Is it worth it if to buy a new whole set PC with monitor every 2 years to deduct tax?

Income Tax Issues v4, Scope: e-BE and eB only

Income Tax Issues v4, Scope: e-BE and eB only

|

|

Jun 6 2025, 02:02 AM Jun 6 2025, 02:02 AM

|

Junior Member

128 posts Joined: Dec 2017 |

Is it worth it if to buy a new whole set PC with monitor every 2 years to deduct tax?

|

|

|

|

|

|

Jun 6 2025, 10:02 AM Jun 6 2025, 10:02 AM

|

Senior Member

1,137 posts Joined: Oct 2018 |

QUOTE(Jened @ Jun 6 2025, 02:02 AM) could do it every year if you wanted to don't think a monitor is required as personal computer points worth considering: 1) no other lifestyle relief being claimed, e.g. internet subscription/phone 2) PC within the budget of RM 3,500 (if including esport equipment) 3) your marginal tax rate 4) resale value of your PC |

|

|

Jun 6 2025, 10:12 AM Jun 6 2025, 10:12 AM

|

Junior Member

128 posts Joined: Dec 2017 |

QUOTE(1mr3tard3d @ Jun 6 2025, 10:02 AM) could do it every year if you wanted to Thank you for your replydon't think a monitor is required as personal computer --- I thought need to buy a whole set of PC which included a monitor, mouse and keyboard? points worth considering: 1) no other lifestyle relief being claimed, e.g. internet subscription/phone --- this means if claim PC then cannot claim internet subscription/phone ? 2) PC within the budget of RM 3,500 (if including esport equipment) 3) your marginal tax rate -- meaning? 4) resale value of your PC -- Agree If buy a second hand PC or laptop with shop receipt given , then can deduct income tax? This post has been edited by Jened: Jun 6 2025, 10:16 AM |

|

|

Jun 6 2025, 10:28 AM Jun 6 2025, 10:28 AM

|

Senior Member

1,137 posts Joined: Oct 2018 |

QUOTE(Jened @ Jun 6 2025, 10:12 AM) I thought need to buy a whole set of PC which included a monitor, mouse and keyboard? your examples would probably be considered as peripherals1) this means if claim PC then cannot claim internet subscription/phone ? 3) your marginal tax rate -- meaning? If buy a second hand PC or laptop with shop receipt given , then can deduct income tax? no, could claim all but it would lower the available amount to claim as all are restricted to RM 2,500 the tax rate of additional income you are paying, e.g. 28% if your chargeable income is between RM 600,001 - RM 2,000,000; 25% for RM 100,001 - RM 400,000 so long as there is supporting document, the law did not mention about new PC so it shall be eligible as tax relief Jened liked this post

|

|

|

Jun 9 2025, 05:51 PM Jun 9 2025, 05:51 PM

|

Junior Member

128 posts Joined: Dec 2017 |

If buy second-hand laptop or PC from carousel but without a sales receipt can deduct tax? Can screenshot carousel sold transaction as proof of purchase to deduct tax?

|

|

|

Jun 10 2025, 07:41 AM Jun 10 2025, 07:41 AM

|

All Stars

14,867 posts Joined: Mar 2015 |

QUOTE(Jened @ Jun 9 2025, 05:51 PM) If buy second-hand laptop or PC from carousel but without a sales receipt can deduct tax? Can screenshot carousel sold transaction as proof of purchase to deduct tax? Wow, good idea if can.As Carousel transaction screenshot has no real confirmed lhdn recognise able seller/buyer details that they can seek to contact/check to seek further clarification if needed. So ..... like this can?? "A" buy new pc claim tax, sell in carousel to "B" buy and claim tax. Next year, "B" sell, "A" buy from carousel claim tax, then sell in carousel to "B". "B" buy n claim tax. Repeat every year. A n B can be husband wife, brother sister or ownself, etc etc too This post has been edited by MUM: Jun 10 2025, 07:43 AM dwRK liked this post

|

|

|

|

|

|

Jun 10 2025, 06:24 PM Jun 10 2025, 06:24 PM

|

Junior Member

128 posts Joined: Dec 2017 |

Last time one accountant company said: PC needs to buy whole set including monitor then can deduct tax.

