Outline ·

[ Standard ] ·

Linear+

Public Mutual Funds, version 0.0

|

1mr3tard3d

|

Apr 26 2024, 05:02 PM Apr 26 2024, 05:02 PM

|

|

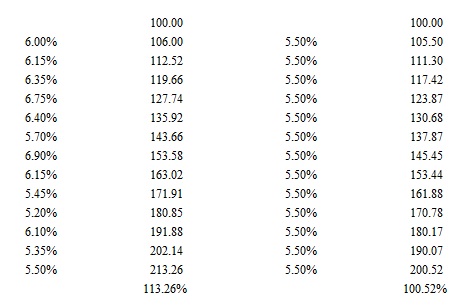

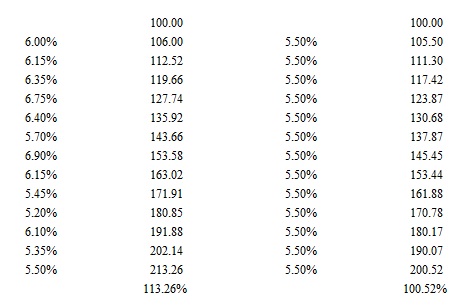

QUOTE(jep @ Apr 26 2024, 03:42 PM) How long do we need to keep the funds? I have 1 fund already 13 years...but profit wise around 100% now..so divided by 13 years...it should be around 7.7% p.a since inception...should I keep it or redeem back to KWSP? depending on how confident you are with the investment made by the fund  investment is about prospective not historic usually they compare with annualised return the EPF annualised return between 2011 and 2023 is around 6%, while your fund is about 5.50%  potential tax relief for EPF voluntary contribution |

|

|

|

|

|

1mr3tard3d

|

Jan 3 2025, 03:58 PM Jan 3 2025, 03:58 PM

|

|

QUOTE(sl3ge @ Jan 3 2025, 02:39 PM) I got family member who dont want open public mutual online account. Everytime when want check account fund value need go to branch print. May i know how to manually calculate distribution? could browse the announcement for latest distribution for an older date, need to search from the annual/interim report |

|

|

|

|

|

1mr3tard3d

|

Jan 3 2025, 06:01 PM Jan 3 2025, 06:01 PM

|

|

QUOTE(sl3ge @ Jan 3 2025, 05:09 PM) Ya, how to calculate the unit? PIEBF for instance: total unit = 1,000 on declaration date distribution = 5.5 sen per unit 1,000 x 0.055 = RM 55 RM 55 / NAV of Declaration date + 1 = unit distributed: RM 55 / RM 1.2005 = 45.81 unit This post has been edited by 1mr3tard3d: Jan 3 2025, 06:27 PM |

|

|

|

|

|

1mr3tard3d

|

Jan 3 2025, 11:47 PM Jan 3 2025, 11:47 PM

|

|

QUOTE(sl3ge @ Jan 3 2025, 07:10 PM) RM 55 / NAV of Declaration date "+ 1" = unit distributed: RM 55 / RM 1.2005 = 45.81 unit "+1" mean what? since RM 55 / RM 1.2005 = 45.81 unit <-no involved "+1" it's "declaration date + 1 business day" the day of NAV being referred to |

|

|

|

|

Apr 26 2024, 05:02 PM

Apr 26 2024, 05:02 PM

Quote

Quote 0.0986sec

0.0986sec

0.40

0.40

7 queries

7 queries

GZIP Disabled

GZIP Disabled