QUOTE(xander2k8 @ Dec 2 2023, 03:22 PM)

What can agent they do 🤦♀️ when do not have the power to do asset allocation and investment decisions

The problem lies in the CIO and the fund portfolio managers who are managing loss making funds with bad investment decisions

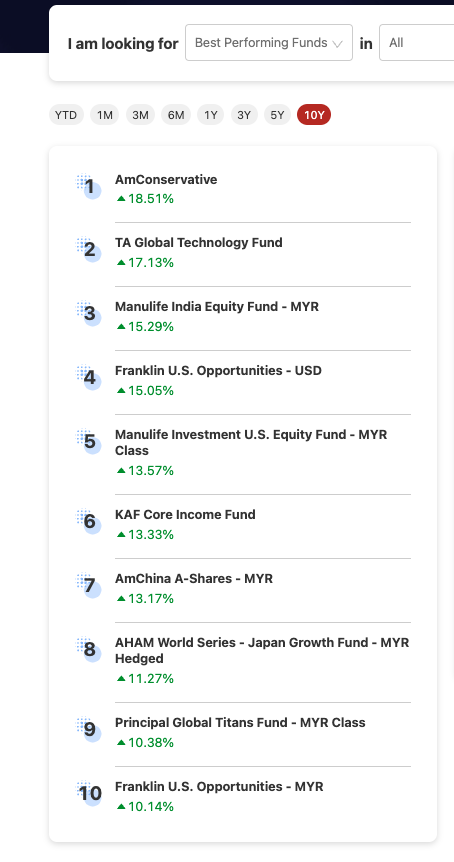

Agent can pick the right UT that beat benchmark and invest in the right market like Japan, India, or fixed incomeThe problem lies in the CIO and the fund portfolio managers who are managing loss making funds with bad investment decisions

Dec 4 2023, 12:26 PM

Dec 4 2023, 12:26 PM

Quote

Quote

0.1778sec

0.1778sec

0.55

0.55

7 queries

7 queries

GZIP Disabled

GZIP Disabled