QUOTE(Jasoncat @ Apr 16 2015, 12:00 AM)

Call them also no use. Sure no more as I missed the boat and then asked them few times to confirm any drop out unit...

purchaser mostly hardcore taikor... financial strong strong... EcoMajestic @ Semenyih (VERSION 7), ~Lets Continue Partyfor MerryDale~

|

|

Apr 16 2015, 12:36 PM Apr 16 2015, 12:36 PM

Return to original view | Post

#181

|

Senior Member

15,454 posts Joined: Nov 2011 |

|

|

|

|

|

|

Apr 17 2015, 10:50 AM Apr 17 2015, 10:50 AM

Return to original view | Post

#182

|

Senior Member

15,454 posts Joined: Nov 2011 |

QUOTE(ckl1998 @ Apr 17 2015, 10:06 AM) Guys, does it matter and which is better if just looking from the rate perspective and risk Base rate derived from cost of fund + statutory reserve requirement --> Bank with lower cost of fund + strong reserve normally will have lower base rate. Bank A 3.99 + 0.41 = 4.4 Bank B 3.15 + 1.25 = 4.4 Spread derived from the operating cost, profit margin, customer's risk margin etc ---> Bank with higher spread means higher profit margin. If all other charges, terms and conditions are same for both banks, I will opt for bank B, coz still maybe have chance and room for me to negotiate with the bank for better rate (lower spread). |

|

|

Apr 17 2015, 03:59 PM Apr 17 2015, 03:59 PM

Return to original view | Post

#183

|

Senior Member

15,454 posts Joined: Nov 2011 |

QUOTE(Chris Chew @ Apr 17 2015, 10:57 AM) Instead, I will opt for A for stability. Chris gor, if the cost of fund is increased, the KLIBOR rate will definately increase as well.. If KLIBOR is increased, I presume Bank B will increase its Base rate also, no?Cost of fund reserve at 3.15% is seriously quite low and with current impact, GST, economy, Ringgit falling, group deposit posibly reducing and withdrawing, bank cost of a loan inclusive system maintenance, salary, etc the cost might be average at 3.5% to 3.6%, for most banks set up at 3.9-4%, it is a calculative risk and offers more stability if funds goes down further by this year, therefore, I opt for a lower spread rate instead of low Base Rate which is review every 3 mths. Klibor increase definately will give more severe impact to those banks with smaller deposit bases, higher current BR rate in this context, no? |

|

|

Apr 17 2015, 11:58 PM Apr 17 2015, 11:58 PM

Return to original view | Post

#184

|

Senior Member

15,454 posts Joined: Nov 2011 |

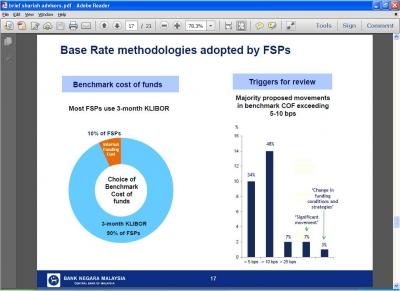

QUOTE(Jasoncat @ Apr 17 2015, 10:27 PM) Samkor, Base Rate is comprised of benchmark cosf of fund + SRR. Most banks (if I remember correctly, up to 90%) use 3M KLIBOR as the benchmark COF. So irrespective of the actual COF whether high or low, since it is to be based on the benchmark COF, it doesn't mean that bank with lower actual COF will have lower BR. Jason gor, if KLIBOR is used as benchmark COF, isn't it supposed to be same across all the banks, as it is an average value? Then how come every bank has its own BR On the part of the spread, it will be maintained throughout the loan tenure unless - so fat hope for better spread I thought Base Rate is the "benchmark cost of fund of the bank itself" in reference to KLIBOR, no? That's why different bank has different actual COF and hence different BR, no? If BR = 3M KLIBOR + SRR, then the variation of BR will only rely on the SRR. This post has been edited by samkps: Apr 18 2015, 12:20 AM |

