Outline ·

[ Standard ] ·

Linear+

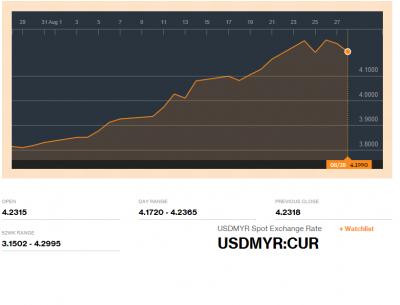

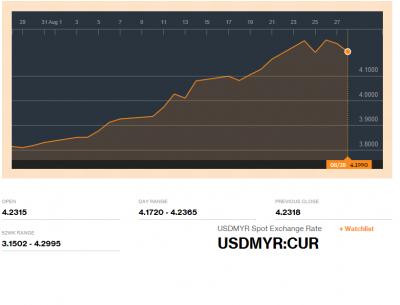

ringgit Malaysia drop , how to I change my RM to USD

|

MGM

|

Jan 7 2015, 03:45 AM Jan 7 2015, 03:45 AM

|

|

QUOTE(AVFAN @ Jan 6 2015, 07:25 PM) not at all. where u were in 1997? usd/rm = 3.80. fd rates >10%. the big question to ask now is what will help strengthen rm and if these elements are there or will happen? In 1998, USD/MYR was at its lowest of 4.40. |

|

|

|

|

|

MGM

|

Jan 7 2015, 08:16 AM Jan 7 2015, 08:16 AM

|

|

QUOTE(TruthHurts @ Jan 7 2015, 05:29 AM) Last time it falls to RM4.40 but the government have enough reserved to circulate the money .. till now RM ever got to 3.0 = 1usd. Last time it was like 2.7 = 1usd. How many years now and we still can't recover below 3.0 = 1usd. And now with all the shits that happen .. I doubt we can recover to 3.0 or yet we might go 5.0 = 1usd and stay there for a couple of years. Read somewhere that the reserve then was only USD30 billion but now is USD110 billion. |

|

|

|

|

|

MGM

|

Aug 7 2015, 10:31 AM Aug 7 2015, 10:31 AM

|

|

QUOTE(richstars8818 @ Aug 6 2015, 09:59 PM) i bought USD100k @ 3.78.. i will sell it when it reach 4 How much net profit can u make for such transaction, knowing that the gross is rm22000? |

|

|

|

|

|

MGM

|

Aug 10 2015, 10:27 PM Aug 10 2015, 10:27 PM

|

|

Many SMEs are hoping for the pegging of RM to US, my boss included.

|

|

|

|

|

|

MGM

|

Aug 12 2015, 12:40 PM Aug 12 2015, 12:40 PM

|

|

QUOTE(eric84cool @ Aug 12 2015, 12:19 PM) Am I right to say that if bank outside Malaysia is selling Ringgit cheap due to supply more than demand, our BNM needs to use US dollar from reserve fund to buy back the ringgit in order not to drop further? Is there any rules mentioning that each country at least need to keep how much USD in their reserve? Or by percentage based on the country GDP? Extract this from http://dapmalaysia.org/english/2012/may12/bul/bul4976.htmMalaysia has the policy of "Non Internationalization" of the Ringgit, whereby the Ringgit is not being traded outside Malaysia. This is to ensure that the Ringgit value is not subjected to speculative activities outside Malaysia. The trading of Ringgit is only allowed to be carried with the licensed bank in Malaysia |

|

|

|

|

|

MGM

|

Aug 22 2015, 07:38 AM Aug 22 2015, 07:38 AM

|

|

What would the reaction be for USD vs MYR if PM suddenly change baton? Below 4.0?

|

|

|

|

|

|

MGM

|

Aug 22 2015, 08:16 AM Aug 22 2015, 08:16 AM

|

|

QUOTE(wil-i-am @ Aug 22 2015, 07:41 AM) Coming soon or just dream? What ever it is, there is a possiblity, it is a factor to consider, esp when Dr M & Opposition have the same target. Just have to wait n see. This post has been edited by MGM: Aug 22 2015, 08:17 AM |

|

|

|

|

|

MGM

|

Aug 24 2015, 11:45 PM Aug 24 2015, 11:45 PM

|

|

Can't believe there are people who are so happy that RM is in such dire straits when most of the fellow Malaysians are going to suffer.

