QUOTE(magika @ Feb 10 2015, 06:01 PM)

Non US citizen is for US anti laundering rules. Why need to sign ?

If you are a US citizen, most banks do not want your business as more paper work for them, haha

QUOTE(almeizer @ Feb 9 2015, 12:57 PM)

Hmm I wonder is there any bank offer 12 months FD promo but the interest credited on monthly basis instead of upon maturity?

Most Banks Senior FD pays interest monthly. If you have a child. then you may want to consider Hong Leong Bank currently having Junior FD Promo at 4.28% but for 24 months.

Click here to read my article title The Best Savings Accounts in Malaysia where I touched on HLB Junior FD. Also

click here to my FD Page where I would comment on HLB Junior FD when they have a promo.

QUOTE(HJebat @ Feb 9 2015, 03:46 PM)

Today went to a few banks to do some FD-related stuffs & other normal banking activities.

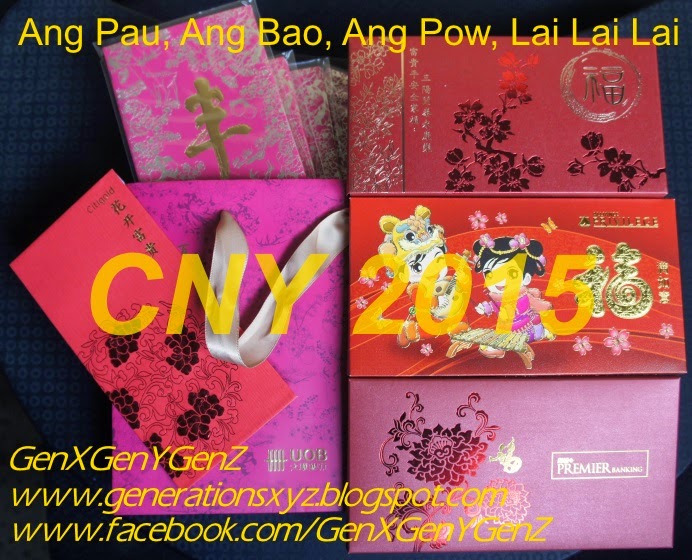

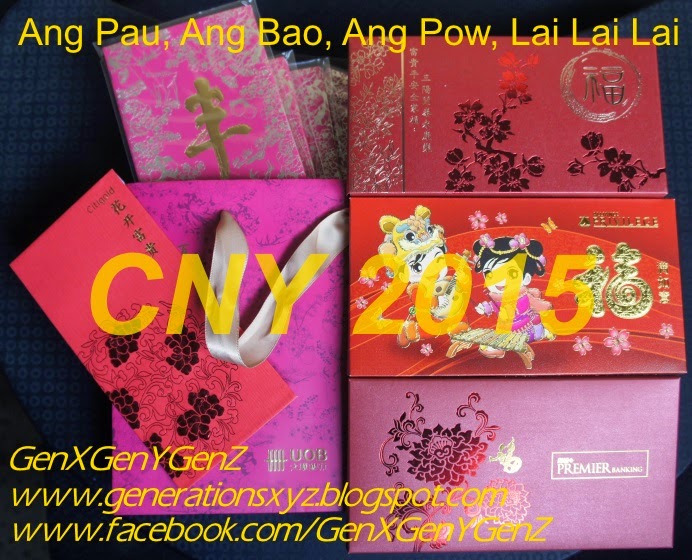

Thought that for convenience sake, might as well take the opportunity to collect some ang pows.

Unfortunately:

1. RHB - belum ada stock

2. Ambank - dah habis stock

3. Maybank - besok baru distribute stock

Fortunately:

a) HLB - manage to collect a few packets (but the picture & paper quality not as good as previous year...my opinion only)

b) CIMB - able to collect a few packets too (but there's a picture of a sparrow...I think...printed on the ang pow, not a goat)

back in 14 January 2015

However, I only collected Maybank Premier Wealth Banking Ang Pow on 9th Febraury 2015.

As for RHB, I got them early last week after I returned from Melbourne.

QUOTE(michaelho @ Feb 9 2015, 08:59 PM)

Some of my angpao haul this week. RHB Normal angpao can rival MBB Premier Wealth's. Anyone who has any other , pls post so that if it is not nice, don't have to go and get ...lol

Affin Bank - dont bother, not nice

Ambank - RM said will pass to me later

PBB - same old boring stuff every year

The winner at point of posting : RHB !!! Anyone who has their Premier Banking ones, please post

Yes, I agree RHB Ang Pow really nice and can be used for any occasion. Click the link below to see my Ang Pow collection which includes RHB Premier Banking. Alliance Bank cute and appropriate for young kids.

As for the CIMB kind of white packet (light pinkish but it can be also off white) you posted, don't they know white packet are used for funerals!!!

Click here to see the 2015 Ang Pows

Click here to see the 2015 Ang Pows I collected from Alliance Bank (Privilege Banking too), CitiGold, Hong Leong Bank (Priority Banking too), Maybank (Premier Wealth Banking too), OCBC, RHB (Premier Banking too) and UOB (Privilege Banking too).

This post has been edited by Gen-X: Feb 11 2015, 03:40 AM

Jan 13 2015, 03:20 PM

Jan 13 2015, 03:20 PM

Quote

Quote

0.0274sec

0.0274sec

0.42

0.42

7 queries

7 queries

GZIP Disabled

GZIP Disabled