QUOTE(squarepilot @ Nov 28 2020, 08:29 PM)

if refer to RM amount it maybe lesser too...as it depended on the NAV of that daybut if according to % then it is the same...just 1.8%

This post has been edited by MUM: Nov 28 2020, 08:38 PM

Public Mutual Funds, version 0.0

|

|

Nov 28 2020, 08:30 PM Nov 28 2020, 08:30 PM

Return to original view | IPv6 | Post

#141

|

All Stars

14,869 posts Joined: Mar 2015 |

QUOTE(squarepilot @ Nov 28 2020, 08:29 PM) if refer to RM amount it maybe lesser too...as it depended on the NAV of that daybut if according to % then it is the same...just 1.8% This post has been edited by MUM: Nov 28 2020, 08:38 PM |

|

|

|

|

|

Dec 3 2020, 11:05 PM Dec 3 2020, 11:05 PM

Return to original view | IPv6 | Post

#142

|

All Stars

14,869 posts Joined: Mar 2015 |

|

|

|

Jan 16 2021, 12:34 AM Jan 16 2021, 12:34 AM

Return to original view | IPv6 | Post

#143

|

All Stars

14,869 posts Joined: Mar 2015 |

QUOTE(iChongYC @ Jan 16 2021, 12:14 AM) Hi all sifu, any idea if "Public Mutual launches US Eagle Fund" is good to invest? Up to 5% of net asset value (NAV) per unit. mind telling more?...Also, how about the "Public Lifestyle & Technology Fund"? first time investing in unit trust funds? do you have another other unit trust funds with public mutual or other fund house? while you wait for more value added responses, you can try read these for some added info... Helpful Tips for A Successful Unit Trust Investment https://www.publicmutual.com.my/Menu/Learni...rust-Investment 5 Pointers on Unit Trust Investing https://www.publicmutual.com.my/Menu/Learni...Trust-Investing Using Fund Volatility To Help In Selecting Funds https://www.publicmutual.com.my/Menu/Learni...Selecting-Funds Having the Proper Mindset for Investing https://www.publicmutual.com.my/Menu/Learni...t-for-Investing https://www.publicmutual.com.my/Menu/Learning-Hub This post has been edited by MUM: Jan 16 2021, 12:39 AM WaNaWe900 liked this post

|

|

|

Jan 16 2021, 12:51 AM Jan 16 2021, 12:51 AM

Return to original view | IPv6 | Post

#144

|

All Stars

14,869 posts Joined: Mar 2015 |

QUOTE(iChongYC @ Jan 16 2021, 12:44 AM) Not really, but first time for public bank unit trust. just wondering what is PBUSEF invested in?Just wondering how you guys thought of these two funds. Is it a good to invest PBUSEF?? any similar mandated funds from other fundhouse that may have existed for sometime and maybe the sales charges is lower too? |

|

|

Jan 16 2021, 12:57 AM Jan 16 2021, 12:57 AM

Return to original view | IPv6 | Post

#145

|

All Stars

14,869 posts Joined: Mar 2015 |

QUOTE(iChongYC @ Jan 16 2021, 12:55 AM) Info as below: so you are buying unit trust funds based on its lower NAV?https://www.thestar.com.my/business/busines...s-us-eagle-fund https://www.thesundaily.my/business/public-...-fund-KG5945286 RM0.25 per unit now, thinking to invest. the new one are selling at 0.25 NAV will be more worthy than those existing one that maybe selling at 1.50 NAV? This post has been edited by MUM: Jan 16 2021, 12:59 AM |

|

|

Jan 16 2021, 01:13 AM Jan 16 2021, 01:13 AM

Return to original view | IPv6 | Post

#146

|

All Stars

14,869 posts Joined: Mar 2015 |

QUOTE(iChongYC @ Jan 16 2021, 01:07 AM) Another question, is there any different between I choose to place my Unit Trust over PMO without entering any consultant? will the sales charge be the same?? if i can remember correctly, someone mentioned that you can don't put in the consultant code, the sales charge still applies but no agent will get it. This post has been edited by MUM: Jan 16 2021, 01:16 AM |

