Guys, I have yet to receive my RM31.70 tax return since e-filling in March.

I feel like contact them, but takut they ask me to bring all my past 7 years receipts along.

Income Tax Issues v4, Scope: e-BE and eB only

Income Tax Issues v4, Scope: e-BE and eB only

|

|

Oct 29 2015, 12:49 AM Oct 29 2015, 12:49 AM

Return to original view | Post

#1

|

Senior Member

2,337 posts Joined: Oct 2014 |

Guys, I have yet to receive my RM31.70 tax return since e-filling in March.

I feel like contact them, but takut they ask me to bring all my past 7 years receipts along. |

|

|

|

|

|

Nov 29 2016, 07:36 PM Nov 29 2016, 07:36 PM

Return to original view | Post

#2

|

Senior Member

2,337 posts Joined: Oct 2014 |

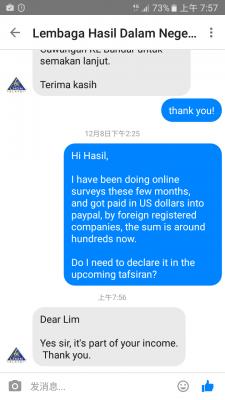

Hey guys, I have been doing online surveys these few months, and paid in US dollars, by foreign registered companies, the sum is around hundreds now.

Do I need to declare it in the upcoming tafsiran? |

|

|

Nov 30 2016, 04:52 PM Nov 30 2016, 04:52 PM

Return to original view | Post

#3

|

Senior Member

2,337 posts Joined: Oct 2014 |

QUOTE(Babylong90 @ Nov 30 2016, 11:14 AM) Hi there, Great to know this, are these considered as "other income" then?Generally, any income that you earned and derived from Malaysia (regardless your employer is registered in Malaysia or not, or your salary is in which currency) shall be declared as income and tax in Malaysia. Back to your question, I will say that you should declare your income although the amount is immaterial. You know, IRB officer have the right to impose penalty nowadays if they found out that you submit incorrect return |

|

|

Dec 1 2016, 01:31 PM Dec 1 2016, 01:31 PM

Return to original view | Post

#4

|

Senior Member

2,337 posts Joined: Oct 2014 |

QUOTE(gogocan @ Dec 1 2016, 12:09 PM) Since your income relate to your job in Msia, it is considered as derived from malaysia and therefore taxable. Location of of payer, currency and method of payment is not relevant in this case. QUOTE(vin_ann @ Dec 1 2016, 12:18 PM) Foreign derived income is not taxable. Paid by foreign company, task performed outside Malaysia soil. That's all. Unless the law changed. QUOTE(BboyDora @ Dec 1 2016, 12:35 PM) QUOTE(vin_ann @ Dec 1 2016, 12:39 PM) Income from PayPal ? Okay, I shall furnish more details here: I sit in my room somewhere in KL, Are money sent from Msia company to ur PayPal ? You heard of it, have you confirmed with any tax friend? answered surveys via Toluna, Globaltest, AnnKate, all these foreign companies, earned multiple hundreds of US dollar, credited into my Paypal account. I withdrawn the Paypal balance twice into my local bank account. So, am I taxable? |

|

|

Dec 15 2016, 11:32 AM Dec 15 2016, 11:32 AM

Return to original view | Post

#5

|

Senior Member

2,337 posts Joined: Oct 2014 |

QUOTE(klthor @ Dec 3 2016, 02:19 PM) if you eanr your income in malaysia you pay malaysian tax, thats the law. unless you are talking about income earn outside malaysia, but judging from your word 'send money for surival' that doesnt seem to be the case. QUOTE(Hansel @ Dec 3 2016, 02:40 PM) I thought abt this too,... to be more specific, I think the best way to describe this would be : if the income-generating activities are being performed in Msia, then such income MUST be declared to the Msian tax collection authorities, irregardless of who pays us the income, and where it is paid into,... yeah,...Yes, then must declare already,.. The statement 'sending money for survival' actually does not matter, and is beside the point to this argument. For example, one could be performing the income-generating activity outside Msia, ie working in Sgp, but at times, he could be staying in Msia, then he can always send money back to Msia for his survival activities, without needing to declare his income to the Msian tax collection authorities. QUOTE(cherroy @ Dec 5 2016, 10:32 PM) A lot of people mis-interpret the foreign income definition as "paying by foreign company", this is incorrect and out of context. Foreign income in tax term is the income generated at foreign place, aka you work at foreign place and being paid. QUOTE(rapple @ Dec 8 2016, 12:57 PM) Tax exemptions is also stated on Page 48 - Income Exempt From Tax Okay people, here's the official reply from LHDN:Since i'm free i shall cut out and put it here [attachmentid=8229109]

|

|

|

Mar 14 2020, 08:49 AM Mar 14 2020, 08:49 AM

Return to original view | IPv6 | Post

#6

|

Senior Member

2,337 posts Joined: Oct 2014 |

2 March- declared foreign accounts in e-BE

Tax refund not showing up till now...I dont feel so good. |

|

|

|

|

|

Mar 14 2020, 10:04 AM Mar 14 2020, 10:04 AM

Return to original view | IPv6 | Post

#7

|

Senior Member

2,337 posts Joined: Oct 2014 |

|

|

|

Mar 15 2020, 12:00 AM Mar 15 2020, 12:00 AM

Return to original view | Post

#8

|

Senior Member

2,337 posts Joined: Oct 2014 |

|

|

|

Mar 19 2020, 09:19 PM Mar 19 2020, 09:19 PM

Return to original view | IPv6 | Post

#9

|

Senior Member

2,337 posts Joined: Oct 2014 |

Dang, mine submitted 2 March, no sign till now.

Is that because I have Sg accounts? |

|

|

Mar 21 2020, 02:28 PM Mar 21 2020, 02:28 PM

Return to original view | IPv6 | Post

#10

|

Senior Member

2,337 posts Joined: Oct 2014 |

QUOTE(cklimm @ Mar 19 2020, 09:19 PM) arrived 20 March at last.QUOTE(ryan18 @ Mar 20 2020, 08:52 AM) Anyone ever kena audited before? My 2017 relief kena claw back and I was requested to make the revised tax payment and make an appeal by providing supporting documents I did, back then in Jib's era, but no claw back though. Get ready your documents in case they choose to visit you for audit.How long do they take as I have heard nothing from LHDN and what are the chances of getting the refund back |

|

|

Jan 27 2021, 02:08 PM Jan 27 2021, 02:08 PM

Return to original view | IPv6 | Post

#11

|

Senior Member

2,337 posts Joined: Oct 2014 |

|

| Change to: |  0.2774sec 0.2774sec

0.52 0.52

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 7th December 2025 - 07:02 PM |