QUOTE(ozak @ Mar 8 2024, 12:39 PM)

i mean your sis could put it in EPF and earns ~5% per yearThis post has been edited by ronnie: Mar 8 2024, 12:58 PM

Public Mutual Funds, version 0.0

|

|

Mar 8 2024, 12:45 PM Mar 8 2024, 12:45 PM

|

All Stars

21,308 posts Joined: Jan 2003 From: Kuala Lumpur |

|

|

|

|

|

|

Mar 8 2024, 12:47 PM Mar 8 2024, 12:47 PM

|

All Stars

17,018 posts Joined: Jan 2005 |

|

|

|

Mar 8 2024, 01:03 PM Mar 8 2024, 01:03 PM

|

Junior Member

228 posts Joined: Jul 2006 From: USJ7, Shah Alam, Banting |

|

|

|

Mar 8 2024, 01:30 PM Mar 8 2024, 01:30 PM

Show posts by this member only | IPv6 | Post

#2904

|

Senior Member

3,952 posts Joined: Nov 2016 |

QUOTE(DoomHammer @ Mar 8 2024, 01:03 PM) impressive returnsesp the Public Islamic Dividend chilskater and DoomHammer liked this post

|

|

|

Mar 8 2024, 11:49 PM Mar 8 2024, 11:49 PM

Show posts by this member only | IPv6 | Post

#2905

|

All Stars

17,018 posts Joined: Jan 2005 |

|

|

|

Mar 9 2024, 10:13 AM Mar 9 2024, 10:13 AM

|

Junior Member

429 posts Joined: Jul 2022 |

|

|

|

|

|

|

Mar 9 2024, 11:22 AM Mar 9 2024, 11:22 AM

Show posts by this member only | IPv6 | Post

#2907

|

All Stars

14,857 posts Joined: Mar 2015 |

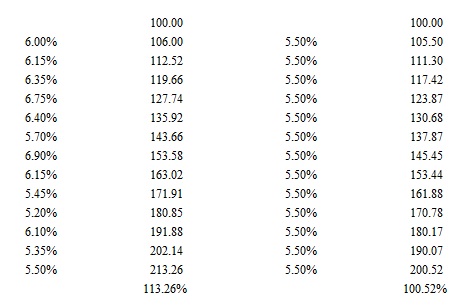

The total performance of Public Dividend Select fund for the past recent 10 yrs is 12.07%....while the Islamic one is 34%.

1 yr is average about % for those funds? I yr is average how much % if put in EPF? If entered in Mar 2014, still got profit how many % AFTER paying the onitial 5.5% SC? This post has been edited by MUM: Mar 9 2024, 05:44 PM Attached thumbnail(s)

|

|

|

Mar 9 2024, 11:49 AM Mar 9 2024, 11:49 AM

Show posts by this member only | IPv6 | Post

#2908

|

All Stars

17,018 posts Joined: Jan 2005 |

What kind of this bullshit dividen fund and either loss or pay peanut?

Fun manager gaji buta. |

|

|

Mar 11 2024, 09:56 AM Mar 11 2024, 09:56 AM

|

Junior Member

429 posts Joined: Jul 2022 |

|

|

|

Apr 26 2024, 03:42 PM Apr 26 2024, 03:42 PM

Show posts by this member only | IPv6 | Post

#2910

|

Senior Member

1,182 posts Joined: Jan 2003 From: Key Ell, Blkg |

How long do we need to keep the funds? I have 1 fund already 13 years...but profit wise around 100% now..so divided by 13 years...it should be around 7.7% p.a since inception...should I keep it or redeem back to KWSP?

