QUOTE(2387581 @ Mar 29 2019, 03:59 AM)

Recently I was filing my own income tax for 2018, and I begin to realise the negative effects the progressive income tax has on myself.

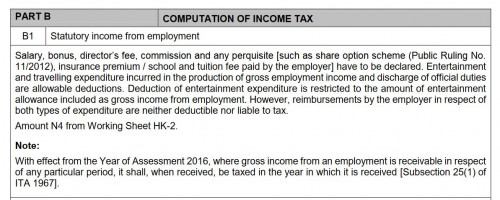

As my gross income increased over the years, I got taxed much more that I am basically taking home about the same amount between and after an increase in my salary. It appears that the current tax regime demotivates Malaysians to earn more for a better living. It doesn't help when the costs of living is getting higher day by day.

I understand that there are people who, after an increase in their income, continue drawing a similar amount of salary from the company, and by a separate agreement invoice their employer using a company registered under the employee's name, so the additional income would go into the company. In this way the employee's personal income will remain at a lower bracket, while the company, as the income is low, will get taxed less. Understandably with a registered Sdn Bhd, you ought to pay a certain amount to maintain the company's registration, accounts, returns, etc.

So here my question is:

1. At what gross income range it is sensible to create such a vehicle company, and

2. How much the costs (per year) are we looking at compliance costs, to maintain such a company legally, like secretary, accountant, returns, etc.?

3. What are the typical daily expenses we can take advantage of by using the company, like buying a car under company name, eating out, etc etc to maximise the use of the company for tax optimisation purpose?

I am asking on the basis that one is being employed full time and all income are derived from the employment only.

Since the personal income tax for taxable income ranging RM70k+ above will get 21%-28%, while company tax starts at 18% for first RM500k, it seems going Sdn Bhd for tax accounting purposes is sensible when we make more than say ~RM100k or so per year?

One needs to realise that personal tax is progressive or step up, while company tax rate is flat across.

Eg.

Personal

Income 100K, max tax needs to pay max is 10,900, 10,900/100k = 10.9% (not yet deducted for personal relief, so should be lesser)

Income 250k, max tax needs to pay is 46,900, 18.76% (as above if deduct for personal relief, should be lesser)

Company

100K income straight away 18% = 18K needs to be paid.

While as company you have many compliance things to do, range from SSM, accounting/auditing, potential extra tax form submission, EPF, Socso etc.

Also, if the company is not running business, then those expenses like car purchase/petrol etc are not eligible for tax deduction.

Even for those company with business, those expenses may be tax deductible, but it is still adding back into personal taxable income in the form of BIK, so still the same.

Sep 21 2018, 03:18 PM

Sep 21 2018, 03:18 PM

Quote

Quote

0.2152sec

0.2152sec

0.66

0.66

7 queries

7 queries

GZIP Disabled

GZIP Disabled