Outline ·

[ Standard ] ·

Linear+

M Reits Version 7, Malaysia Real Estate Investment

|

pisces88

|

Feb 22 2018, 10:51 AM Feb 22 2018, 10:51 AM

|

|

QUOTE(foofoosasa @ Feb 22 2018, 07:44 AM) Got mine @1.34 . I bought very small only for my portfolio percentage. Beside the da men under perform and the interest rate hike, I guess there is no announcement yet. Just don't rush to buy, in bear market trend for reits , plenty of chances. Hopefully we can see net yield around 7 percent Ish.... Last few year all the reits holder syok by the capital gain instead of dividend collection, now after the complacent of low interest rates for so long (after so many years of wind talk want increase rate) , it is time to revert back to yield 6-8 percents range for all the reits. Yea nt gonna rush it.. Jus gonna buy some n keep for long term. Today looks better, as of now is 1.36 |

|

|

|

|

|

pisces88

|

May 28 2018, 06:31 PM May 28 2018, 06:31 PM

|

|

so what reits u guys chasing? been awhile since i last bought reits.

queuing for ytl, igb, and pav on daily basis now.

|

|

|

|

|

|

pisces88

|

May 29 2018, 11:58 PM May 29 2018, 11:58 PM

|

|

QUOTE(Omega Z @ May 29 2018, 11:47 PM) Am chasing for mqreit, pav and IGB. Caught some mqreit at 1.04. Now aiming for more maybe around 1.08-1.10 what prices you queue for IGB and Pav? Pav kena selldown recently due to Najib's scandal and Pav owner, Desmond. Wondering should i get some?  IGB missed out when it was trading around 1.45++  i dont think pav owner's case will kacau pavillion mall.. impossible those tenants move out because of desmond right..  i queue igb around 1.6-1.62, pavreit 1.41-1.43. |

|

|

|

|

|

pisces88

|

May 30 2018, 12:02 AM May 30 2018, 12:02 AM

|

|

QUOTE(Omega Z @ May 29 2018, 11:53 PM) EPF buying in yo hahaha it has been staying above 1.10 for quite long already not.. not sure you can get at 1.08. i think around 1.10 would be a good price to go in I read many reports by different brokers.. most of them giving TP above 1.30 but of course take it as pinch of salt  mrcb 1.10 good price  can queue also, see can get or not |

|

|

|

|

|

pisces88

|

May 30 2018, 11:03 AM May 30 2018, 11:03 AM

|

|

QUOTE(foofoosasa @ May 30 2018, 10:50 AM) got my MQreit, igb ,pav and axreit  U mean today? All red red across board.. Lets see can match my queue or nt hahaha |

|

|

|

|

|

pisces88

|

May 30 2018, 12:56 PM May 30 2018, 12:56 PM

|

|

QUOTE(foofoosasa @ May 30 2018, 12:13 PM) Since few weeks time ago during the panic sales. I think many big fund choose reits as temporarily safe heaven since too many big stocks affected by new gov policy. It turn out that most of the ex related gov counter heavily sell by pnb and epf too, reit will probably one the safer bet since there are not much counter perceived as safer. Must be Tun's instuction to throw all ex gov related counters.. Gamuda very tempting, celaka drop so much. Sakit for me |

|

|

|

|

|

pisces88

|

May 30 2018, 12:58 PM May 30 2018, 12:58 PM

|

|

QUOTE(cherroy @ May 30 2018, 11:53 AM) Reit are steady across generally, despite general and regional/world market selldown. Yup. Waiting for panic sales |

|

|

|

|

|

pisces88

|

Apr 9 2020, 05:16 PM Apr 9 2020, 05:16 PM

|

|

QUOTE(abcn1n @ Apr 9 2020, 05:08 PM) Anybody been buying IGB Reit and Sunreit lately? What reits have you all been buying lately? eyeing all the famous retail reits , hvnt go in  pavreit, sunreit, igbreit. |

|

|

|

|

|

pisces88

|

Jul 29 2020, 05:59 PM Jul 29 2020, 05:59 PM

|

|

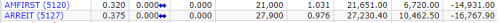

holding amfirst around 2013 until now, from rm1 already rm0.38 now.

