QUOTE(frankzane @ Sep 3 2021, 06:59 PM)

The spread can be up to 9 ringgit...

in terms of %?

count and compare in % easier to see...

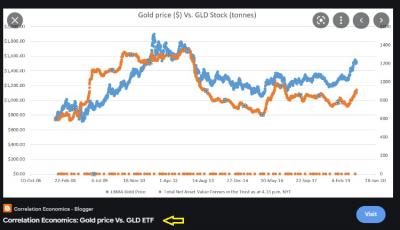

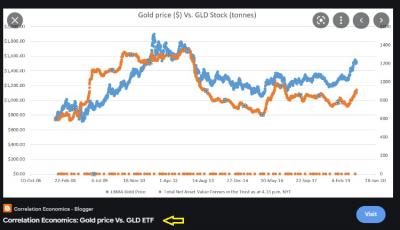

i think, you are comparing directly with Gold price Versus Gold etfs....

not sure if those Gold etfs are directly correlated with direct Gold price....

does the Gold etfs that this P emas gold fund hold will have the same risk and reward ratio compared to direct gold investing thru bank's Gold investing a/c

unknown to what 5 etfs P emas gonna hold...

my wild guess will be these 5 Etfs will have lesser volatility...

A Comparative Study on Gold vs. Gold ETF’s and an

Analysis of Gold ETF’s as an Effective Investment

Tool for Indian Retail Investors

Dr. Raghu G Anand

Jain University- Center for Management Studies, Bangalore, India

http://www.ijmbs.com/Vol7/73/4-dr-raghu-g-anand.pdfbtw, the attached image is NOT from that above study...it is from google image

This post has been edited by MUM: Sep 3 2021, 07:27 PM Attached thumbnail(s)

Jul 12 2021, 06:48 PM

Jul 12 2021, 06:48 PM

Quote

Quote

0.0235sec

0.0235sec

0.34

0.34

6 queries

6 queries

GZIP Disabled

GZIP Disabled