|

|

Apr 18 2015, 08:53 AM Apr 18 2015, 08:53 AM

Return to original view | Post

#185

|

Senior Member

15,454 posts Joined: Nov 2011 |

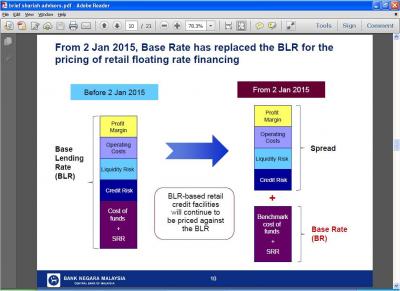

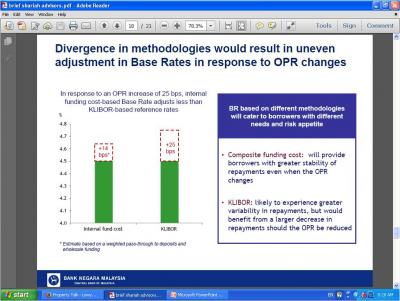

QUOTE(Jasoncat @ Apr 18 2015, 01:08 AM) Samkor, theoretically all the banks that use KLIBOR are supposed to have the same BR. I believe the difference could be due to the timing they captured the data and submitted to Bank Negara last year. Also it is possible that the difference in the way they do the computation resulted in different BR. That explains why the BR of most banks are quite close as you can see here [attachmentid=4415687] Jason gor, thanks for the information... The BR could have changed now as the banks are only required (by Bank Negara) to keep the BR unchanged for the first 3 months. BR = 3M KLIBOR + SRR, so the variation of BR relies on both KLIBOR and SRR (not just only on SRR). Have done some reading and there is clearer picture now.. BR = Benchmark cost of fund + SRR Spread = profit margin + operating cost + credit risk + liquidity risk There are 3 types of reference rate - base rate, benchmark cost of fund, actual cost of fund index. All three have strong correlations with COF. Apparently, the approach adopted by Bank Negara is Reference rate = Benchmark cost of fund + SRR. Bank Negara gives flexibility to the bank to adopt their choice / methodology of Benchmark Cost of Fund. 90% bank choose to use 3M KLIBOR as Benchmark COF, but there is still 10% banks choose to use "Internal Funding Cost" as the Benchmark COF instead. I think the obvious case here would be Maybank, due to their super low BR (3.2%), I suspect they are not using the 3M KLIBOR as the Benchmark COF. Public bank maybe another case as well. Therefore, the divergence in base rate methodologies could lead to uneven adjustment to base rate when there is changes in OPR or KLIBOR. Bank Negara expects that Internal funding Cost-based BR shall be adjusted less than the KLIBOR-based BR. Majority banks propose that when there is a change of 5-10 base points in the benchmark of COF, it will trigger the change of the BR. Notes: 1.) I presume the formula that is being used by the banks for calculating the BR all are same. The variation only rely on which type of benchmark cost of funding the bank is using - either internal fund or KLIBOR. 2.) I presume Bank Negara also provide a time frame for the banks to capture the KLIBOR data. They cannot varies too much between different banks within the same time frame. Therefore, I believe the variation in BR for different banks that adopt the KLIBOR-based COF mostly is due to the SRR components. SRR is the fund deposited to the Central Bank according to the bank liability. Therefore, I believe the variation in bank liability is much higher compare to the KLIBOR and hence carry more weightage in terms of BR variation. This post has been edited by samkps: Apr 18 2015, 09:20 AM Attached thumbnail(s)

|

|

|

Apr 18 2015, 09:09 AM Apr 18 2015, 09:09 AM

Return to original view | Post

#186

|

Senior Member

15,454 posts Joined: Nov 2011 |

QUOTE(ckl1998 @ Apr 18 2015, 07:51 AM) So theory wise and long term wise, should seek for lowest spread possible as BR will move no matter how? Not quite.... Take your example: Before OPR change: Bank A 3.99 + 0.41 = 4.4 Bank B 3.15 + 1.25 = 4.4 After OPR raise up 25 base points: Bank A (3.99 + 0.25) + 0.41 = 4.65 Bank B (3.15 + 0.25) + 1.25 = 4.65 BR movement depends on the benchmark COF, nothing related to the spread portion. Bank Negara projected that those bank using the internal funding-based benchmark COF shall be more resilient to BR changes in case there is any OPR rate change, compared to those adopt KLIBOR-based. Nevertheless, I still believe the banks can offer a better Spread rate for their premier customer. BR depends on the benchmark COF and can't change if there is nothing change in OPR/KLIBOR. Bank can alter or change the Spread rate instead, depending on the credit risk profile of the borrower... This post has been edited by samkps: Apr 18 2015, 09:29 AM |

