday month)  One of the best card for oversea spending but BIG NO for local spend. No birthday redemption package Will you still keep? I wont, gonna cancel it after receive the new card |

|

|

|

|

|

labtec

|

Jul 3 2023, 02:47 PM Jul 3 2023, 02:47 PM

|

|

all UOB card will have annual fee...

are we going to get charge the annual fee immediately when move to UOB next month?

|

|

|

|

|

|

ryansxs

|

Jul 3 2023, 03:18 PM Jul 3 2023, 03:18 PM

|

|

QUOTE(labtec @ Jul 3 2023, 02:47 PM) all UOB card will have annual fee... are we going to get charge the annual fee immediately when move to UOB next month? then immediately will cancel it. |

|

|

|

|

|

JPSB

|

Jul 3 2023, 03:45 PM Jul 3 2023, 03:45 PM

|

|

QUOTE(leetan33 @ Jul 2 2023, 09:49 PM) hopefully, Zenith is a metal-kard |

|

|

|

|

|

_kilakila_

|

Jul 3 2023, 04:09 PM Jul 3 2023, 04:09 PM

|

|

QUOTE(JPSB @ Jul 3 2023, 03:45 PM) hopefully, Zenith is a metal-kard Tbh, the only good looking card is UOB preferred. |

|

|

|

|

|

countdracula

|

Jul 3 2023, 05:02 PM Jul 3 2023, 05:02 PM

|

|

QUOTE(leetan33 @ Jul 2 2023, 09:49 PM) They all look like cheapskate wallpaper  |

|

|

|

|

|

tiramisu83

|

Jul 4 2023, 01:10 PM Jul 4 2023, 01:10 PM

|

|

QUOTE(countdracula @ Jul 3 2023, 05:02 PM) They all look like cheapskate wallpaper  yes, agreed..looks like membership card design  This post has been edited by tiramisu83: Jul 4 2023, 01:13 PM This post has been edited by tiramisu83: Jul 4 2023, 01:13 PM |

|

|

|

|

|

tiramisu83

|

Jul 4 2023, 01:11 PM Jul 4 2023, 01:11 PM

|

|

for Prvi Miles Elite, 1500 PM * 6 = 9000 UNIRM = 1000 KF If you guys wanna keep the points after migrated to UOB, is still fine.  This post has been edited by tiramisu83: Jul 4 2023, 01:12 PM This post has been edited by tiramisu83: Jul 4 2023, 01:12 PM |

|

|

|

|

|

KuzumiTaiga

|

Jul 4 2023, 05:17 PM Jul 4 2023, 05:17 PM

|

|

Mother of god the new card designs especially zenith look so horrible

|

|

|

|

|

|

nrr P

|

Jul 4 2023, 05:23 PM Jul 4 2023, 05:23 PM

|

New Member

|

QUOTE(KuzumiTaiga @ Jul 4 2023, 05:17 PM) Mother of god the new card designs especially zenith look so horrible I agree with you. It doesn’t at all look good neither of them. I hold a citi clear card and I loved over the years how they changed their clear card looks and never regretted having them. |

|

|

|

|

|

nrr P

|

Jul 4 2023, 05:27 PM Jul 4 2023, 05:27 PM

|

New Member

|

Hi there all, just wanna check anyone knows if they are gonna start messing with credit limits after they move to their side after October? I know they mentioned based on their FAQ is a no but I feel that’s only until the full on acquisition takes place. I am surely to cancel if they start messing with limits and all. Only reason to hold on to this card would be my loyalty to citi being the first card that approved my application and the unquestioned af waiver all through the years.

|

|

|

|

|

Jul 2 2023, 07:40 PM

Jul 2 2023, 07:40 PM

Quote

Quote

0.0296sec

0.0296sec

0.69

0.69

6 queries

6 queries

GZIP Disabled

GZIP Disabled