Outline ·

[ Standard ] ·

Linear+

Recommendation for Credit Cards V3, Please post according to Format stated.

|

sbd

|

Jul 29 2015, 05:57 PM Jul 29 2015, 05:57 PM

|

|

Hi, can anyone introduce me to a credit card I should get as my second card?

1. Annual Income: ~RM 120k

2. Free Lifetime Annual Fee: Yes

3. Card required for: payment of Utilities & Petrol & Telecommunications (Cash rebate)

4. Existing credit cards if any: Maybank2Card

5. Looking at CC from: prefer cash back. Any bank.

|

|

|

|

|

|

sbd

|

Sep 28 2015, 11:00 AM Sep 28 2015, 11:00 AM

|

|

you may have a Amex platinum charge card but it won't be widely accepted unless you have Visa/Master as well. You will be disappointed if you have only Amex Plat charge. Trust me, I had it in the past.

Anyway with your income, you qualify to get it, just be prepared to pay more than 2k annual subs.

|

|

|

|

|

|

sbd

|

Sep 28 2015, 02:24 PM Sep 28 2015, 02:24 PM

|

|

QUOTE(azizikhan @ Sep 28 2015, 01:50 PM) Thank you! Appreciate your assistance. PS : If anyone help me answering the AMEX Platinum query would be great. (How to get invited ?) Cheers, AK No need to get invited. Go to any Maybank and ask to apply. If you're overseas, ask them to email you the application form |

|

|

|

|

|

sbd

|

Oct 7 2015, 04:25 PM Oct 7 2015, 04:25 PM

|

|

QUOTE(chiahau @ Oct 6 2015, 10:29 AM) Online shopping - CIMB Dining promotion - CIMB / MBB Mall shopping - Neither since MBB removed it's CB except for dining and CIMB is mostly for online and etc. Petrol - MBB Ikhwan - 5% on friday & Saturday. 2% every day with CIMB CR. No CR for M2C what about utilities and insurance? |

|

|

|

|

|

sbd

|

Oct 7 2015, 10:54 PM Oct 7 2015, 10:54 PM

|

|

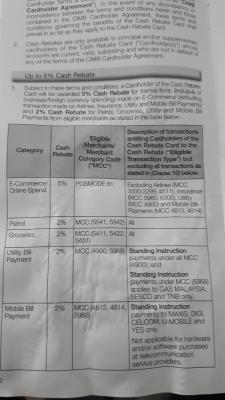

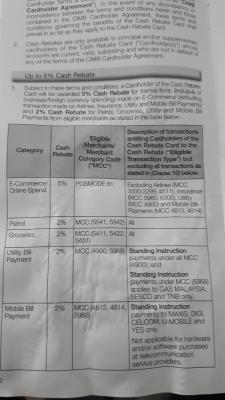

QUOTE(fruitie @ Oct 7 2015, 07:35 PM) Utilities can try HLB Wise or PBB VS. Insurance can take Aeon Watami for 3% per quarter, maximum up to RM 150 cash back per quarter. what about cimb cb plat master which is supposed to give 2% cash back for utilities though via standing instructions |

|

|

|

|

|

sbd

|

Oct 8 2015, 12:52 PM Oct 8 2015, 12:52 PM

|

|

QUOTE(fruitie @ Oct 7 2015, 10:55 PM) Yes but TNB cannot be used as SI for CIMB CR.  Others I'm not sure as I only have TNB as utilities and never got charged by Syabas...  UniFi I have Wise (under groceries because I use ePay in Sam's Groceria) and UOB VOX. hmm that's strange, the T&C clearly states 2% cash back for TNB under SI subject to a max cash back of rm50/month. see attachment.... Attached thumbnail(s)

|

|

|

|

|

|

sbd

|

Oct 8 2015, 04:50 PM Oct 8 2015, 04:50 PM

|

|

QUOTE(alexanderclz @ Oct 8 2015, 02:10 PM) if I'm not mistaken, tnb use to offer SI. but no more recently. not true I just went to TNB to sign up. |

|

|

|

|

|

sbd

|

Oct 22 2015, 03:46 PM Oct 22 2015, 03:46 PM

|

|

If I want to apply for a Maybank Visa Signature, where is the best place to go for instant card (1-hour process). Thanks. I'm in Pj/KL

|

|

|

|

|

|

sbd

|

Oct 23 2015, 08:56 PM Oct 23 2015, 08:56 PM

|

|

Just went to apply for Visa Signature in the Gardens Megamall. They can't process this card in the one hour window; in fact it will take several days.

The other BOMBSHELL - they said they received a memo only today - in order to waive annual fees, rm50k annual spending is required instead of rm30k!!!!

|

|

|

|

|

|

sbd

|

Nov 2 2015, 10:15 PM Nov 2 2015, 10:15 PM

|

|

QUOTE(cybpsych @ Nov 2 2015, 07:35 PM) i think Gen-X need to update post #2's template to include average spending amount per month. this way, we can recommend the relevant card with spending/cashback cap. excellent idea; one can max out cash backs at around 2-5k spending per card so if you spend considerably more, then more options should be available to you! |

|

|

|

|

|

sbd

|

Dec 16 2015, 08:16 PM Dec 16 2015, 08:16 PM

|

|

QUOTE(laymank @ Dec 16 2015, 03:26 PM) the good thing about this card is, it doesn't care what category of expenses you are going to spend on, they are all eligible, that including insurance that usually a huge amount. You can consider using this card only at the quarter when you are going to spend big, since it's secondary anyway. not for petrol though. |

|

|

|

|

Jul 29 2015, 05:57 PM

Jul 29 2015, 05:57 PM

Quote

Quote

0.0520sec

0.0520sec

0.26

0.26

7 queries

7 queries

GZIP Disabled

GZIP Disabled