Hi everyone!

In case there's anybody here need new UTC (Public Mutual) or want to invest but dunno how, feel free to contact me.

Especially those who want to invest via EP£ acc 1, service charge are heavily discounted until April 2021.

Starting this May 2020, investment via EP£ acc 1 will only charged 1.5%, compared to 3% previously.

The only thing I can promise to my client is, you will never regret to have me as your servicing UTC.

😊😊😊

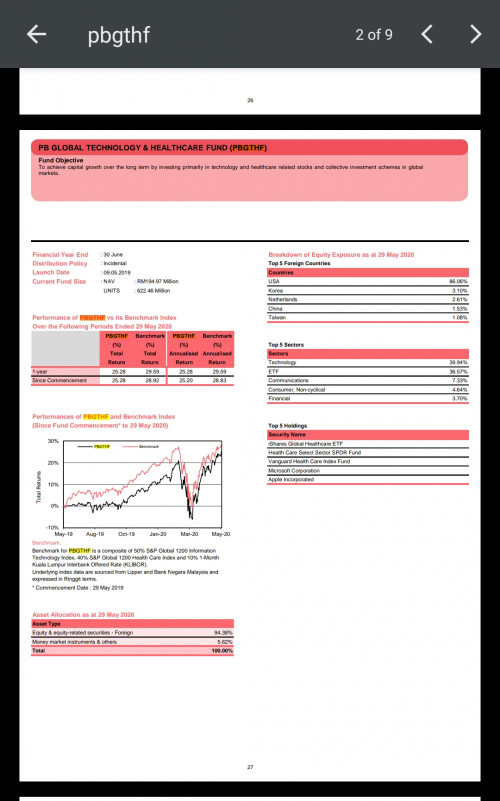

Public Mutual Funds, version 0.0

Jun 15 2020, 09:12 AM

Jun 15 2020, 09:12 AM

Quote

Quote

0.0866sec

0.0866sec

0.72

0.72

7 queries

7 queries

GZIP Disabled

GZIP Disabled