|

|

|

Apr 26 2024, 04:01 PM Apr 26 2024, 04:01 PM

|

All Stars

21,308 posts Joined: Jan 2003 From: Kuala Lumpur |

QUOTE(jep @ Apr 26 2024, 03:42 PM) How long do we need to keep the funds? I have 1 fund already 13 years...but profit wise around 100% now..so divided by 13 years...it should be around 7.7% p.a since inception...should I keep it or redeem back to KWSP? which fund did you get ?it's up to you.... if annual growth is ~7.7% is higher than EPF/...keep it there. is that 7.7% = CAGR ? This post has been edited by ronnie: Apr 26 2024, 04:01 PM |

|

|

Apr 26 2024, 04:16 PM Apr 26 2024, 04:16 PM

Show posts by this member only | IPv6 | Post

#2912

|

Senior Member

1,182 posts Joined: Jan 2003 From: Key Ell, Blkg |

|

|

|

Apr 26 2024, 04:17 PM Apr 26 2024, 04:17 PM

Show posts by this member only | IPv6 | Post

#2913

|

Senior Member

1,182 posts Joined: Jan 2003 From: Key Ell, Blkg |

|

|

|

|

|

|

Apr 26 2024, 05:02 PM Apr 26 2024, 05:02 PM

Show posts by this member only | IPv6 | Post

#2914

|

Senior Member

1,137 posts Joined: Oct 2018 |

QUOTE(jep @ Apr 26 2024, 03:42 PM) How long do we need to keep the funds? I have 1 fund already 13 years...but profit wise around 100% now..so divided by 13 years...it should be around 7.7% p.a since inception...should I keep it or redeem back to KWSP? depending on how confident you are with the investment made by the fund investment is about prospective not historic usually they compare with annualised return the EPF annualised return between 2011 and 2023 is around 6%, while your fund is about 5.50%  potential tax relief for EPF voluntary contribution |

|

|

Apr 26 2024, 06:22 PM Apr 26 2024, 06:22 PM

|

Junior Member

302 posts Joined: Mar 2010 |

|

|

|

May 11 2024, 12:24 PM May 11 2024, 12:24 PM

|

Junior Member

420 posts Joined: Feb 2022 |

Just ranting here. PM being from Public Bank is really very not user friendly.

its been sometime since I last access look at my funds maybe already 2 years. tried to log in to PMO for domestic borrowing status,upload my MyKad/passport. jezz they already have my mykad, been investing from them since I was a kid. very irritated |

|

|

Jan 3 2025, 02:39 PM Jan 3 2025, 02:39 PM

|

Senior Member

1,367 posts Joined: Jan 2003 |

Hi,

I got family member who dont want open public mutual online account. Everytime when want check account fund value need go to branch print. May i know how to manually calculate distribution? This post has been edited by sl3ge: Jan 3 2025, 02:40 PM |

|

|

Jan 3 2025, 03:58 PM Jan 3 2025, 03:58 PM

Show posts by this member only | IPv6 | Post

#2918

|

Senior Member

1,137 posts Joined: Oct 2018 |

QUOTE(sl3ge @ Jan 3 2025, 02:39 PM) I got family member who dont want open public mutual online account. could browse the announcement for latest distributionEverytime when want check account fund value need go to branch print. May i know how to manually calculate distribution? for an older date, need to search from the annual/interim report |

|

|

Jan 3 2025, 05:09 PM Jan 3 2025, 05:09 PM

|

Senior Member

1,367 posts Joined: Jan 2003 |

QUOTE(1mr3tard3d @ Jan 3 2025, 03:58 PM) could browse the announcement for latest distribution Ya, how to calculate the unit?for an older date, need to search from the annual/interim report |

|

|

Jan 3 2025, 06:01 PM Jan 3 2025, 06:01 PM

Show posts by this member only | IPv6 | Post

#2920

|

Senior Member

1,137 posts Joined: Oct 2018 |

QUOTE(sl3ge @ Jan 3 2025, 05:09 PM) PIEBF for instance:total unit = 1,000 on declaration date distribution = 5.5 sen per unit 1,000 x 0.055 = RM 55 RM 55 / NAV of Declaration date + 1 = unit distributed: RM 55 / RM 1.2005 = 45.81 unit This post has been edited by 1mr3tard3d: Jan 3 2025, 06:27 PM sl3ge liked this post

|

| Change to: |  0.0211sec 0.0211sec

1.08 1.08

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 2nd December 2025 - 03:15 PM |