Crude (Brent) below USD 60. Dropped 5.27%

Fundsupermart.com v11, Grexit or not, Europe will sail on...

Fundsupermart.com v11, Grexit or not, Europe will sail on...

|

|

Jul 6 2015, 08:33 PM Jul 6 2015, 08:33 PM

Return to original view | Post

#21

|

All Stars

52,874 posts Joined: Jan 2003 |

Crude (Brent) below USD 60. Dropped 5.27%

|

|

|

|

|

|

Jul 7 2015, 06:08 AM Jul 7 2015, 06:08 AM

Return to original view | Post

#22

|

All Stars

52,874 posts Joined: Jan 2003 |

Oil crashes 8 percent as Greek vote, Iran talks set off exodus

NEW YORK (Reuters) - Oil prices suffered their biggest selloff in five months on Monday, falling as much as 8 percent as Greece's rejection of debt bailout terms and China's stock market woes set off a deepening spiral of losses. Adding to the pressure on oil, Iran and global powers were trying to meet a July 7 deadline on a nuclear deal, which could bring more supply to the market if sanctions on Tehran are eased. The self-imposed deadline could be extended again, officials at the negotiations sai URL: http://finance.yahoo.com/news/u-crude-fall...-000616180.html |

|

|

Jul 7 2015, 07:06 AM Jul 7 2015, 07:06 AM

Return to original view | Post

#23

|

All Stars

52,874 posts Joined: Jan 2003 |

Stock Corrections Come to Europe as Greek Vote Hits Italy, Spain

While most financial markets were spared selloffs Monday, it was hardly a good day in equities -- especially those perceived as vulnerable to Greek contagion. Stocks in Italy and Portugal fell more than 3.8 percent, and benchmark indexes in Spain and France lost 2 percent after voters in Greece rejected bailout terms. Half of the 18 western-European markets tracked by Bloomberg are now in corrections, with shares down 10 percent or more from their 2015 highs. URL: http://www.bloomberg.com/news/articles/201...its-italy-spain |

|

|

Jul 7 2015, 08:57 AM Jul 7 2015, 08:57 AM

Return to original view | Post

#24

|

All Stars

52,874 posts Joined: Jan 2003 |

Fitch boost for Malaysia short-lived, ringgit hardest hit in Asia

PETALING JAYA: The simmering economic crisis in Greece and weakness in China continued to roil financial markets across the region, with the ringgit being the hardest hit among Asian currencies. Sentiment on the ringgit was further compounded by rising domestic political risk, lingering concerns about 1Malaysia Development Bhd’s massive debt problems and lower oil revenue. The local unit fell to a 16-year low yesterday at 3.809 against the US dollar - a level last seen before the exchange rate was pegged in 1998. [attachmentid=4559855] URL: http://www.thestar.com.my/Business/Busines...ived/?style=biz |

|

|

Jul 7 2015, 11:26 AM Jul 7 2015, 11:26 AM

Return to original view | Post

#25

|

All Stars

52,874 posts Joined: Jan 2003 |

SSE Comp drops 3.86% as of now!

|

|

|

Jul 7 2015, 01:24 PM Jul 7 2015, 01:24 PM

Return to original view | Post

#26

|

All Stars

52,874 posts Joined: Jan 2003 |

I tried to make a payment today but I'm not able to receive TAC for all 3 banks.

Anybody faced similar problem on TAC delivery? |

|

|

|

|

|

Jul 7 2015, 03:13 PM Jul 7 2015, 03:13 PM

Return to original view | Post

#27

|

All Stars

52,874 posts Joined: Jan 2003 |

Chinese Trading Suspensions Freeze $1.4 Trillion of Shares Amid Rout

Chinese companies have found a guaranteed way to prevent investors from selling their shares: suspend trading. Almost 200 stocks halted trading after the close on Monday, bringing the total number of suspensions to 745, or 26 percent of listed firms on mainland exchanges, according to data compiled by Bloomberg. Most of the halts are by companies listed in Shenzhen, which is dominated by smaller businesses. The suspensions have locked up $1.4 trillion of shares, or 21 percent of China’s market capitalization, and are becoming increasingly popular as equity prices tumble. If not for the halts, a 29 percent plunge in the Shanghai Composite Index from its June 12 peak would probably be even deeper. URL: http://www.bloomberg.com/news/articles/201...hares-amid-rout |

|

|

Jul 7 2015, 03:14 PM Jul 7 2015, 03:14 PM

Return to original view | Post

#28

|

All Stars

52,874 posts Joined: Jan 2003 |

RBA Holds Rate as Greek Drama Drives Aussie Below 75 Cents

Australia left its key interest rate unchanged after Greece’s drama drove the currency below 75 U.S. cents and Sydney’s property bubble argued against a further cut. Central bank Governor Glenn Stevens kept the cash rate at a record-low 2 percent Tuesday as predicted by markets and economists, and after cuts in May and February. He identified 75 cents in December as a level that would help the economy. “The Australian dollar has declined noticeably against a rising U.S. dollar over the past year, though less so against a basket of currencies,” Stevens said in a statement. “Further depreciation seems both likely and necessary, particularly given the significant declines in key commodity prices.” URL: http://www.bloomberg.com/news/articles/201...cy-sub-75-cents |

|

|

Jul 7 2015, 04:21 PM Jul 7 2015, 04:21 PM

Return to original view | Post

#29

|

All Stars

52,874 posts Joined: Jan 2003 |

Topped up KAPTRF today!

