QUOTE(limwc78 @ May 11 2016, 11:34 AM)

Their Nidoz still around RM 520 psf consider reasonable in the market. So increase 6% to RM 550 psf still acceptable.

Nidoz have huge price range esp facing and block. Same size unit, if 3 different blocks and all different viewing, the price can be vary as high as RM 40-50 psf. RM 520 psf I reckoned was low floors, when I visit their showroom, middle floors to higher floors a bit was RM 550-580 psf nett.

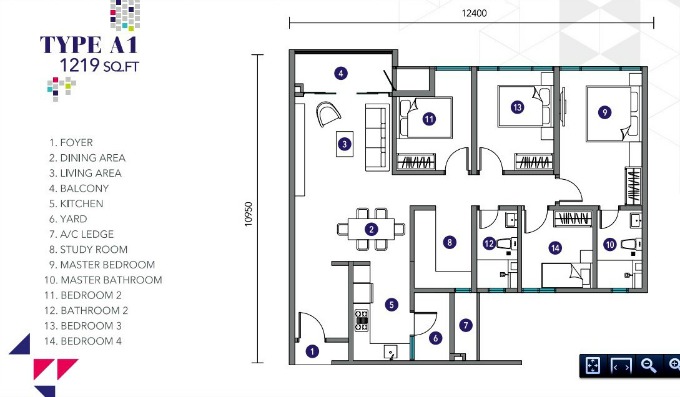

Overall layout ok, though smaller yard, small rooms and smaller living hall. But the foyer is not acceptable at only 2-3" ft btw main door and grille gate. Big size ideal for own stay, as mentioned by SAs, some walls can be hack to make it larger. But, SAs a bit over confident on the layout, claimed almost 10/10 points for all areas and flawless. Sorry to SAs, I know most of u are here.

If previously has lower floor unit, I could take one dy. but, I feel price is fair although leasehold and high density. Progressive interests for 4 years was the major obstacle to let me decided not to go for middle floor, approx RM 600+ psf inclusive 7-8% interest.

May 18 2016, 04:16 PM

May 18 2016, 04:16 PM

Quote

Quote

0.1999sec

0.1999sec

0.82

0.82

7 queries

7 queries

GZIP Disabled

GZIP Disabled