i am almost "full" at my allocation....will wait till closing date to decide what is "cheap" then. else still keep to my % allocated.

Fundsupermart.com v8, The MS Excel Masterclass version!

Fundsupermart.com v8, The MS Excel Masterclass version!

|

|

Feb 13 2015, 12:44 PM Feb 13 2015, 12:44 PM

Return to original view | Post

#301

|

Senior Member

8,188 posts Joined: Apr 2013 |

i am almost "full" at my allocation....will wait till closing date to decide what is "cheap" then. else still keep to my % allocated.

|

|

|

|

|

|

Feb 15 2015, 11:55 PM Feb 15 2015, 11:55 PM

Return to original view | Post

#302

|

Senior Member

8,188 posts Joined: Apr 2013 |

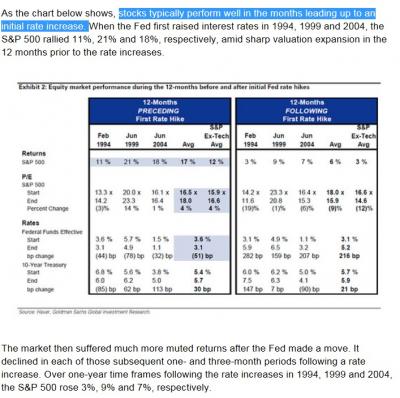

interesting data on the performance of S&P 500, 6 months before the FED raises interest rate...

Sam Stovall, S&P Capital IQ’s U.S. equity strategist, recently tracked Fed interest rate hikes going back to the end of World War II. “In 13 of the 16 times the Fed raised rates, the market went into a pullback, correction or bear market” in the six months before the rate hikes began, he told me in a phone interview last week. In the years since 1946, Stovall found six pullbacks (a 5% to 10% decline), four corrections (when stocks fell from 10% to 20%) and three bear markets (a drop of 20% or more) began in the six months before the Fed started tightening. He used the S&P 500 Index for his research. The S&P 500 lost 16% of its value, on average, during those declines, but it fell slightly less in the six months after rate hikes began. “We had pullbacks, corrections and bear markets start more often in the six months before [a rate increase] than the six months after,” he told me. Altogether, Stovall wrote last week, “88% of the time, the markets were thrown into a pullback or worse when an initial rate hike was a possibility or reality.” That means “a very high likelihood that the S&P 500 will begin a decline of 5% or more within six months” of the Fed’s first hike. http://www.marketwatch.com/story/heres-wha...14-09-24?page=1 |

|

|

Feb 16 2015, 12:35 AM Feb 16 2015, 12:35 AM

Return to original view | Post

#303

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(David83 @ Feb 16 2015, 12:19 AM) But some even say negative interest rate for US. the sign same as in highlighted?.....URL: http://finance.yahoo.com/news/banks-in-eur...-195532627.html Despite, US market hit record high on last Friday! http://blogs.wsj.com/moneybeat/2014/08/05/...-in-two-charts/ Attached thumbnail(s)

|

|

|

Feb 17 2015, 01:50 PM Feb 17 2015, 01:50 PM

Return to original view | Post

#304

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(sonicbull @ Feb 17 2015, 12:42 PM) FSM is the ROI...it does NOT take into consideration of the "time" to get that returns.example, KGF is 20%...but how long does it takes to get that 20%?.... IF it takes 10 years....then IF it takes 2 years....then in post #1 there is a chart take mention this "Return On Investment (ROI) vs Annualised Return, similar to Internal Rate of Return (IRR)" click on it to understand its usefulness. if you do periodic top ups...there is a file for uploading in Post#1 too. "Pinky's Portfolio Worksheet with IRR Calculation" use this file to make the calculation for periodic top ups. |

|

|

Feb 17 2015, 05:29 PM Feb 17 2015, 05:29 PM

Return to original view | Post

#305

|

Senior Member

8,188 posts Joined: Apr 2013 |

for those that are HEAVY and a firm believers in M'sia Equities.