Can somebody answer? This post has been edited by Jened: Jun 10 2025, 06:27 PM |

|

|

Jun 10 2025, 06:27 PM Jun 10 2025, 06:27 PM

|

Junior Member

128 posts Joined: Dec 2017 |

QUOTE(MUM @ Jun 10 2025, 07:41 AM) Wow, good idea if can. If get caught by LHDN, need to pay penalty?As Carousel transaction screenshot has no real confirmed lhdn recognise able seller/buyer details that they can seek to contact/check to seek further clarification if needed. So ..... like this can?? "A" buy new pc claim tax, sell in carousel to "B" buy and claim tax. Next year, "B" sell, "A" buy from carousel claim tax, then sell in carousel to "B". "B" buy n claim tax. Repeat every year. A n B can be husband wife, brother sister or ownself, etc etc too |

|

|

Jun 10 2025, 07:42 PM Jun 10 2025, 07:42 PM

|

All Stars

14,867 posts Joined: Mar 2015 |

QUOTE(Jened @ Jun 10 2025, 06:27 PM) Offences, Fines and Penaltieshttps://www.hasil.gov.my/en/legislation/off...-and-penalties/ If no need to pay penalty when caught, how to deter tax payers from performing non tax reporting compliance? |

|

|

Jun 10 2025, 07:49 PM Jun 10 2025, 07:49 PM

Show posts by this member only | IPv6 | Post

#10690

|

Senior Member

6,230 posts Joined: Jun 2006 |

|

|

|

Jun 10 2025, 08:14 PM Jun 10 2025, 08:14 PM

Show posts by this member only | IPv6 | Post

#10691

|

Senior Member

6,230 posts Joined: Jun 2006 |

kmrdeva liked this post

|

|

|

Jun 11 2025, 05:43 PM Jun 11 2025, 05:43 PM

|

Junior Member

88 posts Joined: Jan 2020 |

QUOTE(jerebubu @ Jun 3 2025, 01:49 PM) it seems that LHDN is including the meal and transport allowance as taxable income. contact live agent chat.i received penalty from them for year 2023 assessment. LHDN follows the amount in my EA form instead, but the EA form is including all of those allowance. Anyone have similar experience? the reply i received is that employer need to segregate out in EA form under Section F (allowance) LHDN will refer to EA form submitted by employer. I minus out based on payslip amount on the meal&transport allowance, ended up they do not accept. |

