small cap dropped a lot and i am lossing money. il should i withdraw all money out or just leave it there till covid19 issue over? Someonecpls advise me.

Public Mutual Funds, version 0.0

Public Mutual Funds, version 0.0

|

|

Mar 18 2020, 09:28 AM Mar 18 2020, 09:28 AM

Return to original view | IPv6 | Post

#1

|

Junior Member

102 posts Joined: Jul 2019 |

small cap dropped a lot and i am lossing money. il should i withdraw all money out or just leave it there till covid19 issue over? Someonecpls advise me.

|

|

|

|

|

|

Mar 19 2020, 09:00 PM Mar 19 2020, 09:00 PM

Return to original view | Post

#2

|

Junior Member

102 posts Joined: Jul 2019 |

QUOTE(j.passing.by @ Mar 15 2020, 02:59 AM) The asset allocation "concept" proposed by many is tied to age. It is to take away the investor's temperament... how the investor perceives himself, whether he can handle risk, how much risk he can take, etc. Conclusion, i need to hold during this uncertain turbulence?The equity/bond ratio shows how much risk you, the investor, should take. So, you don't try to see how you view or classify yourself into which investor category you belongs to... you should try to understand and follow the equity/bond ratio as suggested in your age group. The only different I am saying here is that the money in EPF is also taken into account. Consider the money in EPF as part of your fixed income and bond funds when calculating the equity/bond ratio. How conservative/aggressive you should be is also depended on the amount of money you are having. See the 4-box method in the previous post. There is a threshold minimal amount for 'survival'. The excess amount above this 'survival' level can be risked for higher returns. Combine these 2 factors... your age group and how much you have and earning... you can figure out how much you should have in equity funds. By knowing the appropriate equity/bond ratio that you should have, you are not setting yourself short by not taking enough risk. ======== As for unusual market turbulence, maybe wait for things to settle down before continuing building the portfolio as previously planned. Personally, I tried before to take advantage of market volatility to gain some extra money... sometimes lucky, sometimes not. At the end, all alternate paths lead to the same destination. |

|

|

Mar 20 2020, 07:01 AM Mar 20 2020, 07:01 AM

Return to original view | Post

#3

|

Junior Member

102 posts Joined: Jul 2019 |

QUOTE(j.passing.by @ Mar 20 2020, 12:02 AM) If you are still holding it this week, you should be able to hold it for another week. If you are still holding it next week, you should hold it longer. i asked the opinion from the banker (who sell me this fund), he told this dropping is temporary and advise to do top up when it reach min price so that i can sell it at average later.At the end of the day, you didn't sell because you don't feel any pressure and panic to sell. I think you should diversify the portfolio by having large cap funds too. Check the portfolio next week, calculate how much the smallcap fund has lost from its peak, then spend this amount into Public Islamic Asia Leaders Equity fund. When the market situation is relatively more stable in 2-3 months or earlier, switch the smallcap fund to PIALEF or Public Islamic U.S. Equity fund. f Is this a good idea? |

|

|

Mar 20 2020, 08:36 AM Mar 20 2020, 08:36 AM

Return to original view | IPv6 | Post

#4

|

Junior Member

102 posts Joined: Jul 2019 |

|

|

|

Mar 20 2020, 01:11 PM Mar 20 2020, 01:11 PM

Return to original view | Post

#5

|

Junior Member

102 posts Joined: Jul 2019 |

|

|

|

Mar 20 2020, 02:20 PM Mar 20 2020, 02:20 PM

Return to original view | IPv6 | Post

#6

|

Junior Member

102 posts Joined: Jul 2019 |

|

|

|

|

|

|

Mar 31 2020, 05:28 PM Mar 31 2020, 05:28 PM

Return to original view | IPv6 | Post

#7

|

Junior Member

102 posts Joined: Jul 2019 |

|

|

|

Apr 7 2020, 05:27 PM Apr 7 2020, 05:27 PM

Return to original view | IPv6 | Post

#8

|

Junior Member

102 posts Joined: Jul 2019 |

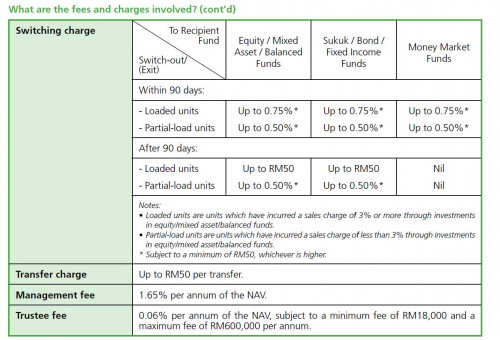

if i switch from bond fund to equity fund, any service charges 5.5% incur? i need advise urgently...

|

|

|

Apr 16 2020, 03:04 PM Apr 16 2020, 03:04 PM

Return to original view | IPv6 | Post

#9

|

Junior Member

102 posts Joined: Jul 2019 |

QUOTE(ameli7a @ Apr 15 2020, 08:25 PM) Hello. I need some advice about this unit trust. I have invested in equity fund 3 years ago. However, the fund’s performance is just average. I have a few questions: which equity fund you invest now?1.What are the difference between these two charges Switching Charge and Transfer Charge? 2. I wish to open a new fund. At the same time, can I transfer just certain units from the old fund to this new fund? If yes, what are the charges and the total charges? Thank you  |

|

|

Apr 17 2020, 07:27 PM Apr 17 2020, 07:27 PM

Return to original view | IPv6 | Post

#10

|

Junior Member

102 posts Joined: Jul 2019 |

QUOTE(ameli7a @ Apr 17 2020, 01:46 PM) Thank you very much your explanation on the switching/transfer charges. I invest in Public Mutual equity fund - PIEMOF. That picture was from the PIEMOF prospectus. I also aimed for the PB Global Technology & Healthcare, it's up a lot for past few weeks but i still dare not to switch yet because worry there is another crash...I wish to open a new fund. 1.Can i open a new fund under PMO Online without a consultant? Is it possible? The current fund I'm investing in has a consultant. Would it automatically take this consultant for the new fund I'm opening? If no, where does the commision for consultant go for the new fund I would be opening 2. Public vs PB funds. One thing I know is that PB funds doesn't have consultant. Anything else pros and cons between these two? 3. Which funds under Public Mutual would you be recommending now. Well it would be wise to invest in funds that are dealing with technology and healthcare. This year suppose to be the breakthrough for 5G, unfortunately Covid-19 landed. 4. Based on my observation, I'm attracted to these few funds but I can't make up my mind. Or is there better fund than these. Please advice. a) PB GLOBAL TECHNOLOGY & HEALTHCARE FUND b) PUBLIC TACTICAL ALLOCATION FUND c) PUBLIC LIFESTYLE & TECHNOLOGY FUND |

|

|

Apr 19 2020, 04:43 PM Apr 19 2020, 04:43 PM

Return to original view | IPv6 | Post

#11

|

Junior Member

102 posts Joined: Jul 2019 |

May i know now is a good time to switch to Global equity fund? |

| Change to: |  0.0961sec 0.0961sec

0.56 0.56

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 02:29 PM |