QUOTE(Avangelice @ Sep 28 2015, 02:56 PM)

Fundsupermart.com v11, Grexit or not, Europe will sail on...

Fundsupermart.com v11, Grexit or not, Europe will sail on...

|

|

Sep 28 2015, 02:59 PM Sep 28 2015, 02:59 PM

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

|

|

|

Sep 28 2015, 03:03 PM Sep 28 2015, 03:03 PM

|

Senior Member

5,272 posts Joined: Jun 2008 |

Lol read gtf greater China fund sorry.

Titans now is expensive. Im looking at jap |

|

|

Sep 28 2015, 03:51 PM Sep 28 2015, 03:51 PM

|

Senior Member

3,806 posts Joined: Feb 2012 |

QUOTE(T231H @ Sep 28 2015, 12:32 PM) From GTF's prospectus:QUOTE The asset allocation strategy for this Fund is as follows: between 50% to 98% (both inclusive) of the Fund’s NAV in collective investment schemes with exposure in US, Europe and Japan; and investments in Malaysian securities: up to 50% of the Fund’s NAV. The fund manager should be able to reduce the ratio for US, and increase the ratio for Japan. This post has been edited by river.sand: Sep 28 2015, 08:55 PM |

|

|

Sep 28 2015, 05:45 PM Sep 28 2015, 05:45 PM

|

Senior Member

3,541 posts Joined: Mar 2015 |

Reluctantly I have been cutting my losses and selling down my China funds and China linked funds. My ROI now is only about 3.1%.

Hopefully my performance for the remaining quarter would be better. The restructuring of my portfolio is in progress. |

|

|

Sep 28 2015, 06:03 PM Sep 28 2015, 06:03 PM

|

Senior Member

1,498 posts Joined: Nov 2012 |

Finally migrated my spreadsheet to the latest version. Thanks guys for the even better spreadsheet

Happy to report my messy portfolio still maintains IRR of 7.9% My mum's portfolio also 7.6% Some double digit IRR investments, all >1 year old - GTF KGF RHB Asian total return RHB Asian Income fund - balanced fund Somehow the balanced fund does well when everything else in asia not doing so well |

|

|

Sep 28 2015, 06:03 PM Sep 28 2015, 06:03 PM

|

Senior Member

16,872 posts Joined: Jun 2011 |

QUOTE(Vanguard 2015 @ Sep 28 2015, 05:45 PM) Reluctantly I have been cutting my losses and selling down my China funds and China linked funds. My ROI now is only about 3.1%. Dah cakap... Hopefully my performance for the remaining quarter would be better. The restructuring of my portfolio is in progress. 1. Don't too gung-ho on any particular region/sector...DIVERSIFICATION 2. Don't over-transact |