Malaysia One of the Fastest Growing Economies in 2014 In a slew of GDP growth figure releases, Malaysia surprised markets by announcing that its domestic economy grew by 5.8% year-on-year in 4Q 2014, exceeding consensus estimates of a 5% year-on-year increase and placing Malaysia as one of the fastest growing economies in the world. In comparison, India grew 7.5% year-on-year in 4Q 2014, to overtake China’s 7.3% year-on-year growth during the same period. On the other hand, our neighbours Indonesia and Singapore grew by 5.0% and 1.5% respectively. ......Investors who would like to benefit from the continued growth in Malaysia can bank on the expertise of our Malaysian funds such as Kenanga Growth Fund, Eastspring Investments Equity Income Fund and Affin Hwang AIIMAN Growth Fund. http://www.fundsupermart.com.my/main/resea...?articleNo=5540 |

|

|

Feb 18 2015, 12:16 AM Feb 18 2015, 12:16 AM

Return to original view | Post

#306

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(shakiraa @ Feb 17 2015, 11:44 PM) iFAST Corporation Ltd. (Stock Code: AIY) officially listed on the SGX-ST Mainboard on 11th December 2014 http://www.fundsupermart.com.my/main/resea...?articleNo=5339 Q: What if iFAST/Fundsupermart ceases as a business concern? For cash investments, all units will be registered under iFAST Nominees Sdn. Bhd. For EPF Account 1 investment, they will be registered in your names. These units are segregated from the company’s assets. In the unlikely event that iFAST Capital ceases as a business concern, with your permission, all your assets registered under iFAST Nominees Sdn. Bhd. will be transferred to another Institutional Unit Trust Advisers (IUTA) or they will be returned to you. http://www.fundsupermart.com.my/main/faq/faq.svdo?id=998 Is there structure in place by the authority to ensure that my monies is safe with them.....that is the more important question...I would say. This post has been edited by yklooi: Feb 18 2015, 12:21 AM |

|

|

|

|

|

Feb 18 2015, 12:15 PM Feb 18 2015, 12:15 PM

Return to original view | Post

#307

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Feb 18 2015, 12:28 PM Feb 18 2015, 12:28 PM

Return to original view | Post

#308

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Feb 18 2015, 12:38 PM Feb 18 2015, 12:38 PM

Return to original view | Post

#309

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Feb 19 2015, 11:29 AM Feb 19 2015, 11:29 AM

Return to original view | Post

#310

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(wongmunkeong @ Feb 19 2015, 07:57 AM) The better one is the one that U have planned & committed to for the long term else main tikam sahaja. because one can NEVER know when is the right time to top up.... Woopy_901 When got time read this.....hope this helps.... Dollar Cost Averaging Method ..... October 30, 2008 The Regular Savings Plan (RSP) utilizes the dollar cost averaging (DCA) concept of investing which is the practice of investing a fixed amount of money regularly regardless of market conditions. In the case of RSP, the investments take place monthly. This article helps investor understand the benefits of DCA and what considerations that an investor has to make in executing a dollar cost averaging plan. ...Author : iFAST Research Team http://www.fundsupermart.com.my/main/resea...l?articleNo=118 How Did Dollar Cost Averaging (DCA) Fare Over The Past 100 Years?...... February 22, 2012 Using the wealth of historical data available for the US market, we assess how a dollar cost averaging strategy fared over the past century. ....Author : iFAST Research Team http://www.fundsupermart.com.my/main/resea...?articleNo=2069 |

