Fundsupermart.com v11, Grexit or not, Europe will sail on...

Fundsupermart.com v11, Grexit or not, Europe will sail on...

|

|

Sep 28 2015, 08:08 PM Sep 28 2015, 08:08 PM

Return to original view | Post

#141

|

All Stars

48,488 posts Joined: Sep 2014 From: REality |

|

|

|

|

|

|

Sep 28 2015, 08:36 PM Sep 28 2015, 08:36 PM

Return to original view | Post

#142

|

All Stars

48,488 posts Joined: Sep 2014 From: REality |

QUOTE(xuzen @ Sep 28 2015, 08:15 PM) I wrote the above on 22/9/2015. Today in starbiz (Mon, 28/9/2015), this article came out...Investing in Volatile Times by Haren Shah, Citi's CIO. Even the pro's are saying what I am saying..... wow. I proud to have u here anyhow the link http://www.thestar.com.my/Business/Busines...imes/?style=biz |

|

|

Sep 29 2015, 10:23 AM Sep 29 2015, 10:23 AM

Return to original view | Post

#143

|

All Stars

48,488 posts Joined: Sep 2014 From: REality |

QUOTE(David83 @ Sep 29 2015, 08:42 AM) MYR is so depressing: needed to do some "adjustment" to some of plans in Dec Ringgit at new low, foreign funds continue to exit emerging markets KUALA LUMPUR: The ringgit hit a fresh intra-day low of 4.4250 against the greenback as foreign funds continued to exit emerging markets amid expectations that the US Federal Reserve (Fed) would likely raise interest rates by year-end. The ringgit hit its lowest of 4.4250 against the US dollar at 4:30 pm yesterday, putting the currency closer to its 17-year ebb of 4.7125 recorded on Jan 9, 1998, just before Bank Negara pegged the ringgit to the US dollar at 3.8000 in September in the same year. URL: http://www.thestar.com.my/Business/Busines...-low/?style=biz |