|

|

|

|

|

Jan 19 2021, 07:03 PM Jan 19 2021, 07:03 PM

Return to original view | IPv6 | Post

#147

|

All Stars

14,869 posts Joined: Mar 2015 |

QUOTE(jlkh760830 @ Jan 19 2021, 06:59 PM) Yalor ,,by the way,, need to ask, while waiting for responses, you can try these article for some added infoWhat if I plans to invest at new fund? How to justify to fund is potential or not? And if I plans to join account with my daughter to invest a fund that allow her generate some extra funds for her future studies,, which type of fund are secure to invest? Anyone sifu can tunjuk ajar? 🙏🙇 Things That Every Unit Trust Investor Should Know https://www.publicmutual.com.my/Menu/Learning-Hub |

|

|

Jan 19 2021, 07:47 PM Jan 19 2021, 07:47 PM

Return to original view | IPv6 | Post

#148

|

All Stars

14,869 posts Joined: Mar 2015 |

sometimes for some people,...they will do it in reverse...

sort of like this,... think of how much $$ they want as a goal/target to have in the end. think of how much they can save initial and the periodic investment they can add into it, think of how long they can do that before reaching the target, then think of how much they need the initial money and the periodic top up to work (how many % of ROI per year) to enable meeting of target. then think of what investment can provide that type of returns... then think of whether one can stomach the risk that come with that investment. if the parameters is not feasible,...adjust them. |

|

|

Feb 10 2021, 04:42 AM Feb 10 2021, 04:42 AM

Return to original view | IPv6 | Post

#149

|

All Stars

14,869 posts Joined: Mar 2015 |

QUOTE(!@#$%^ @ Feb 10 2021, 02:40 AM) just wondering if PM funds are really performing well if excluding the high service charge? thinking of putting in some via i-invest. I think you can have a look of the past performance track record of the fund you wanted to buy before actually buying it. The past performance track records are without the sales charge input factor |

|

|

Feb 14 2021, 10:09 PM Feb 14 2021, 10:09 PM

Return to original view | IPv6 | Post

#150

|

All Stars

14,869 posts Joined: Mar 2015 |

QUOTE(jlkh760830 @ Feb 14 2021, 10:02 PM) Any sifu can explain what's the meaning of the chart with the blue color line & the benchmark brown color line? means the actual fund performance is "BETTER" than its stated benchmark during the selected period (time frame)How to different ship the meaning of the chart? ............ |

|

|

Feb 15 2021, 08:01 PM Feb 15 2021, 08:01 PM

Return to original view | IPv6 | Post

#151

|

All Stars

14,869 posts Joined: Mar 2015 |

QUOTE(jojojoget @ Feb 15 2021, 07:58 PM) how much does PM charge for sales charge?are there any others fundhouses that charges less? |

|

|

Feb 15 2021, 08:09 PM Feb 15 2021, 08:09 PM

Return to original view | IPv6 | Post

#152

|

All Stars

14,869 posts Joined: Mar 2015 |

|

|

|

Feb 15 2021, 08:13 PM Feb 15 2021, 08:13 PM

Return to original view | IPv6 | Post

#153

|

All Stars

14,869 posts Joined: Mar 2015 |

|

|

|

|

|

|

Feb 15 2021, 08:27 PM Feb 15 2021, 08:27 PM

Return to original view | IPv6 | Post

#154

|

All Stars

14,869 posts Joined: Mar 2015 |

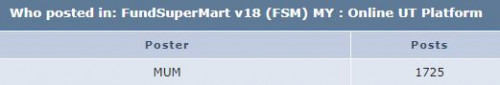

QUOTE(GrumpyNooby @ Feb 15 2021, 08:14 PM) If I know I won't ask you since I'm so stupid with investment. And you give so many valuable advices till be the top poster in the other thread.  Definitely you're more resourceful and qualified adviser as per SC guideline. I'm just a noob. QUOTE(GrumpyNooby @ Dec 25 2020, 10:44 AM) then i kena pulak wongmunkeong liked this post