|

|

Jun 14 2025, 09:33 PM Jun 14 2025, 09:33 PM

|

All Stars

21,308 posts Joined: Jan 2003 From: Kuala Lumpur |

|

|

|

|

|

|

Jun 18 2025, 08:09 PM Jun 18 2025, 08:09 PM

|

Junior Member

837 posts Joined: Sep 2011 |

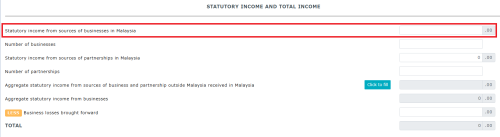

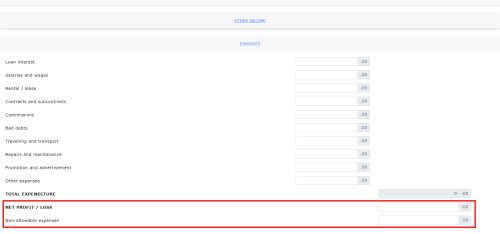

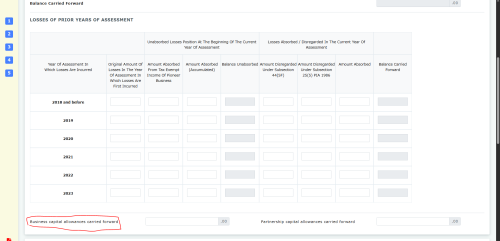

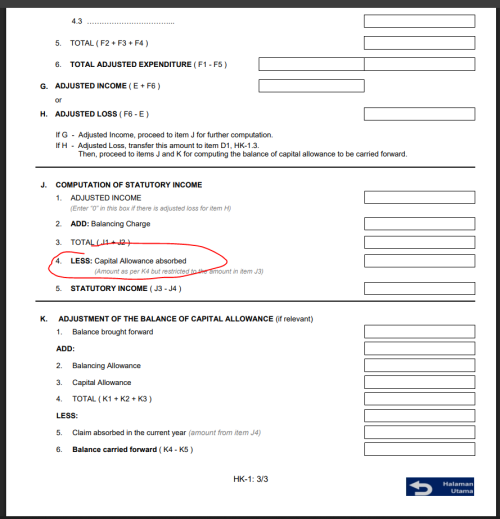

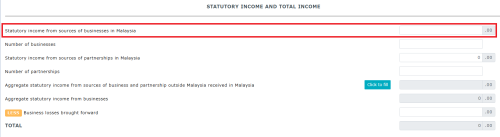

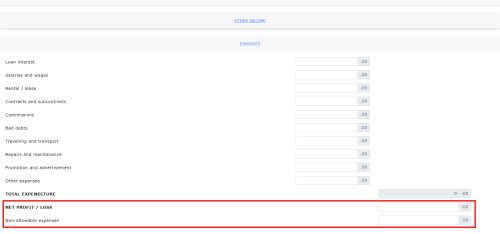

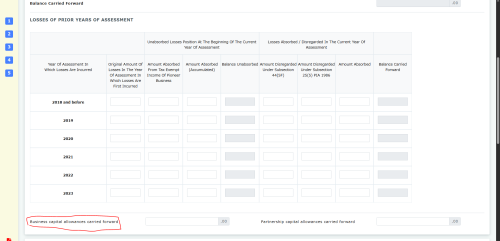

Questions on filling in Form B

1. For Statutory Income, is this amount the Net Profit Less Allowable expenses per the two screenshots below? This screenshot is from section 3: Income  This one is from section 2: PARTICULARS OF BUSINESS INCOME / FINANCIAL PARTICULARS OF INDIVIDUAL (MAIN BUSINESS ONLY)  2. Where do I input capital allowance? the only box I see is the Business capital allowances carried forward? Or am I supposed to calculate somewhere else and add the ca amount as an Other Expense? 3. For capital allowance, is there an threshold amount to claim 100% in single year? e.g. if under RM3k, can we claim it all? and just expense it?  This post has been edited by poooky: Jun 18 2025, 08:22 PM |

|

|

Jun 18 2025, 08:38 PM Jun 18 2025, 08:38 PM

|

Junior Member

837 posts Joined: Sep 2011 |

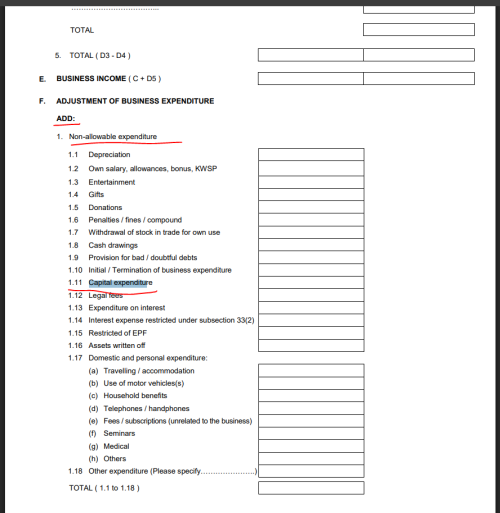

I'm looking at the work sheet https://www.hasil.gov.my/media/3r5nc3p2/working-sheet_2.pdf

