Starting to plan for YA2023 reliefs. Anyone know the details behind these two tax reliefs for YA2022?

1. Lifestyle - Purchase of personal computer, smartphone or tablet (Not for business use) - RM2,500

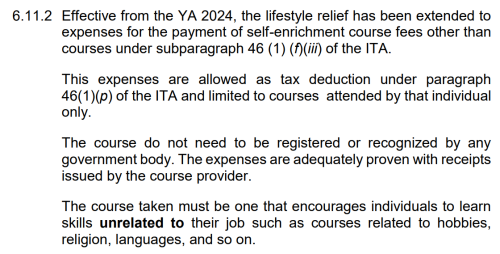

2. Education fees (Self) - Course of study undertaken for the purpose of upskilling or self-enhancement - RM3,000

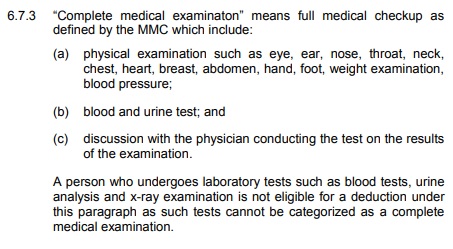

3. Medical expenses - Complete medical examination for self, spouse or child - RM1,000

Source: https://www.hasil.gov.my/en/individual/indi...me/tax-reliefs/

Questions:

1. Lifestyle relief - Is this applicable to purchase of PC monitor only? how about individual PC components (RAM, Hard Drive, etc) and other peripherals?

Previous posts from 2021 suggest that it is only applicable for full set PCs, but it doesn't make sense to be purchasing a new laptop/phone every year just to claim this.

2. Education Fees - Does this include language courses from ICLS? and also online courses from udemy/coursera?

3. Medical expenses - Does this include blood tests at places like BP Healthcare clinics?

Income Tax Issues v4, Scope: e-BE and eB only

Aug 15 2023, 07:12 AM

Aug 15 2023, 07:12 AM

Quote

Quote

0.2442sec

0.2442sec

0.62

0.62

7 queries

7 queries

GZIP Disabled

GZIP Disabled