QUOTE(prophetjul @ Nov 21 2021, 11:28 AM)

Aust financial year is 1 July - 30 June while Msia financial year is the calendar year (1 Jan - 31 Dec). If you have assets in Aust and is a non-resident, then you pay a flat 10% tax. Declaring yourself as a non-tax resident may actually save you tax if your income (from your assets) is quite substantial.Let me quote you an example:

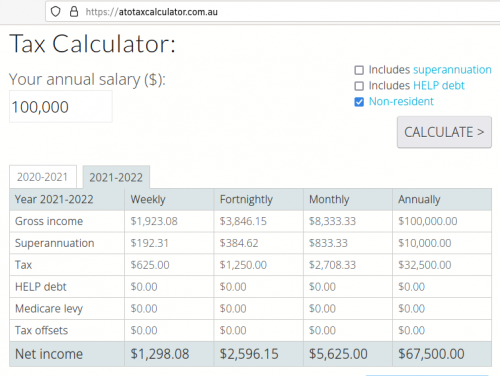

Let's say you have an income of A100k. As a non-tax resident, you will pay a flat 10% which is A10k. Now if you were a tax resident of Aust, you will have a tax bill of around A23k (not including the 2% Medicare levy). This is why a lot of people do not want to stay more than 183 day/yr in Aust so then they become non-tax resident and their tax bill is a lot less.

Aust tax rate:

$0 – $18,200 0% Nil

$18,201 – $45,000 19% 19c for each $1 over $18,200

$45,001 – $120,000 32.5% $5,092 plus 32.5c for each $1 over $45,000

$120,001 – $180,000 37% $29,467 plus 37c for each $1 over $120,000

$180,001 and over 45% $51,667 plus 45c for each $1 over $180,000

P's: As far as i am aware the above is correct but the tax rules may have changed in the last few years.

This post has been edited by Garysydney: Nov 21 2021, 09:58 PM

Nov 21 2021, 09:48 PM

Nov 21 2021, 09:48 PM

Quote

Quote

0.0339sec

0.0339sec

0.14

0.14

7 queries

7 queries

GZIP Disabled

GZIP Disabled