|

|

Sep 29 2015, 10:47 AM Sep 29 2015, 10:47 AM

Return to original view | Post

#144

|

All Stars

48,488 posts Joined: Sep 2014 From: REality |

|

|

|

Sep 29 2015, 01:38 PM Sep 29 2015, 01:38 PM

Return to original view | Post

#145

|

All Stars

48,488 posts Joined: Sep 2014 From: REality |

|

|

|

Sep 29 2015, 11:13 PM Sep 29 2015, 11:13 PM

Return to original view | Post

#146

|

All Stars

48,488 posts Joined: Sep 2014 From: REality |

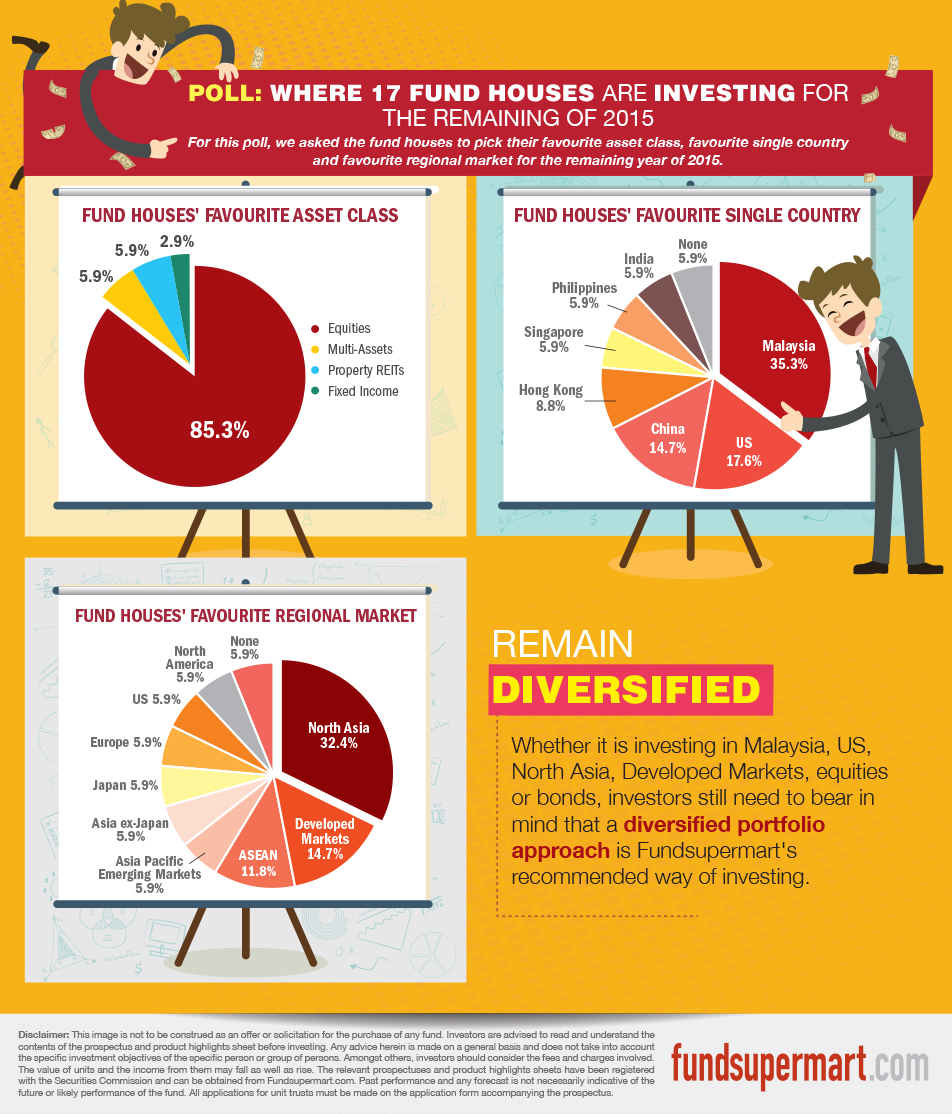

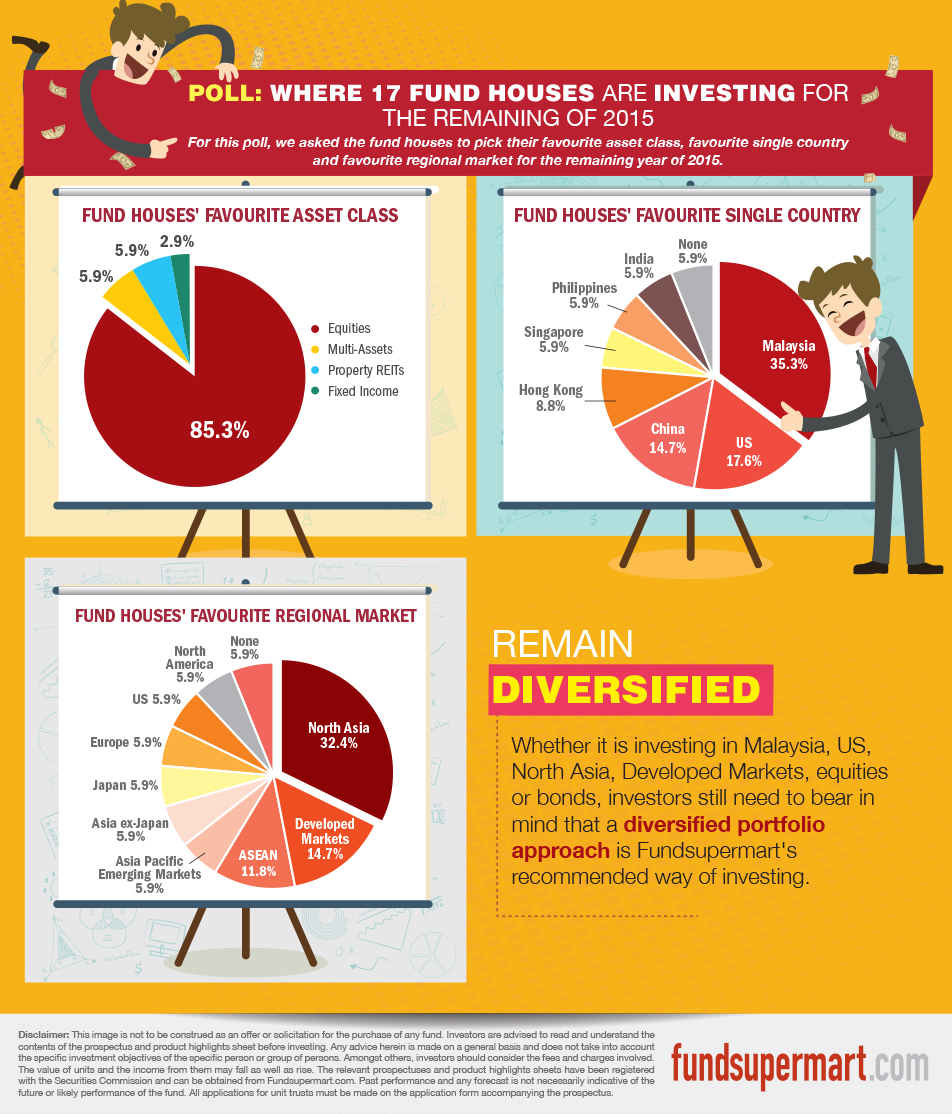

QUOTE(T231H @ Sep 29 2015, 09:56 PM) Goldman Sachs Slashes S&P 500 Price Target, Sees Negative Return for U.S. Stocks if not mistaken that day FSM talk got say US market now overvalue. don't invest now http://www.bloomberg.com/news/articles/201...-for-u-s-stocks |

|

|

|

|

|

Sep 30 2015, 12:36 PM Sep 30 2015, 12:36 PM

Return to original view | Post

#147

|

All Stars

48,488 posts Joined: Sep 2014 From: REality |

|

|

|

Sep 30 2015, 06:15 PM Sep 30 2015, 06:15 PM

Return to original view | Post

#148

|

All Stars

48,488 posts Joined: Sep 2014 From: REality |

Stocks end worst quarter in 4 years on positive note

QUOTE Stocks were on track to end their most bruising quarter in four years with gains on Wednesday, led by shares that have been most exposed to global economic slowdown and commodity sector rout that have rattled investors in recent days. Overall, investors will be glad to see the back of the third quarter. "The market is a bit oversold but there are still worries over