QUOTE(guy3288 @ Jan 28 2015, 12:04 AM)

Polarz, i must thank you for your hardwork and generosity to share. It looks very comprehensive with colourful charts, real tempting to transfer my portfolio fr FSM to it.

But first before i copy my FSM portfolio from FSM, I must clear those existing data already in there, right? How to do it without destroying the formula?

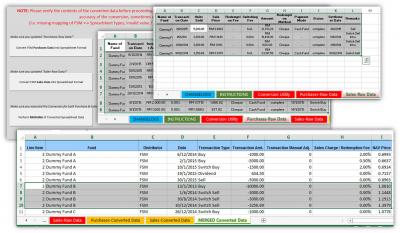

If you want to do a mass-copy, just make sure that:

1) You only copy & paste values inside (when pasting, choose "Paste Values" only - this will avoid overriding of formats / etc)

2) Only modify those cells in White Colour / Gold Colour. Dark Grey and Light Grey are ALL formulas (or used in formula)

3) When performing mass-copy-and-paste, make sure there are "enough" rows to hold your paste. If your going to copy 100 rows worth of data for "Date", make sure there are 100 details row for that fund (in my template) to "hold" it.

4) Copy multiple rows' worth of data, one type at a time

----- (e.g. first mass copy all Transaction Dates, make sure it pastes correctly and works;

----- then repeat it for transaction type (most if not all of it has same text with FSM, except some like "Platform Fee Switch Sell", just check before you paste.;

----- then repeat it for Transaction Amount. However, in FSM, its data are formatted as TEXT in "RM XXXX.XX" format. I have a formula to convert this into XXXX.XX format, and you can convert it into NUMBERS, then do a simple NUMBER*-1 to get the negative value, which you can COPY it and PASTE it to my worksheet (PASTE IT AS VALUES ONLY PLEASE!) But use it only if you are comfortable with manipulating excel data (and also please do this in new sheet

). Here's the formula:

CODE

DATA MANIPULATING FROM FSM:

Step 1: Copy all TOTAL INVESTED AMOUNT (e.g. many rows of data with RM 1000.00, RM 100.00, RM 950.00) into a NEW temporary worksheet

Step 2: Enter this formula ----> =RIGHT(A1,LEN(A1)-3)

Step 3: Drag this formula all the way down (to convert whatever amount of data you have)

Step 4: Copy the "converted values" into next column, paste as Values. You will notice that there's a warning at top-left of the cell indicating "Number stored as text", click on it and select "Convert to Number"

Step 5: Now you have all the values, at the next column (supposedly column D now), enter this formula ----> =C1*-1

Step 6: Drag this formula down also, now you have all the negative "invested" value

Step 7: Copy & Paste this into my worksheet's "Transaction Amount", Before you do this, make sure it have ENOUGH rows and t-type already set accordingly.

the same steps above (step 1 - step 4) can also be used to convert NAV pricing.

----- then repeat it for Sales Charge / RF %, this one pretty straight forward

----- and finally the bread and butter of unit trust, copy the NAV price and paste it (also make sure paste as value & format is accurate).

As for those already-existing data, you can select the entire rows (of that fund) and "Delete Row". (p/s: this is especially important for the "retired" rows, make sure you delete them instead of setting value to 0 as this will screw up IRR formula)

This post has been edited by polarzbearz: Jan 28 2015, 12:23 AM

Jan 27 2015, 08:38 PM

Jan 27 2015, 08:38 PM

Quote

Quote

0.0466sec

0.0466sec

0.36

0.36

7 queries

7 queries

GZIP Disabled

GZIP Disabled