QUOTE(Boon3 @ Jun 23 2015, 06:59 PM)

» Click to show Spoiler - click again to hide... «

Talk own self again....

Never think like an investor when you are trading.....

oops.... I think the opposite holds true also...

ie never think like a trader when you are an investor....

this is for those who loves chasing falling stocks...

example?

AirAsia.

Well? AirAsia mah...

many are WRONGLY thought to buy/invest based on what they see...

for example...

they go airport...

they see...

so many fei kei...

all also say....

can fly...

all red color...

so many AirAsia...

business must be good....

how can it not be good?

when so many are flying AirAsia?

so when they see it fall...

they say...

bargain...

sifu from mountain...

says so one...

I saw GMT video.... have you?

https://vimeo.com/131236783

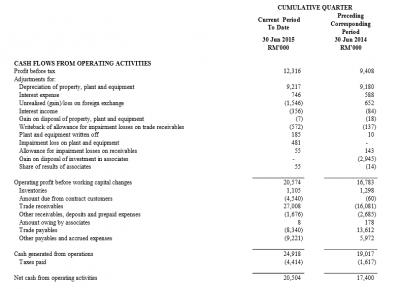

to check what the Mat Salleh talk about the related party profits....inflating profits....

I also sibuk myself mah...

don't pick lose...

see myself...

http://cdn1.i3investor.com/my/files/dfgs88...--591047246.pdf

I think it's the profits stated under 'Share of results of associates - see notes 23' ..... 33.1 million....

"Thai AirAsia achieved an operating profit of THB1,195.0 million in 1Q15, compared to an

operating profit of THB346.6 million in 1Q14. Thai AirAsia achieved a net profit of

THB922.8 million in 1Q15, compared to a net profit of THB244.7 million in 1Q14.

AirAsia Berhad has equity accounted RM37.1 million in 1Q15, as reflected in the AirAsia

Berhad income statement"

what Mat saying....

AirAsia Thai losses...

went to losses heaven lor....

"The AirAsia Berhad share of the net loss in 1Q15 amounted to RM73.5 million. However,

as the Group’s interest in Indonesia AirAsia has been reduced to zero any profits will only

be recognized when a total of RM407.9 million of unrecognized losses have been reversed."

and same with Philipines.... went to losses heaven also...

"AirAsia Philippines recorded a net loss of RM25.7 million (quarter ended 31 March 2014:

net loss of RM24.6 million) in the quarter under review out of which RMNil million is

equity accounted in the AirAsia Berhad income statement. As the Group’s interest in

AirAsia Philippines has been reduced to zero, in accordance with MFRS128, any profits

will only be recognized when a total of RM112.8 million of unrecognized losses have been

reversed."

so these losses not accounted....

dunno go where...

so profits look higher than it should be....

ps: clearly I am not an accountant.... so I only see laaa....

ps: I do not think accountant is a prerequisite to be a trader la..... or am I WRONG here?

ok... even if all the above is acceptable...

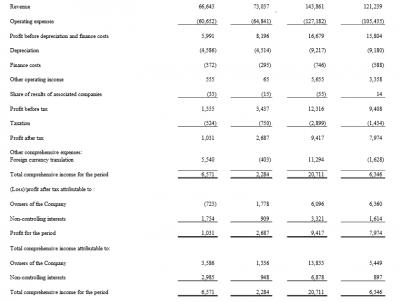

I see this...

I can see so many issues....

like sales revenue is down...

most costs are up.... (compared to same quarter last year laa.... )

anyway.... no 11. shows a disposal gain.... 62 million.

and then... the big disposal gain of AirAsia Expedia... which contributed 320 million...

all these one of gains.... yes?

if AirAsia did not sell AirAsia Expedia...

would AirAsia even be making money for the quarter?

and remember how much losses it recorded the previous quarter?

THIS i think is the real problem....

clearly money... is a REAL issue...

it's not a joke when you have 1.6 billion cash but carry a loan of 13.1 BILLION...

and a commitment to take delivery of 81 billion worth of fei kei.

this is clearly not sustainable...

CLEARLY BILLION DOLLAR DEBTs is NOT a sports for Malaysia companies..................

yeah..... do see the GMT video.... see it over and over again...

ps: what is AirAsia NTAB?

Answer? 1.64

trick question:

with AirAsia main assets being fei kei's....

assets which are depreciating...

and with AirAsia 's debts exploding at dunno what rate.....

why on earth should AirAsia even trade higher than its NTAB?

yes? no? yes? no?

trick question:

what is AirAsia market capital at 1.64?

ie... in layman's term...if AirAsia sells all its shares at a price of 1.64, how much is AirAsia worth?