|

|

|

|

|

Sep 28 2015, 07:17 PM Sep 28 2015, 07:17 PM

|

Senior Member

5,143 posts Joined: Jan 2015 |

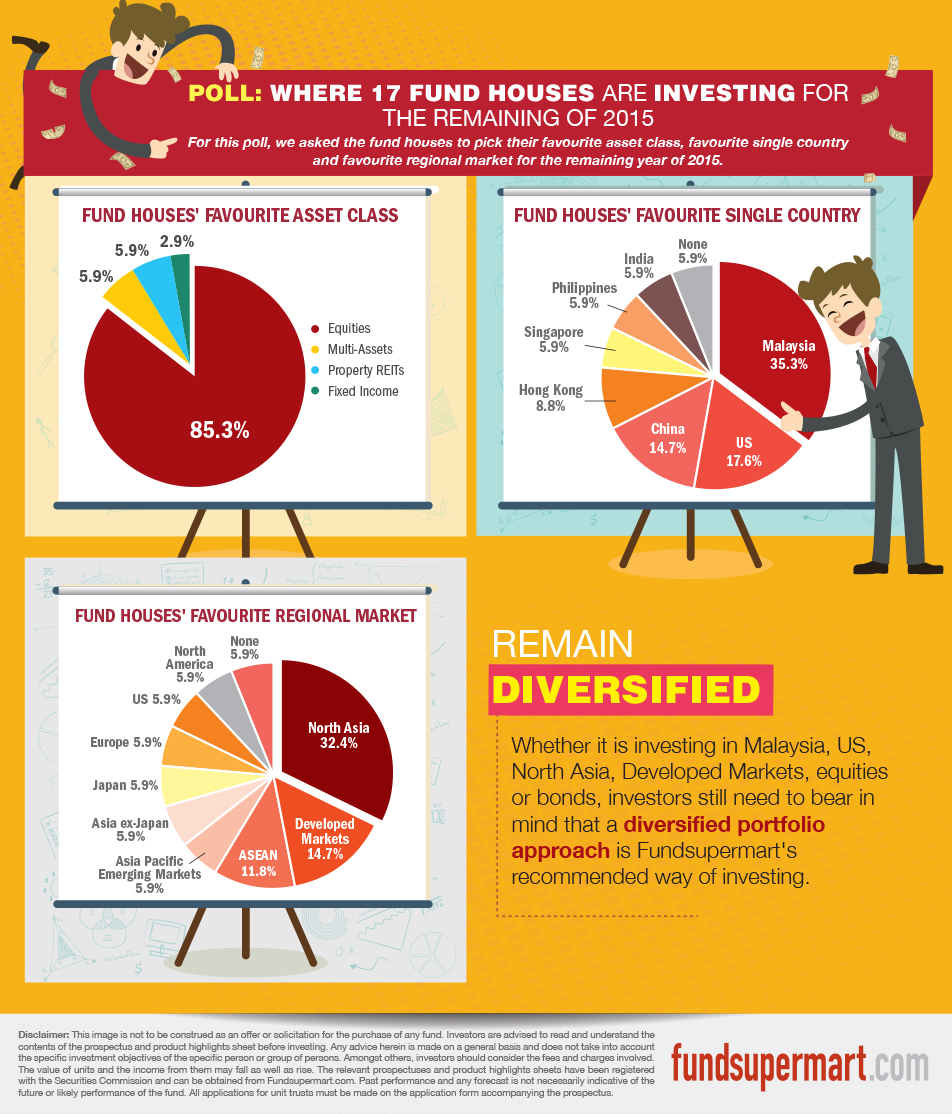

Where to Invest Your Money for the remaining of 2015? We asked the fund houses for answers!

Author : Fundsupermart http://www.fundsupermart.com.my/main/resea...g-of-2015--6346 Bolehland.... |

|

|

Sep 28 2015, 07:34 PM Sep 28 2015, 07:34 PM

|

Senior Member

3,541 posts Joined: Mar 2015 |

|

|

|

Sep 28 2015, 07:40 PM Sep 28 2015, 07:40 PM

|

Senior Member

5,272 posts Joined: Jun 2008 |

QUOTE(Vanguard 2015 @ Sep 28 2015, 07:34 PM) My first three months I treated every egg as if it was my last man. Dont follow the trend and research into the prospectus of each fund. Scan through and see what they are investing in. Read the ups and downs in Bloomberg. It will some what tally into the next updated price a UT |

|

|

Sep 28 2015, 07:56 PM Sep 28 2015, 07:56 PM

|

Senior Member

3,541 posts Joined: Mar 2015 |

QUOTE(Avangelice @ Sep 28 2015, 07:40 PM) My first three months I treated every egg as if it was my last man. Dont follow the trend and research into the prospectus of each fund. Scan through and see what they are investing in. Read the ups and downs in Bloomberg. It will some what tally into the next updated price a UT Thanks for the advice bro. Greed and over confidence caused my recent portfolio downfall.Actually I started dabbling in unit trusts about 11 years ago. I was just joking with Pink Spider. |