i think only reits for prime shopping malls like igb, klcc and pav worth to hold. offices etc, dont look good

|

|

|

|

|

|

pisces88

|

Jul 29 2020, 11:24 PM Jul 29 2020, 11:24 PM

|

|

QUOTE(moosset @ Jul 29 2020, 11:14 PM) dropped so much?  how many times did you DCA? jus a couple of times. but enough la. no more liao, better put money elsewhere |

|

|

|

|

|

pisces88

|

Aug 3 2020, 02:48 PM Aug 3 2020, 02:48 PM

|

|

QUOTE(ozak @ Aug 3 2020, 01:46 PM) Just sell all my Amfirst today. And Arreit also. I m slowly get rid off most of the REIT. The graph for most of the counter doesn't look growing from the past yrs. Probably lost 50%. Will put into other sector counter to earn back the profit. Ouch. Yala maybe put in glove counters 2 weeks already get back profit loll |

|

|

|

|

|

pisces88

|

Aug 3 2020, 07:17 PM Aug 3 2020, 07:17 PM

|

|

QUOTE(return78 @ Aug 3 2020, 04:07 PM) Today lots of reit counter had big movement especially YTLReit. YTLReit kinda become high beta stock where its likely foreign index fund is making move again. They probably worried about curfew in Victoria state. ytlreit at 0.75-0.8 looks tempting though |

|

|

|

|

|

pisces88

|

Aug 3 2020, 07:37 PM Aug 3 2020, 07:37 PM

|

|

QUOTE(ozak @ Aug 3 2020, 07:35 PM) That is the share lost. Not div.  my share lost -60% celaka  |

|

|

|

|

|

pisces88

|

Aug 4 2020, 04:03 PM Aug 4 2020, 04:03 PM

|

|

QUOTE(thxxht @ Aug 4 2020, 04:02 PM) you are not alone  I'm still holding some though, can get dividend still, hopefully once vaccine comes out it'll recover. Which ones? Amfirst -60%, arreit -30%... Gg hahah |

|

|

|

|

|

pisces88

|

Aug 4 2020, 04:09 PM Aug 4 2020, 04:09 PM

|

|

QUOTE(thxxht @ Aug 4 2020, 04:05 PM) i have most MREITs lol, the worst hit are HEKTAR, YTLREIT, CMMT (this one has been a lost cause since very beginning, sungai wang is a graveyard), ARREIT, ALSTREIT, AMFIRST. Wow me too. I hv twrreit (gg also), sunreit, ytlreit, amfirst, arreit, pavreit and igbreit lol |

|

|

|

|

|

pisces88

|

Aug 5 2020, 12:37 AM Aug 5 2020, 12:37 AM

|

|

QUOTE(moosset @ Aug 4 2020, 11:48 PM) wah... -60% also you sold?  maybe I should sell some of my shares... Belum sell bro.. i think i jus let it be la. See can recover abit next qr |

|

|

|

|

|

pisces88

|

Aug 6 2020, 02:04 AM Aug 6 2020, 02:04 AM

|

|

ytl looking very oversold. any takers?  |

|

|

|

|

|

pisces88

|

Aug 6 2020, 10:49 AM Aug 6 2020, 10:49 AM

|

|

QUOTE(tangtang22 @ Aug 6 2020, 10:38 AM) Not sure if u are aware of the major disclousures just announced few days ago. Would say it is a fair price right now. Yup the 50% discounts, stil attractive at current price hehe i queue 77 sen. See can get or nt |

|

|

|

|

|

pisces88

|

Aug 10 2020, 05:27 PM Aug 10 2020, 05:27 PM

|

|

ytlreit slowly up

|

|

|

|

|

|

pisces88

|

Mar 21 2024, 12:35 PM Mar 21 2024, 12:35 PM

|

|

just wanna put this here so people can understand that reits are not as stable as you think, and malaysia reits in general is not to be held long term, with exception to Malls reits only. after about 10 years. this is the return.   This post has been edited by pisces88: Mar 21 2024, 12:36 PM This post has been edited by pisces88: Mar 21 2024, 12:36 PM |

|

|

|

|

Feb 22 2018, 10:51 AM

Feb 22 2018, 10:51 AM

Quote

Quote

0.0241sec

0.0241sec

0.90

0.90

7 queries

7 queries

GZIP Disabled

GZIP Disabled