|

|

|

Jul 7 2015, 06:32 PM Jul 7 2015, 06:32 PM

Return to original view | Post

#30

|

All Stars

52,874 posts Joined: Jan 2003 |

Ponzi 1.0 being hit a lot. NAV below 1.3500!

|

|

|

Jul 7 2015, 07:13 PM Jul 7 2015, 07:13 PM

Return to original view | Post

#31

|

All Stars

52,874 posts Joined: Jan 2003 |

|

|

|

Jul 7 2015, 07:15 PM Jul 7 2015, 07:15 PM

Return to original view | Post

#32

|

All Stars

52,874 posts Joined: Jan 2003 |

Chinese Shares in Hong Kong Follow Mainland Into BEAR Market

Chinese companies traded in Hong Kong fell 20 percent from a May high, following mainland shares into a bear market. The Hang Seng China Enterprises Index sank 3.3 percent to 11,827.30 on Tuesday, led by Citic Securities Co. Haitong Securities Co., Citic Securities and China Railway Group Ltd. dropped the most on the H share gauge during the period, posting declines of at least 37 percent. The city’s benchmark Hang Seng Index entered a correction on Monday, sliding 11 percent from its April peak. URL: http://www.bloomberg.com/news/articles/201...nto-bear-market |

|

|

Jul 7 2015, 07:16 PM Jul 7 2015, 07:16 PM

Return to original view | Post

#33

|

All Stars

52,874 posts Joined: Jan 2003 |

Greek Stock Market Suspended for Two More Days Amid Bank Closure

Greece’s stock market will remain closed on Tuesday and Wednesday after a bank holiday was extended. The alternative market of the Athens Exchange will also stay shut, Alexandra Grispou, spokeswoman for the exchange operator, said in e-mailed comments. Equity trading in the debt-ridden country has been suspended since June 29 after the government closed banks and imposed capital controls. URL: http://www.bloomberg.com/news/articles/201...id-bank-closure |

|

|

|

|

|

Jul 7 2015, 07:37 PM Jul 7 2015, 07:37 PM

Return to original view | Post

#34

|

All Stars

52,874 posts Joined: Jan 2003 |

If you have bullets or ammo, use this golden period for accumulation!

|

|

|

Jul 7 2015, 08:15 PM Jul 7 2015, 08:15 PM

Return to original view | Post

#35

|

All Stars

52,874 posts Joined: Jan 2003 |

|

|

|

Jul 7 2015, 08:30 PM Jul 7 2015, 08:30 PM

Return to original view | Post

#36

|

All Stars

52,874 posts Joined: Jan 2003 |

|

|

|

Jul 7 2015, 08:51 PM Jul 7 2015, 08:51 PM

Return to original view | Post

#37

|

All Stars

52,874 posts Joined: Jan 2003 |

Equities Weekly: Fear Grips Markets Over Greek Impasse [3 Jul 15]

Equity markets worldwide on aggregate declined over the week ended 3 July 2015, with the MSCI AC World Index falling -1.59%. US equities, as represented by the benchmark S&P 500 index, declined by -1.82% over the week. Deeper declines were seen across the equity markets in Europe, as fears of the situation in Greece increased – the benchmark Stoxx 600 index fell -3.94% over the week. On the other hand, the Japanese equity market, represented by the Nikkei 225 index, was the least affected developed market under our coverage during the risk aversion seen last week, with the index up just 0.23%. Asian and emerging markets also saw declines as a whole, with the MSCI Asia ex Japan index and the MSCI Emerging Markets index declining by -1.30% and -1.48% respectively over the week. East Asian markets like China (represented by the HSML 100 index) and Taiwan incurred losses, falling by -2.91% and -0.54% over the week. The volatile local Chinese equity market however, was the bottom performer under our coverage over the week, with the Shanghai Composite index plunging -11.85% and the Shenzhen CSI 300 index falling -10.15%. Other emerging markets like Russia and Brazil also saw declines, with the RTSI$ index and the Bovespa index falling by -2.30% and -2.89% respectively over the week. Southeast Asian equity markets in general actually posted gains, with Malaysia and Singapore up 1.39% and 0.86% respectively, while Indonesia's JCI index posted a 1.28% gain over the week. Crude oil prices, as represented by WTI crude, fell -5.15% in MYR terms, closing with a price of USD 56.93 when the week ended. [All returns in MYR terms unless otherwise stated] Investors may refer to Market Valuations as of 3 July 2015 for more details. URL: http://www.fundsupermart.com.my/main/resea...?articleNo=6024 |

