Outline ·

[ Standard ] ·

Linear+

Fundsupermart.com v11, Grexit or not, Europe will sail on...

|

T231H

|

Jul 10 2015, 12:04 PM Jul 10 2015, 12:04 PM

|

|

QUOTE(yeah016 @ Jul 10 2015, 10:40 AM) Annual can share with me how to calculate annual return over using dollar/ringgit cross averaging method? in page # 1 post# 1 there are 2 files that can be downloaded for use 1 is much easier to use but the other one is much nicer to view and analyse |

|

|

|

|

|

T231H

|

Jul 10 2015, 12:26 PM Jul 10 2015, 12:26 PM

|

|

QUOTE(yck1987 @ Jul 8 2015, 07:51 PM) Look like I sold most of my China fund units on the right timing last week , IRR still at 25-27% . Today add back some by doing intra swift. QUOTE(yck1987 @ Jul 10 2015, 12:18 PM) top up already lo 2 days ago.    seems like you timed it perfectly.... sold most off just before the corrections and top up at just at the bottom...   |

|

|

|

|

|

T231H

|

Jul 10 2015, 01:04 PM Jul 10 2015, 01:04 PM

|

|

QUOTE(yck1987 @ Jul 10 2015, 01:01 PM) i experience it many times d up and down in the past 2 years. can up 10% then become negative. really need stronger heart to hold on china region. You can convince yourself aim for long term la when market turn to downtrend. if can convince oneself for long term...why do one sell it off just before the correction? |

|

|

|

|

|

T231H

|

Jul 11 2015, 09:48 PM Jul 11 2015, 09:48 PM

|

|

Talk of $3 trillion of lost wealth also ignores the fact that only about 40 percent of China’s stock market value can be freely bought and sold. The rest is held by controlling shareholders, which are mostly state entities. Shares account for just 9.4 percent of China’s household wealth, according to Credit Suisse: bank deposits and real estate are much more important. What was lost in China’s stock market slide http://blogs.reuters.com/breakingviews/201...k-market-slide/

|

|

|

|

|

|

T231H

|

Jul 11 2015, 09:54 PM Jul 11 2015, 09:54 PM

|

|

Yklooi tried to go but failed as in page 19, post 372

|

|

|

|

|

|

T231H

|

Jul 13 2015, 01:49 PM Jul 13 2015, 01:49 PM

|

|

calling polarzbearz...pls take note of post# 447

|

|

|

|

|

|

T231H

|

Jul 13 2015, 08:56 PM Jul 13 2015, 08:56 PM

|

|

|

|

|

|

|

|

T231H

|

Jul 13 2015, 09:06 PM Jul 13 2015, 09:06 PM

|

|

QUOTE(hihihehe @ Jul 13 2015, 09:02 PM) thx man but i also prefer to attend a session to get more idea too  call them? maybe they can assign someone to arrange to that? http://www.publicmutual.com.my/ContactUs.aspx |

|

|

|

|

|

T231H

|

Jul 14 2015, 08:50 AM Jul 14 2015, 08:50 AM

|

|

tips, hints or money traps? Five Charts Putting China's Stock Market Mayhem in Perspective "Markets are allowed to operate on the way up, not on the way down" http://www.bloomberg.com/news/articles/201...-in-perspectiveBulls are using the measures to justify investing in shares. Chen Xiaofei, an investment adviser at Changjiang Securities Co. in Shanghai, tells margin-trading clients -- some sitting on losses of as much as 60 percent -- to stick with their positions because state support will lead to a rally. “In China, once the government is acting, there’s no difficulty we cannot get over,” Chen said.

.... China’s 90 million individual investors, who drive more than 80 percent of trades on mainland bourses. Fifty-four percent of those surveyed by CLSA predict shares will rise in the next three months, with 66 percent saying they expect the government to support the market. About 77 percent say they’ll maintain or boost holdings over the next month, CLSA wrote in a July 6 report. “The government’s series of measures will eventually take effect,” he said. “I’m still confident in the market’s future.”

http://www.bloomberg.com/news/articles/201...ts-moral-hazardThis post has been edited by T231H: Jul 14 2015, 08:56 AM |

|

|

|

|

|

T231H

|

Jul 16 2015, 11:32 AM Jul 16 2015, 11:32 AM

|

|

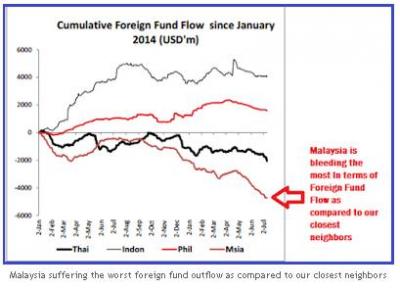

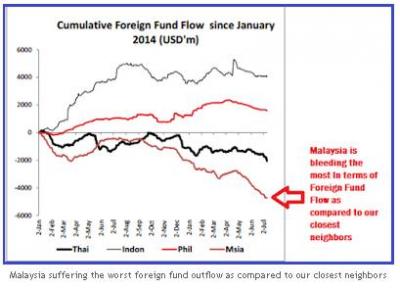

some interesting figures... when the time come for FED to raise interest rate.. will there be any BIG impact left to be felt? Malaysia suffers 11 consecutive weeks of foreign outflows! Plus other key fund flow highlights for week ending 10th July 2015 http://invest-made-easy.blogspot.com/ Attached thumbnail(s)