My understanding is Statutory Income is Net Profit less allowable expenses and capital allowance per Sections F and J below 1. Basically, in Section F, I add back my all capital expenditure purchases (e.g. ICT equipment) 2. Then in section J, less capital allowance 3. Meaning that Statutory Income amount in Form B is Net Profit less allowable expenses and capital allowance 4. The threshold for Small Value Asset is RM2k per https://www.pwc.com/my/en/publications/mtb/...allowances.html. Can't find the official LHDN source on this one Is this correct?   QUOTE(poooky @ Jun 18 2025, 08:09 PM) Questions on filling in Form B This post has been edited by poooky: Jun 18 2025, 08:49 PM1. For Statutory Income, is this amount the Net Profit Less Allowable expenses per the two screenshots below? This screenshot is from section 3: Income  This one is from section 2: PARTICULARS OF BUSINESS INCOME / FINANCIAL PARTICULARS OF INDIVIDUAL (MAIN BUSINESS ONLY)  2. Where do I input capital allowance? the only box I see is the Business capital allowances carried forward? Or am I supposed to calculate somewhere else and add the ca amount as an Other Expense? 3. For capital allowance, is there an threshold amount to claim 100% in single year? e.g. if under RM3k, can we claim it all? and just expense it?  |

|

|

Jun 18 2025, 11:59 PM Jun 18 2025, 11:59 PM

Show posts by this member only | IPv6 | Post

#10696

|

Senior Member

1,137 posts Joined: Oct 2018 |

QUOTE(poooky @ Jun 18 2025, 08:38 PM) Statutory Income is Net Profit less allowable expenses and capital allowance per Sections F and J below hopefully that is a typo, should be adding non-allowable expenses less capital allowance1. Basically, in Section F, I add back my all capital expenditure purchases (e.g. ICT equipment) 2. Then in section J, less capital allowance net profit less allowable expenses would result in double claiming expenses because net profit = revenue - expenses (allowable & non-allowable) which is why section F requires adding non-allowable expenses from net profit but your process 1 & 2 are correct QUOTE 4. The threshold for Small Value Asset is RM2k per https://www.pwc.com/my/en/publications/mtb/...allowances.html. Can't find the official LHDN source on this one the special allowance on small value asset is currently capped at RM 20,000 per year for non-SMCPR03/2021 as for the non-allowable expenses column in form B, refer to the explanatory note page 33, N27 |

|

|

Jun 19 2025, 10:03 AM Jun 19 2025, 10:03 AM

|

Junior Member

837 posts Joined: Sep 2011 |

QUOTE(1mr3tard3d @ Jun 18 2025, 11:59 PM) hopefully that is a typo, should be adding non-allowable expenses less capital allowance Sorry. I got it mixed it up. Thank you for correcting this.net profit less allowable expenses would result in double claiming expenses because net profit = revenue - expenses (allowable & non-allowable) which is why section F requires adding non-allowable expenses from net profit but your process 1 & 2 are correct the special allowance on small value asset is currently capped at RM 20,000 per year for non-SMC PR03/2021 as for the non-allowable expenses column in form B, refer to the explanatory note page 33, N27 Also, thanks for the CA. Is my understanding of the special allowance correct? 1. Sole prop is non-SMC? 2. If I purchase 11 ICT equipment small value assets of RM2k each totaling RM22k, the special allowance capped at RM20k means that I can only claim 100% capital allowance for the initial 10 assets (RM2k * 10) in the current year? and the remaining 2k asset, I can only claim the IA and AA (20% + 40%) in the current year? Also, a question on claiming business expenses: 1. Is SSM registration and renewal an allowable expense? 2. I current use my own personal mobile line and data for business purposes, and want to claim this portion. I did a rough calculation and I would say 30% is used for business purposes. Can I claim this 30% as allowable expense? (e.g. phone bill for month is RM50, 30% means I claim RM15 each month) Would LHDN accept this? 3. Same like above, if I am renting, but utility bill is not under my name, can I also do rough calculation and claim 30% as allowable expense? 4. Similar to earlier question, if I take MRT for business purpose, can I do the same? How strict would the LHDN audit be in this regard? |