|

|

Feb 19 2015, 08:48 PM Feb 19 2015, 08:48 PM

Return to original view | Post

#311

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(calvin_kenni @ Feb 19 2015, 07:51 PM) so i'd read all the "getting started" under fsm, but still have no clue on how to form my portfolio. individual portfolio is subjective,...it has to suit individual likings....so anyone could share some example of ur portfolio and their IRR? i'm looking at time horizon of 10-20 years here. many thanks cannot have one to suit all....time, risk appetite and purpose of investing in UT do play some important parts in portfolio formation.... also cannot have one that can be set FIXED for 10~20 years....it has to periodically rebalanced. if you want to see some portfolio in under trackings....(less than 10 years old) goto FSM website...click research/recommended portfolio to see it...it has details of the selected portfolio. some article for from FSM on this subject.....there are more (at times better) on the web. Our Portfolio Construction Process [Look Forward to Our Revamped Portfolio!]...... July 9, 2014 In this article, we will be highlighting the rationales behind our actions of revamping the recommended portfolios, the portfolio construction process and the changes that we had made in this revamped version. http://www.fundsupermart.com.my/main/resea...?articleNo=4787 Basic Steps To Construct An Investment Portfolio.... November 4, 2011 Many have embarked on the endless pursuit for the perfect portfolio; we offer some of our own portfolio construction guidelines http://www.fundsupermart.com.my/main/resea...?articleNo=1753 Enhance Your Portfolio Returns Like A Pro..... March 30, 2012 In this Idea of the Week, we relook at a very important investment concept – the core and supplementary portfolio. http://www.fundsupermart.com.my/main/resea...?articleNo=2193 3 Ways To Mitigate Your Portfolio From Market Disasters... November 9, 2012 While Sandy did not leave NYC in tatters, financial disasters can certainly leave an investor’s portfolio in ruin and drowning in losses if one is unprepared. Investors should always be prepared for unforeseen events and not leave it to the last minute to build up their portfolio’s resilience. http://www.fundsupermart.com.my/main/resea...?articleNo=2902 Aberdeen: Benchmarks Are Measuring Devices Not Portfolio Construction Tools....... April 9, 2014 This article expands upon the second of Hugh Young’s 10 Golden Rules, which was first published in booklet form in August 2012. http://www.fundsupermart.com.my/main/resea...?articleNo=4514 How To Use Correlation To Build Portfolios - Part 4/4.... September 11, 2014 The aim of this article is to extend on The Mathematics of Diversification and prove the benefits of portfolio diversification using real historical data. http://www.fundsupermart.com.my/main/resea...?articleNo=5000 Maximise Returns while Minimising Risk with a Core and Supplementary Portfolio http://www.fundsupermart.com.my/main/resea...pl?articleNo=59 6 Steps to Fixing Your Portfolio amidst a Market Crash December 10, 2008 Investors who suffered serious losses in their portfolios should not be panicking now. Instead, it may be a good time to re-look your portfolios and do a bit of doctoring http://www.fundsupermart.com.my/main/resea...l?articleNo=147 As The Year Comes To A Close, Consider Rebalancing ......December 17, 2010 The rebalancing method has shown that over a long period of time (our back test is over 40 years), a portfolio that used the rebalancing method has outperformed passive buy and hold methods by a quite a large margin. Did it outperform in 2010? http://www.fundsupermart.com.my/main/resea...l?articleNo=842 5 Tips to Rebalance Like a Pro....December 9, 2011 With the year drawing to a close soon, it is time to dig up your “dusty” portfolio, review its performance and rebalance for a brand new year. This year, let us give you a helping hand by offering some useful practical tips. http://www.fundsupermart.com.my/main/resea...?articleNo=1849 Mythbusting: Frequent Rebalancing Improves Portfolio Returns...... April 28, 2010 You might have heard this one before: Frequent rebalancing to simultaneously lock in profits and dollar cost average into lower priced assets will provide better returns. We examined the myth and here's what we found. http://www.fundsupermart.com.my/main/resea...l?articleNo=566 IF you have NOT started......(here is the advise from Sui Jau's Blog (FSM S'pore)) The most important advice I would give to anyone who hasn't started (be it man or woman) and is being held back is to starting investing now, but use a small amount. Something you are comfortable with even if you suffer losses. It can be as little as one thousand dollars because that is usually all you need to start investing into a unit trust. Then, as you invest, you will see how markets and such affect your returns and you will be able to learn from your experiences without suffering too much heartache compared to if you placed your entire life savings into the market and lose half of it in a market crash. The key thing is you have to accumulate investing experience. No amount of prior reading up and accumulating of knowledge can compare with actual investing experience which can only be built up by using your own money to invest. You have to experience the emotional pull that comes from market ups and downs and learn how to handle your emotions during those times. And learning from mistakes made is the greatest teacher. portfolio of 10~20 years in UT??? Do You Know How Much You Might Be Losing In Fees? ....as an investor, it also pays to know if the odds are on your side in making a good-bet for a good-performing unit trust or fund (hint: it’s poor!). Those expenses are deadly – keep a close eye on them! http://www.fool.sg/2013/07/18/do-you-know-...losing-in-fees/ click "refresh" when prompted to log in. This post has been edited by yklooi: Feb 19 2015, 09:10 PM |

