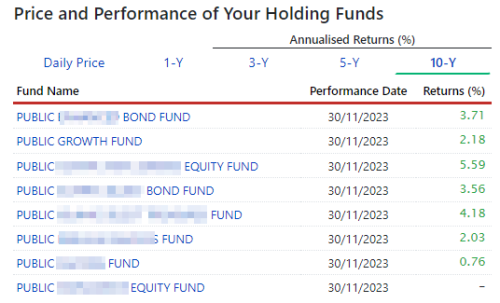

Since the above Annualised numbers below EPF Dividend rate, should I just cash out and put in EPF

Public Mutual Funds, version 0.0

|

|

Dec 8 2023, 11:15 AM Dec 8 2023, 11:15 AM

Return to original view | Post

#1

|

All Stars

21,332 posts Joined: Jan 2003 From: Kuala Lumpur |

|

|

|

|

|

|

Dec 8 2023, 04:45 PM Dec 8 2023, 04:45 PM

Return to original view | Post

#2

|

All Stars

21,332 posts Joined: Jan 2003 From: Kuala Lumpur |

QUOTE(markedestiny @ Dec 8 2023, 04:04 PM) Compile the sums withdrawn throughout the years you took out from EPS to invest in PM against declared EPF divs and see... i do not have the capital info as this UT was "inherited"But in the last 7 years... it only had capital appreciation of 22% as of November 2023 This post has been edited by ronnie: Dec 8 2023, 04:47 PM |

|

|

Jan 9 2024, 03:32 PM Jan 9 2024, 03:32 PM

Return to original view | Post

#3

|

All Stars

21,332 posts Joined: Jan 2003 From: Kuala Lumpur |

QUOTE(wacko_joy @ Jan 9 2024, 12:29 PM) Hi all, I have PM for quite some years. But I'm very noob til i dun understand most of the info in the monthly/yearly statement except profit or minus. Tat's why i neglected PM. Recently, I try absorb as much knowledge as possible. simple answer : move it back to EPFI look at the statement, the performance is not that great. As many here even return back to EPF... so i'm wondering is it because of the funds i invested is not the right one or is memang is not as great EPF? I'm thinking whether i should give it a second chance or just return back to EPF... Kindly advice. Thx! Concise answer compare the funds from the day you put in capital from EPF + dividends calcuilcate if you didnt put in PM). if in PM less than EPF "backcast", go back to simple answer. |

|

|

Jan 18 2024, 10:45 PM Jan 18 2024, 10:45 PM

Return to original view | Post

#4

|

All Stars

21,332 posts Joined: Jan 2003 From: Kuala Lumpur |

QUOTE(mowlous @ Jan 18 2024, 10:14 PM) Hi sifus ....... I got a small PM funds last time invest with angpow money long time ago. To cut it short, its a small pocket of funds I didn't use for a long time, so like two years back or so my agent (more like my mom's agent) intro us to switch the investment to some china base investment that is under PM of some sort, we switch, but recently check with agent the funds growth are pityful ...... like RM91 bucks for a roughly 6k+ funds. if you want to invest lazily, you can try ASMx funds or put in EPF (only can take out when you reach 50/55)I wanna know is it wise to sit those small funds there and don't bother? Or waste time to keep there and just take them out to put somewhere else? I'm a total noob at this and the only investment I pump is asnb. This seems like not worth holding to pray for a miricle to happen. |

|

|

Mar 6 2024, 12:06 PM Mar 6 2024, 12:06 PM

Return to original view | Post

#5

|

All Stars

21,332 posts Joined: Jan 2003 From: Kuala Lumpur |

QUOTE(creations @ Mar 6 2024, 12:58 AM) Hi all, just keep it there till CHINA comes back big and strong later in a few yearsJust want to seek advice whether I should stop DDA to china titan fund, and maintain my fund within the account to let it grow without investing into it every month. Managed to dig my fund accounts over 16 years and found and found that it doesn't seem giving profit much (worse than promotional fixed deposit offered), and I have lost contact of my UT who serves my fund account. Any advice would be appreciated. Thanks. Unit trust is never a good investment vehicle.... it takes 3 steps forward, 4 steps backward creations, DoomHammer, and 1 other liked this post

|

|

|

Mar 7 2024, 12:39 PM Mar 7 2024, 12:39 PM

Return to original view | Post

#6

|

All Stars

21,332 posts Joined: Jan 2003 From: Kuala Lumpur |

QUOTE(togekiss @ Mar 7 2024, 09:21 AM) i wonder what's the management fees charged by public mutual funds so far. had a friend who took out from EPF to put into public mutual funds, but he said if left with EPF, it would have earned more dividend. too late for your friend.... but we should use this to "teach others" not to fall for agent's sweet talk.Ask the sales agent if he/she invested his/her EPF in the Mutual fund he/she recommends. CommodoreAmiga liked this post

|

|

|

|

|

|

Mar 8 2024, 10:25 AM Mar 8 2024, 10:25 AM

Return to original view | Post

#7

|

All Stars

21,332 posts Joined: Jan 2003 From: Kuala Lumpur |

QUOTE(tehoice @ Mar 8 2024, 10:18 AM) the answer is always yes.... Talk only no use, ask them to logon to Public Mutual Online and show lo....also same goes to property investment, when you ask if you have also invested? a lot of them would say yes (in my experience). if you believe every sales agent says. you will be scam for sure. CommodoreAmiga liked this post

|

|

|

Mar 8 2024, 12:20 PM Mar 8 2024, 12:20 PM

Return to original view | Post

#8

|

All Stars

21,332 posts Joined: Jan 2003 From: Kuala Lumpur |

QUOTE(ozak @ Mar 8 2024, 11:57 AM) My mom don't no anything cincai buy some MF from PB for my sis. (Some relative also) what is the fund name she invested in ? better warn other people.When I took over and checked, 1/2 the money was gone. More than 10yrs of investment. Take out everything and close the acc. Now I invest for her and slowly gain back some loss. |

|

|

Mar 8 2024, 12:20 PM Mar 8 2024, 12:20 PM

Return to original view | Post

#9

|

All Stars

21,332 posts Joined: Jan 2003 From: Kuala Lumpur |

|

|

|

Mar 8 2024, 12:25 PM Mar 8 2024, 12:25 PM

Return to original view | Post

#10

|

All Stars

21,332 posts Joined: Jan 2003 From: Kuala Lumpur |

|

|

|

Mar 8 2024, 12:45 PM Mar 8 2024, 12:45 PM

Return to original view | Post

#11

|

All Stars

21,332 posts Joined: Jan 2003 From: Kuala Lumpur |

|

|

|

Apr 26 2024, 04:01 PM Apr 26 2024, 04:01 PM

Return to original view | Post

#12

|

All Stars

21,332 posts Joined: Jan 2003 From: Kuala Lumpur |

QUOTE(jep @ Apr 26 2024, 03:42 PM) How long do we need to keep the funds? I have 1 fund already 13 years...but profit wise around 100% now..so divided by 13 years...it should be around 7.7% p.a since inception...should I keep it or redeem back to KWSP? which fund did you get ?it's up to you.... if annual growth is ~7.7% is higher than EPF/...keep it there. is that 7.7% = CAGR ? This post has been edited by ronnie: Apr 26 2024, 04:01 PM |

| Change to: |  0.0886sec 0.0886sec

0.56 0.56

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 24th December 2025 - 01:12 AM |