the growth outlook and central bank policy," said Antonin Jullier, head of equity trading strategy at Citi in London. "The kind of volatility we are seeing is not the good kind. Risk appetite is being hurt." http://www.thestar.com.my/Business/Busines...note/?style=biz |

|

|

Oct 1 2015, 05:50 PM Oct 1 2015, 05:50 PM

Return to original view | Post

#149

|

All Stars

48,488 posts Joined: Sep 2014 From: REality |

KLCI was up 12.89 points or 0.8% to 1,633.93. Turnover was 1.51 billion shares valued at RM1.82bil. Advancers led decliners 465 to 306 while 302 counters were unchanged.

Among the key regional markets, Japan’s Nikkei 225 rose 1.92% to 17,722.42; Taiwan’s Taiex added 1.4% to 8,295.94; South Korea’s Kospi added 0.84% to 1,979.32 and Singapore’s Straits Times Index rose 0.42% to 2,802.69. |

|

|

Oct 2 2015, 12:13 AM Oct 2 2015, 12:13 AM

Return to original view | Post

#150

|

All Stars

48,488 posts Joined: Sep 2014 From: REality |

QUOTE(kimyee73 @ Oct 1 2015, 10:38 PM) My main portfolio update for month-end September 2015 Overall IRR 6.75% Top 3 funds - EI Small Cap IRR 17.07%, +8.97% from Aug (7.4% of portfolio) - CIMB Global Titan IRR 13.7%, -0.54% (2.6%) - RHB ATR ROI 12.4%, +5.8% (5.8%) Bottom 3 funds - AMB Ethical IRR -16.3%, +3.43% from Aug (0.9% of portfolio) - AMB Dividend ROI -6.06%, -0.08% (0.7%) - RHB Emerging Opp IRR -3.3%, -3.3% (2%) |

|

Topic ClosedOptions

|

| Change to: |  0.0516sec 0.0516sec

0.78 0.78

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 11th December 2025 - 05:33 PM |