|

|

|

|

|

|

MGM

|

Aug 25 2015, 08:00 AM Aug 25 2015, 08:00 AM

|

|

QUOTE(dreamer101 @ Aug 25 2015, 01:52 AM) MGM, What suffering?? The 3 millions UMNO members do not think anything is wrong. "Don't worry, be happy!!!" and "Not too bad!!" There is NO PROBLEM. Civil servants will probably get a pay raise to cover the inflation.. Ditto for GLC employees and FELDA settlers... Dreamer You are right about these people, but the other 80% will still suffer. Like most SMEs n their workers, parents who sacrifice to send their children overseas to study. |

|

|

|

|

|

MGM

|

Aug 26 2015, 09:33 AM Aug 26 2015, 09:33 AM

|

|

QUOTE(markpsp @ Aug 26 2015, 07:44 AM) Heys, actually, I've already disposed all my shares early this year. I don't mind not making these few months cause parking everything in PBB's FD is safe and risk free. True enough, market went down by so much. I'm targetting 1k-1.2k in Bursa index. Propertywise, 2017 will be good to buy, as 2013 was our peak and many of the launches are expected to be completed in 2016. However, I'll have to buy next year, might lose a bit but because I have no choice (due to personal reasons). Let's just say, I got very strong reason to believe that market go down the next few years. Sorry, can't reveal my sources, but my contacts come from one of the largest investment banks in the world.  Anyway enjoy the bumpy road downwards. See you guys at 1k-1.2k. With strong reason n good source of info, why not short the market? |

|

|

|

|

|

MGM

|

Aug 26 2015, 09:34 AM Aug 26 2015, 09:34 AM

|

|

QUOTE(Croner @ Aug 26 2015, 06:54 AM) Yea and I lefted this thread for a long long time. The legend is here Wonder whether the legend make a killing?  |

|

|

|

|

|

MGM

|

Aug 26 2015, 09:39 AM Aug 26 2015, 09:39 AM

|

|

QUOTE(AVFAN @ Aug 26 2015, 02:10 AM) tt has a worse rate. sell usd to get 4.25, wait for 4.30. crude still falling, possible this or next week. now 4.213. see how oil exporting country floated currencies jive brent? rm is probably less correlated since oil exports is not that much. still, if rm is put on the chart, probably similar pattern. Malaysia is probably at the same level of Mexico. |

|

|

|

|

|

MGM

|

Aug 26 2015, 10:26 AM Aug 26 2015, 10:26 AM

|

|

QUOTE(nujikabane @ Aug 26 2015, 10:21 AM) Is RM appreciating/depreciating against INR ? |

|

|

|

|

|

MGM

|

Aug 29 2015, 07:26 AM Aug 29 2015, 07:26 AM

|

|

QUOTE(anudora @ Aug 29 2015, 02:29 AM) This month oil price in USD drop a little but MYR drop a lot. Maybe petrol increase by RM0.15 to RM0.30. So remember to fill your tank. Another round of inflation coming. The dominoes are all in place.

|

|

|

|

|

|

MGM

|

Aug 31 2015, 11:47 PM Aug 31 2015, 11:47 PM

|

|

QUOTE(anudora @ Aug 29 2015, 10:52 PM) Let me give a better illustration on Monthly candlestick chart. 1 candle = 1 month. You will be better able to see how petrol price will increase the most next month. You can predict based on previous month petrol price setting. Sometimes technical just doesn't work: extract from paultan: It’s good news again for motorists in Malaysia. Fuel prices for the month of September 2015 have been announced, and RON 95, RON 97 and diesel will all be cheaper from tomorrow (Tuesday). RON 95 will be priced at RM1.95 per litre (10 sen down compared to August 2015), RON 97 at RM2.35 per litre (10 sen down), diesel at RM1.80 per litre (15 sen down) and Euro 5 Diesel at RM1.90 (15 sen down). This post has been edited by MGM: Aug 31 2015, 11:48 PM |

|

|

|

|

|

MGM

|

Sep 3 2015, 12:57 PM Sep 3 2015, 12:57 PM

|

|

QUOTE(blogomatic @ Sep 3 2015, 12:13 PM) like what unker dreamer says, will use ASx money to cover  I don't think ASx carries so much cash, unless they liquidate their stock holdings which will affect KLSE. |

|

|

|

|

Jan 7 2015, 03:45 AM

Jan 7 2015, 03:45 AM

Quote

Quote

0.0644sec

0.0644sec

0.69

0.69

7 queries

7 queries

GZIP Disabled

GZIP Disabled