|

|

Jul 7 2015, 08:54 PM Jul 7 2015, 08:54 PM

Return to original view | Post

#38

|

All Stars

52,874 posts Joined: Jan 2003 |

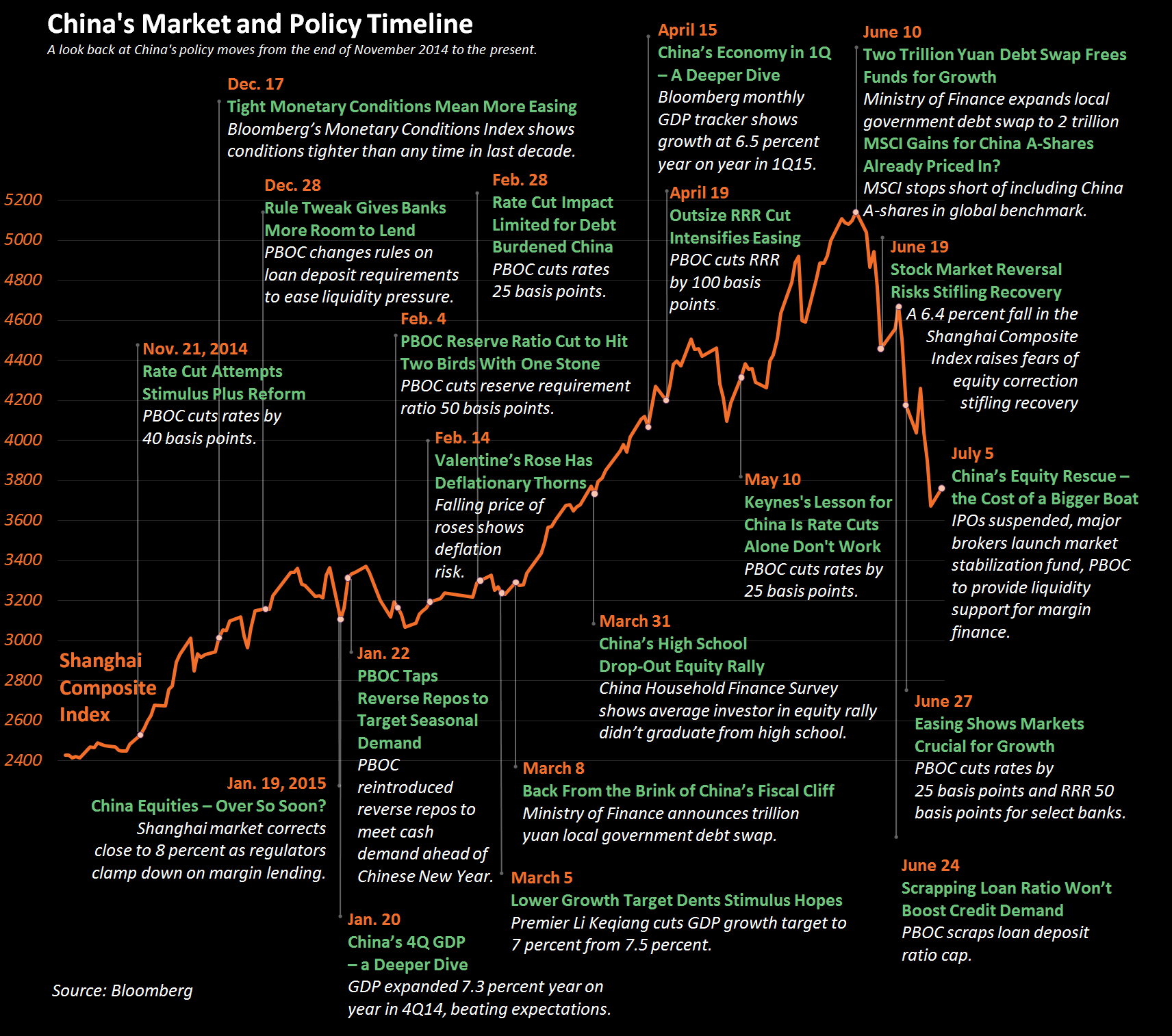

China fund lovers, you may be interested with this article:

Charting the Rise and Fall of China's Equity Market It’s been a wild ride on China’s equity market, with the Shanghai Composite Index rising from just above 2,400 in November 2014 to a high close of 5,200 in June, before plunging back toward 3,700 in early July. Along the way there have been four rate cuts, three reserve requirement cuts and, most recently, a raft of measures from the government aimed at stabilizing the market. This chart maps out the recent history of policy and market moves.  URL: http://www.bloomberg.com/news/articles/201...s-equity-market |

|

|

Jul 7 2015, 09:54 PM Jul 7 2015, 09:54 PM

Return to original view | Post

#39

|

All Stars

52,874 posts Joined: Jan 2003 |

|

|

|

Jul 8 2015, 04:16 AM Jul 8 2015, 04:16 AM

Return to original view | Post

#40

|

All Stars

52,874 posts Joined: Jan 2003 |

Europe market closed nearly 2% lower.

|

|

Topic ClosedOptions

|

| Change to: |  0.0475sec 0.0475sec

0.42 0.42

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 7th December 2025 - 08:15 AM |