|

|

|

|

|

Apr 18 2015, 11:36 AM Apr 18 2015, 11:36 AM

Return to original view | Post

#187

|

Senior Member

15,454 posts Joined: Nov 2011 |

QUOTE(Jasoncat @ Apr 18 2015, 10:38 AM) Samkor, impressed Excellent piece of info... Gain some new knowledge today... Oh yeah, I missed out MBB which I believe it uses blended COF (the actual COF) instead of KLIBOR as its reference. So its BR rate is supposed to be closer to FD/CASA. Theoretically, banks like MBB that uses blended COF may see relatively less volatility in their BR as its liability components which comprises FD will be repriced slower. This implies 2 things - if OPR hikes, then its BR will adjust up slower / smaller and vice versa. Nevertheless, since I / we do not have the privy access to their BR computation methodology, I presume the BR adjustment is elastic and timely to reflect the change in some key reference rate, eg OPR which will have widespread effect to all the funding cost. For banks that have effective cost control this will give them more room to play around with their spread and remain competitive in the market. As for your presumption stated in the 2nd part of your note, in terms of quantum different banks will have different amount of statutory funds to be kept but same rate 4% applied across all banks. Naturally banks with higher eligible liability will have higher funds to be reserved for that regulatory purpose. But again, how significant is the weightage of it in BR calculatotion will depend on the methodology used by each banks. Based on this, it is hard to preclude me assuming Jason gor profession is in finance/actuarial science... |

|

|

Apr 18 2015, 12:03 PM Apr 18 2015, 12:03 PM

Return to original view | Post

#188

|

Senior Member

15,454 posts Joined: Nov 2011 |

|

|

|

Apr 18 2015, 12:04 PM Apr 18 2015, 12:04 PM

Return to original view | Post

#189

|

Senior Member

15,454 posts Joined: Nov 2011 |

|

|

|

Apr 24 2015, 11:03 PM Apr 24 2015, 11:03 PM

Return to original view | Post

#190

|

Senior Member

15,454 posts Joined: Nov 2011 |

|

|

|

Apr 24 2015, 11:24 PM Apr 24 2015, 11:24 PM

Return to original view | Post

#191

|

Senior Member

15,454 posts Joined: Nov 2011 |

|

|

|

Apr 25 2015, 10:49 AM Apr 25 2015, 10:49 AM

Return to original view | Post

#192

|

Senior Member

15,454 posts Joined: Nov 2011 |

|

|

|

Apr 25 2015, 12:34 PM Apr 25 2015, 12:34 PM

Return to original view | Post

#193

|

Senior Member

15,454 posts Joined: Nov 2011 |

Seems like the owner is selling the land between EcoMajestic and Ecohill.. It's at a higher ground compare to Ecomajestic, any impact?

https://www.youtube.com/watch?v=MGCdl4Iemq4 |

|

|

|

|

|

Apr 26 2015, 11:59 AM Apr 26 2015, 11:59 AM

Return to original view | Post

#194

|

Senior Member

15,454 posts Joined: Nov 2011 |

|

|

|

Apr 26 2015, 12:02 PM Apr 26 2015, 12:02 PM

Return to original view | Post

#195

|

Senior Member

15,454 posts Joined: Nov 2011 |

|

|

|

Apr 26 2015, 12:59 PM Apr 26 2015, 12:59 PM

Return to original view | Post

#196

|

Senior Member

15,454 posts Joined: Nov 2011 |

|

|

|

Apr 26 2015, 10:03 PM Apr 26 2015, 10:03 PM

Return to original view | Post

#197

|

Senior Member

15,454 posts Joined: Nov 2011 |

QUOTE(Jasoncat @ Apr 26 2015, 01:00 PM) I'm thinking the possibility of either SPS or EW to acquire the land (assuming the owner own the one whole big piece) and then swap the reserve land with SEH2 or EcoForest. Based on the YouTube, no idea which plot of land for sale. Most likely due to some issues... Otherwise neither SPS nor EW would just leave this piece of land in such a way... very awkward indeed... |

|

|

Apr 26 2015, 10:14 PM Apr 26 2015, 10:14 PM

Return to original view | Post

#198

|

Senior Member

15,454 posts Joined: Nov 2011 |

|

|

|

Apr 26 2015, 10:26 PM Apr 26 2015, 10:26 PM

Return to original view | Post

#199

|

Senior Member

15,454 posts Joined: Nov 2011 |

|

|

|

Apr 26 2015, 11:08 PM Apr 26 2015, 11:08 PM

Return to original view | Post

#200

|

Senior Member

15,454 posts Joined: Nov 2011 |

|

| Change to: |  0.0489sec 0.0489sec

0.40 0.40

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 7th December 2025 - 09:25 AM |