|

|

Sep 28 2015, 08:08 PM Sep 28 2015, 08:08 PM

|

All Stars

48,447 posts Joined: Sep 2014 From: REality |

|

|

|

Sep 28 2015, 08:15 PM Sep 28 2015, 08:15 PM

|

Senior Member

4,436 posts Joined: Oct 2008 |

QUOTE(xuzen @ Sep 22 2015, 01:00 PM) My balls data are in... this mth sikit early wor... I wrote the above on 22/9/2015. Today in starbiz (Mon, 28/9/2015), this article came out...Investing in Volatile Times by Haren Shah, Citi's CIO. Even the pro's are saying what I am saying.....Before I talk about Algozen™ recommendation, let me just say a few observation. I) The risk-return of equities generally has gone done. Meaning, the equities are getting more risky. The days of easy buffet lunch is getting less. You want more gain, you need to take more risk. Simple as that.... II) Equities across different geographical zones are converging, the correlation-coefficients are increasing. This means that it is not easy to get good diversification. Now, onwards to the recommendation: Titanic is still floating, iceberg is nowhere in sight; Titanic is still preferred, even though the Europeans are making headway, Ponzi two is still game on, it is loved for its low volatility, Don't ignore the small cap, she may surprise you yet, show her a little bit of love. Titanic with Ponzi two with small dash of small cap is still the best diversified portfolio there is according to Algozen™... Xuzen This post has been edited by xuzen: Sep 28 2015, 08:22 PM Attached thumbnail(s)

|

|

|

Sep 28 2015, 08:36 PM Sep 28 2015, 08:36 PM

|

All Stars

48,447 posts Joined: Sep 2014 From: REality |

QUOTE(xuzen @ Sep 28 2015, 08:15 PM) I wrote the above on 22/9/2015. Today in starbiz (Mon, 28/9/2015), this article came out...Investing in Volatile Times by Haren Shah, Citi's CIO. Even the pro's are saying what I am saying..... wow. I proud to have u here anyhow the link http://www.thestar.com.my/Business/Busines...imes/?style=biz |

|

|

|

|

|

Sep 28 2015, 08:43 PM Sep 28 2015, 08:43 PM

|

Senior Member

1,338 posts Joined: Sep 2012 |

|

|

|

Sep 28 2015, 09:16 PM Sep 28 2015, 09:16 PM

Show posts by this member only | IPv6 | Post

#2415

|

Senior Member

10,001 posts Joined: May 2013 |

QUOTE(T231H @ Sep 28 2015, 07:17 PM) Where to Invest Your Money for the remaining of 2015? We asked the fund houses for answers! On wat basis fund hse over weight Bursa? Author : Fundsupermart http://www.fundsupermart.com.my/main/resea...g-of-2015--6346 Bolehland.... |

|

|

Sep 28 2015, 09:21 PM Sep 28 2015, 09:21 PM

|

Senior Member

16,872 posts Joined: Jun 2011 |

QUOTE(wil-i-am @ Sep 28 2015, 09:16 PM) My take on this - Because of Ringgit weakness, foreign assets become expensive; if u invest in foreign assets now, u are buying HIGH, when Ringgit eventually recovers to what is perceived to be it's "fair value", your foreign assets will drop in value. Not that KLSE stocks have become grossly cheap overnight (though it has somewhat dropped), but it's Ringgit weakness that makes it not worthwhile going offshore now. |

|

|

Sep 28 2015, 09:27 PM Sep 28 2015, 09:27 PM

|

Senior Member

16,872 posts Joined: Jun 2011 |

|

|

|

Sep 28 2015, 10:39 PM Sep 28 2015, 10:39 PM

Show posts by this member only | IPv6 | Post

#2418

|

Senior Member

10,001 posts Joined: May 2013 |

Glencore melt down

All other commodities stock follow suit |

|

|

Sep 29 2015, 12:20 AM Sep 29 2015, 12:20 AM

|

Junior Member

76 posts Joined: May 2014 |

Hi Xuzen, so according to Algozen, still a good move to top up GTF, ponzi 2 and small cap?

Dilemma... not sure to focus topping up the exising funds (but they seem expensive to me now) or exploring new funds. |

|

|

Sep 29 2015, 08:42 AM Sep 29 2015, 08:42 AM

|

All Stars

52,874 posts Joined: Jan 2003 |

MYR is so depressing:

Ringgit at new low, foreign funds continue to exit emerging markets KUALA LUMPUR: The ringgit hit a fresh intra-day low of 4.4250 against the greenback as foreign funds continued to exit emerging markets amid expectations that the US Federal Reserve (Fed) would likely raise interest rates by year-end. The ringgit hit its lowest of 4.4250 against the US dollar at 4:30 pm yesterday, putting the currency closer to its 17-year ebb of 4.7125 recorded on Jan 9, 1998, just before Bank Negara pegged the ringgit to the US dollar at 3.8000 in September in the same year. URL: http://www.thestar.com.my/Business/Busines...-low/?style=biz |

|

Topic ClosedOptions

|

| Change to: |  0.0180sec 0.0180sec

0.38 0.38

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 8th December 2025 - 05:08 AM |