QUOTE(ironman16 @ Feb 9 2021, 08:34 AM)

PUBLIC e-CARBON EFFICIENT FUND (PeCEF) Risk 5

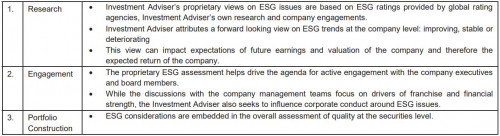

The fund will invest in stocks of companies with efficient carbon footprint. Companies with efficient carbon footprint refer to companies that have lower levels of carbon emissions relative to peers within a particular industry.

The fund will invest in stocks of companies with efficient carbon footprint which are component stocks of an Environmental, Social and Governance (ESG) index

PUBLIC e-CARBON EFFICIENT

The link is dead from my office networkThe fund will invest in stocks of companies with efficient carbon footprint. Companies with efficient carbon footprint refer to companies that have lower levels of carbon emissions relative to peers within a particular industry.

The fund will invest in stocks of companies with efficient carbon footprint which are component stocks of an Environmental, Social and Governance (ESG) index

PUBLIC e-CARBON EFFICIENT

QUOTE

This fund is temporarily not available for investment via this service. Please call our Customer Service at 03-2022 5000 for further assistance.

Feb 9 2021, 08:38 AM

Feb 9 2021, 08:38 AM

Quote

Quote

0.1046sec

0.1046sec

0.38

0.38

7 queries

7 queries

GZIP Disabled

GZIP Disabled