|

|

|

Feb 20 2021, 11:49 PM Feb 20 2021, 11:49 PM

Return to original view | IPv6 | Post

#155

|

All Stars

14,869 posts Joined: Mar 2015 |

QUOTE(jlkh760830 @ Feb 20 2021, 11:22 PM) Hi all sifu,, I'm still in learning stage, can I know actually when doing redemption on each unit? Actually how to calculate the each unit worth how much? the unit price or NAV is published as per https://www.publicmutual.com.my/Our-Products/UT-Fund-Prices the NAV stated on the date is the unit price of that date. This post has been edited by MUM: Feb 20 2021, 11:50 PM |

|

|

Feb 22 2021, 03:54 PM Feb 22 2021, 03:54 PM

Return to original view | IPv6 | Post

#156

|

All Stars

14,869 posts Joined: Mar 2015 |

QUOTE(george_dave91 @ Feb 22 2021, 03:39 PM) Hi guys. I’ve been doing a comparison of several fundfact sheets between PM funds and that of its competitors such as Affin Hwang, Eastspring, etc. what is the criteria for winning the award? is it solely based on the BEST ROI performance for the period in evaluation?I find that most of the PM funds don’t seem to be doing as well when compared to its competitors (mainly looking at funds that have been around for more than 10 years or at least 5 years). Nevertheless PM seems to be winning many awards now and then. I can’t understand why. Yes I do understand that past performance for not guarantee future performance but track record still helps us make an educated guess on how well these funds are managed. Especially when doing comparative types of analysis. Do you guys agree? Anyways, does anyone here have great performance/ experience with their PM funds (which funds?)? Care to share? Thanks. |

|

|

Feb 22 2021, 05:56 PM Feb 22 2021, 05:56 PM

Return to original view | IPv6 | Post

#157

|

All Stars

14,869 posts Joined: Mar 2015 |

QUOTE(DragonReine @ Feb 22 2021, 05:48 PM) so, the award is given based solely on the BEST ROI performance for the period in evaluation? |

|

|

Mar 17 2021, 05:30 PM Mar 17 2021, 05:30 PM

Return to original view | IPv6 | Post

#158

|

All Stars

14,869 posts Joined: Mar 2015 |

QUOTE(kakashial @ Mar 17 2021, 05:20 PM) wanna ask, how regular do you redeem the profit? while waiting for value added responsesWill the unrealised profit turns into the top up? or just redeem when see the profit went high? i googled and found this... some redeem the profit by moving to other laggard funds,...something like this...to try to stay inline with the desired % of allocation Rebalancing Your Portfolio https://www.publicmutual.com.my/Menu/Learni...-Your-Portfolio A Sensible Approach on When to Redeem your Funds https://www.publicmutual.com.my/Menu/Learni...deem-your-Funds WaNaWe900 liked this post

|

|

|

Apr 12 2021, 12:56 PM Apr 12 2021, 12:56 PM

Return to original view | IPv6 | Post

#159

|

All Stars

14,869 posts Joined: Mar 2015 |

QUOTE(wildhawk @ Apr 12 2021, 12:12 PM) FYI, found out that Public Mutual is really not earning due to agent only concern to "fulfill" her quota, ask another friend to calculate EPF earnings against Public Mutual, if kept in EPF I would have earned 20K or more, Public Mutual, I'm losing....lesson learned. Withdraw from Public Mutual and diversify in FD where it is safe with PIDM. Just my 2 cents on Public Mutual and not helpful agents. Hope you are not diversifying Yr epf money into fd. Medufsaid and wongmunkeong liked this post

|

|

|

Apr 14 2021, 05:20 PM Apr 14 2021, 05:20 PM

Return to original view | IPv6 | Post

#160

|

All Stars

14,869 posts Joined: Mar 2015 |

|

| Change to: |  0.0286sec 0.0286sec

0.27 0.27

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 7th December 2025 - 09:32 PM |