Thanks a lot, I guess for now I should take advantage of both platforms. If eunittrust SC is lower then topup using that otherwise FSM

Wow Unker

yklooi already replied to so many...unker no go yamseng ar?

With FSM, it takes 4 working days to FINALISE, for u to see them in your summary of holdings. But the 4 days lag is just processing time, as long as your buy transaction is completed (click buy + make payment + payment received by FSM) by 3PM on a business day, u get NAV for THAT DAY, your money ain't gonna disappear during that 4 days.

By the way, don't get too overly bothered with NAV, u are not trading UTs (well, u should NOT be!), over the long term, a few % difference would not make much difference.

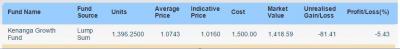

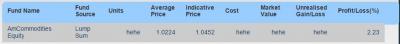

WAC showed in FSM includes your sales charges.

With FSM, u could invest GLOBAL. Why think only of local equity market?

But as some would say, it's good to make local market the "anchor" of your portfolio, if u are not already invested in local equities yourself. Main reasons:

(1) no foreign currency translation loss

(2) local market is "inefficient", i.e. fund managers can easily beat the market. But this argument is also valid for most developing countries stock market

As for myself, I'm already invested in local equities, so my UT portfolio is mainly overseas-focused.

Err...find some under-covered gems and buy them?

The stocks which contributed the most to my portfolio, most fund managers would not even look at them.

Apollo - makes your favourite snacks

Hup Seng - makes your Ping Pong cream crackers

Gems are not easy to come by. I've already dumped these 2 stocks. Of my current holdings, DiGi and Karex

are the most profitable stock. But don't blindly replicate my portfolio oh...some stocks are already overvalued.

Dec 25 2014, 01:00 AM

Dec 25 2014, 01:00 AM

Quote

Quote

0.0494sec

0.0494sec

0.31

0.31

7 queries

7 queries

GZIP Disabled

GZIP Disabled