|

|

|

|

|

|

T231H

|

Jul 16 2015, 09:03 PM Jul 16 2015, 09:03 PM

|

|

QUOTE(river.sand @ Jul 16 2015, 08:30 PM) China's growth for 2nd quarter beat expectation wor... In 2007, Li Keqiang, a Chinese provincial official, let the American ambassador in on a little secret: China's GDP figures are "man-made" and therefore "unreliable."  http://money.cnn.com/2015/07/15/news/econo...mic-statistics/ http://money.cnn.com/2015/07/15/news/econo...mic-statistics/ |

|

|

|

|

|

T231H

|

Jul 17 2015, 07:49 AM Jul 17 2015, 07:49 AM

|

|

alamak...from the mouth of a remisier...  “I try to hold on to more cash and I don’t really invest in the market now. As long as the 1MDB issue does not have a clear outcome, I guess investors won’t have confidence in the local market,” said John Ang, a remisier with a local bank. ‘Cash is king’ as Malaysian investors switch gameplans to deal with bearish market - See more at: http://www.themalaymailonline.com/malaysia...h.IIz4Y2SL.dpuf |

|

|

|

|

|

T231H

|

Jul 20 2015, 02:02 PM Jul 20 2015, 02:02 PM

|

|

QUOTE(adamdacutie @ Jul 20 2015, 01:58 PM) I m worry bout the draggyness of 1Mdb issue from recent seminar...by KGF If the entire RM42bn outstanding borrowings from IMDB is taken on balance sheet, Malaysia’s debt to GDP ratio will spike to 70%. However banking system well capitalised. A default by IMDB will not cause a shock to the banking system. 1MDB exposure is 3.4%-4.0% of assets of each bank only |

|

|

|

|

|

T231H

|

Jul 20 2015, 02:32 PM Jul 20 2015, 02:32 PM

|

|

QUOTE(adamdacutie @ Jul 20 2015, 01:58 PM) I m worry bout the draggyness of 1Mdb issue so....i guess should not be a big issue QUOTE(wil-i-am @ Jul 20 2015, 02:12 PM) All local Banks r listed on Bursa n they can call for RI for capitalization, if necessary In addition, their shareholders namely EPF, KWSP, TH, KWAP, PNB, Insurance Co n etc won't hesitate to lend support |

|

|

|

|

|

T231H

|

Jul 20 2015, 03:32 PM Jul 20 2015, 03:32 PM

|

|

Changes To Star Ratings For 2Q 15: Upgrading Japan & Initiating Chinese A-Share Coverage we upgrade our star ratings for Japan from 3.0 Stars to 3.5 Stars “Attractive.” While we have retained our 5 Stars – “Very Attractive” rating for the Chinese H-Share market, we initiate coverage of the China A-Share market with a 3.5 Stars – “Attractive” rating. We maintain our rating of 2.5 Stars – “Neutral” at this juncture for the European market. Thus, we maintain our 2.5 Stars “Neutral” for the US. http://www.fundsupermart.com.my/main/resea...?articleNo=6060 |

|

|

|

|

|

T231H

|

Jul 20 2015, 05:00 PM Jul 20 2015, 05:00 PM

|

|

QUOTE(xuzen @ Jul 20 2015, 04:28 PM) Japan = only on fund that does Japan. How to compare and evaluate it? For all we know, that fund manager may have given some "incentive"    to FSM analyst to say something positive on Japan.... Xuzen having the same article in FSM HK and FSM SG...i think HK and SG can have more funds focused in Japan... |

|

|

|

|

|

T231H

|

Jul 20 2015, 10:43 PM Jul 20 2015, 10:43 PM

|

|

QUOTE(besiegetank @ Jul 20 2015, 10:24 PM) Time to horde all the gold now   horde ALL?? Top 10 Countries with Largest Gold Reserves http://www.fundsupermart.com.my/main/resea...?articleNo=5803 |

|

|

|

|

|

T231H

|

Jul 20 2015, 10:47 PM Jul 20 2015, 10:47 PM

|

|

QUOTE(nexona88 @ Jul 20 2015, 10:46 PM) why no Malaysia?  suda jual semua kah  Spore also not in wor... |

|

|

|

|

|

T231H

|

Jul 21 2015, 09:32 AM Jul 21 2015, 09:32 AM

|

|

QUOTE(joylay83 @ Jul 21 2015, 01:42 AM) Our Ponzi 1.0 have been laggard... anyone selling? notice quite a number have been topping up   Ponzi 1.0 and 2.0 comparison of DIFFERENT animal thou Attached thumbnail(s)

|

|

|

|

|

|

T231H

|

Jul 22 2015, 09:34 PM Jul 22 2015, 09:34 PM

|

|

QUOTE(IvanWong1989 @ Jul 22 2015, 09:24 PM) Anyone here gets eastspring euro small cap fund? what's your comment on this? Thinking to diversify I have exposure to Asia ex jap. And boleh land. Euro zone. Get ta euro find or east small cap? Fund Focus: Opportunities for Greater Returns in European Smaller Companies......Fundsupermart ... June 19, 2015 https://secure.fundsupermart.com/main/artic...Companies-10478eastspring got euro small cap fund? can share the link? |

|

|

|

|

Jul 10 2015, 12:04 PM

Jul 10 2015, 12:04 PM

Quote

Quote

0.0220sec

0.0220sec

0.11

0.11

7 queries

7 queries

GZIP Disabled

GZIP Disabled