|

|

Jun 21 2025, 04:30 PM Jun 21 2025, 04:30 PM

|

Senior Member

1,137 posts Joined: Oct 2018 |

QUOTE(poooky @ Jun 19 2025, 10:03 AM) 1. Sole prop is non-SMC? yes, one of the condition of SMC being, ...paid-up capital in respect of ordinary shares..., which sole proprietor will not be qualified2. If I purchase 11 ICT equipment small value assets of RM2k each totaling RM22k, the special allowance capped at RM20k means that I can only claim 100% capital allowance for the initial 10 assets (RM2k * 10) in the current year? and the remaining 2k asset, I can only claim the IA and AA (20% + 40%) in the current year? Also, a question on claiming business expenses: 1. Is SSM registration and renewal an allowable expense? 2. I current use my own personal mobile line and data for business purposes, and want to claim this portion. I did a rough calculation and I would say 30% is used for business purposes. Can I claim this 30% as allowable expense? (e.g. phone bill for month is RM50, 30% means I claim RM15 each month) Would LHDN accept this? » Click to show Spoiler - click again to hide... « u r correct in terms of the application, the small value assets in excess of RM 20,000 will still be qualified under normal IA + CA (e.g. 11 ICT of RM 1,999 each --> RM 19,990 at accelerated IA + AA while RM 1,999 under normal IA+AA) but should be IA 40% + AA 20% from YA2024 INCOME TAX (ACCELERATED CAPITAL ALLOWANCE) (INFORMATION AND COMMUNICATION TECHNOLOGY EQUIPMENT) RULES 2024 registration fee will be regarded as initial expense/capital in nature which is not tax deductible; renewal fee should be eligible referring to dialogue with IRB, page 25 of the PDF although it is an age-old document, the concept should still apply though the challenging part would be the 'reasonable basis of apportionment' poooky liked this post

|

|

|

Jun 22 2025, 11:49 AM Jun 22 2025, 11:49 AM

Show posts by this member only | IPv6 | Post

#10699

|

Senior Member

5,875 posts Joined: Sep 2009 |

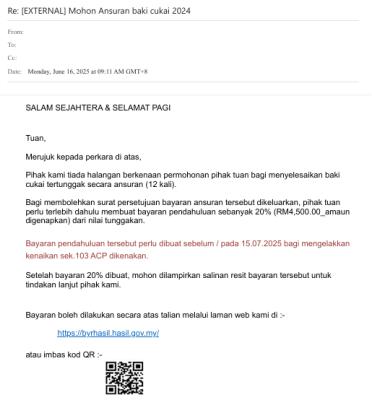

tips for you guys those who after e filing still got significant balance tax to pay you can get interest free instalments x 12 months interest free money This post has been edited by guy3288: Jun 24 2025, 01:05 AM Attached thumbnail(s)

ubsacc2004 liked this post

|

|

|

Jul 2 2025, 09:45 AM Jul 2 2025, 09:45 AM

|

Junior Member

837 posts Joined: Sep 2011 |

QUOTE(guy3288 @ Jun 22 2025, 11:49 AM) tips for you guys I didn't receive this email. Maybe only for those with high tax payable. those who after e filing still got significant balance tax to pay you can get interest free instalments x 12 months interest free money Also for Form B saw that payment due date is 15/7 instead of 30/06. Can delay another two weeks. |

| Change to: |  0.0204sec 0.0204sec

0.17 0.17

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 7th December 2025 - 10:15 AM |