Answer: 4.564 billion!!!

now I ask myself...

given AirAsia's balance sheet issues....

it's profitability...

it's BILLION dollar currency hedges.....

should AirAsia be worth 4.564 billion?

ps: would you pay 4.564 billion ringgit to own a company which has 13.1 billion in debts?

something long isn't it?

ps: I wonder Mat GMT got see latest profit report from AirAsia or not?

Never think like an investor when you are trading.....

oops.... I think the opposite holds true also...

ie never think like a trader when you are an investor....

this is for those who loves chasing falling stocks...

example?

AirAsia.

Well? AirAsia mah...

many are WRONGLY thought to buy/invest based on what they see...

for example...

they go airport...

they see...

so many fei kei...

all also say....

can fly...

all red color...

so many AirAsia...

business must be good....

how can it not be good?

when so many are flying AirAsia?

so when they see it fall...

they say...

bargain...

sifu from mountain...

says so one...

I saw GMT video.... have you?

https://vimeo.com/131236783

to check what the Mat Salleh talk about the related party profits....inflating profits....

I also sibuk myself mah...

don't pick lose...

see myself...

http://cdn1.i3investor.com/my/files/dfgs88...--591047246.pdf

I think it's the profits stated under 'Share of results of associates - see notes 23' ..... 33.1 million....

"Thai AirAsia achieved an operating profit of THB1,195.0 million in 1Q15, compared to an

operating profit of THB346.6 million in 1Q14. Thai AirAsia achieved a net profit of

THB922.8 million in 1Q15, compared to a net profit of THB244.7 million in 1Q14.

AirAsia Berhad has equity accounted RM37.1 million in 1Q15, as reflected in the AirAsia

Berhad income statement"

what Mat saying....

AirAsia Thai losses...

went to losses heaven lor....

"The AirAsia Berhad share of the net loss in 1Q15 amounted to RM73.5 million. However,

as the Group’s interest in Indonesia AirAsia has been reduced to zero any profits will only

be recognized when a total of RM407.9 million of unrecognized losses have been reversed."

and same with Philipines.... went to losses heaven also...

"AirAsia Philippines recorded a net loss of RM25.7 million (quarter ended 31 March 2014:

net loss of RM24.6 million) in the quarter under review out of which RMNil million is

equity accounted in the AirAsia Berhad income statement. As the Group’s interest in

AirAsia Philippines has been reduced to zero, in accordance with MFRS128, any profits

will only be recognized when a total of RM112.8 million of unrecognized losses have been

reversed."

so these losses not accounted....

dunno go where...

so profits look higher than it should be....

ps: clearly I am not an accountant.... so I only see laaa....

ps: I do not think accountant is a prerequisite to be a trader la..... or am I WRONG here?

ok... even if all the above is acceptable...

I see this...

I can see so many issues....

like sales revenue is down...

most costs are up.... (compared to same quarter last year laa.... )

anyway.... no 11. shows a disposal gain.... 62 million.

and then... the big disposal gain of AirAsia Expedia... which contributed 320 million...

all these one of gains.... yes?

if AirAsia did not sell AirAsia Expedia...

would AirAsia even be making money for the quarter?

and remember how much losses it recorded the previous quarter?

THIS i think is the real problem....

clearly money... is a REAL issue...

it's not a joke when you have 1.6 billion cash but carry a loan of 13.1 BILLION...

and a commitment to take delivery of 81 billion worth of fei kei.

this is clearly not sustainable...

CLEARLY BILLION DOLLAR DEBTs is NOT a sports for Malaysia companies..................

yeah..... do see the GMT video.... see it over and over again...

ps: what is AirAsia NTAB?

Answer? 1.64

trick question:

with AirAsia main assets being fei kei's....

assets which are depreciating...

and with AirAsia 's debts exploding at dunno what rate.....

why on earth should AirAsia even trade higher than its NTAB?

yes? no? yes? no?

trick question:

what is AirAsia market capital at 1.64?

ie... in layman's term...if AirAsia sells all its shares at a price of 1.64, how much is AirAsia worth?

Answer: 4.564 billion!!!

now I ask myself...

given AirAsia's balance sheet issues....

it's profitability...

it's BILLION dollar currency hedges.....

should AirAsia be worth 4.564 billion?

ps: would you pay 4.564 billion ringgit to own a company which has 13.1 billion in debts?

something long isn't it?

ps: I wonder Mat GMT got see latest profit report from AirAsia or not?

btw, market looks too good to be true... it's about time where correction or a big tsunami will come

Jun 23 2015, 11:33 PM

Jun 23 2015, 11:33 PM

Quote

Quote

0.0491sec

0.0491sec

0.47

0.47

7 queries

7 queries

GZIP Disabled

GZIP Disabled