|

|

Feb 20 2015, 01:03 PM Feb 20 2015, 01:03 PM

Return to original view | Post

#312

|

Senior Member

8,188 posts Joined: Apr 2013 |

what you guys mentioned made me

just wanted to keep my posts count ticking.... at the same time getting more people invested by guiding them to the FSM info center. Happy New Year guys.... May this be the GOodat Year for our portfolio check your letter boxes...got Red Packets from FSM.... |

|

|

Feb 24 2015, 08:50 AM Feb 24 2015, 08:50 AM

Return to original view | Post

#313

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(Kaka23 @ Feb 24 2015, 07:13 AM) ex....if you "think' hv enough Eq in M'sia in yr portfolio.....and the Eq section of these balanced fund is also heavy in M'sia.......then why not buy a standalone Eq fund that is covering for your underweighted region in yr portfolio and another bond fund....at a ratio that you liked (try not to get a EQ that is single country/sector focused fund) |

|

|

|

|

|

Feb 24 2015, 09:03 AM Feb 24 2015, 09:03 AM

Return to original view | Post

#314

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(cybermaster98 @ Feb 24 2015, 08:34 AM) Yup, that's why im considering Aberdeen Islamic World Equity now. But I have to be extra cautious because im taking funds from ASB to invest in this so if the returns aren't good, then it would be a waste. will you curse if Aberdeen did not perform as ASB? try not to enter for diversification....try to enter to reach the goal.....what is your goal? if you are already happy with that...it is good for you. (but is it sustainable?) if you just wanted more.....have to leave the comfort of the cocoon...which may hurt. if you wanted just a little more excitement from the ASB.....(excitement of ROI comes yearly only), take out 10% (or any rate that is comfortable to you) and get into this Aberdeen.......(excitement come almost daily) This post has been edited by yklooi: Feb 24 2015, 09:11 AM |

|

|

Feb 24 2015, 01:09 PM Feb 24 2015, 01:09 PM

Return to original view | Post

#315

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(adele123 @ Feb 24 2015, 12:52 PM) the one with lease malaysia exposure... ponzi 2... but that's because i already have KGF. also because kenanga ap isn't spread across more countries. oh... and i kiasu, not holding any small cap-ish fund. but again personal preference. (what is Plan B then?) This post has been edited by yklooi: Feb 24 2015, 01:10 PM |

|

|

Feb 24 2015, 01:33 PM Feb 24 2015, 01:33 PM

Return to original view | Post

#316

|

Senior Member

8,188 posts Joined: Apr 2013 |

Notice of Meeting to Unit Holders of the CIMB-Principal Asia Pacific Dynamic Income Fund

The meeting will be held at the CIMB Auditorium, Ground Floor, Bangunan CIMB, Jalan Semantan, Damansara Heights, 50490 Kuala Lumpur on Wednesday, 18 March 2015, at 1.30 p.m. to consider and, if thought appropriate by the Unit Holders, to pass the Resolution below: Resolution 1 Approval for change in Fund structure That the Manager and/or the Trustee be and is/are hereby authorised to carry out the following:- (a) To authorise the Manager to change the Fund structure to a multi-class fund and to issue new classes with different and/or similar features (including but not limited to fees, charges, currency denomination and/or distribution policy with that of the current units in the Fund) as the Manager may determine in future without the need to seek Unit Holders’ prior approval; © To authorise the Manager to issue a Ringgit Malaysia Class (i.e. Class MYR) in the Fund, where all current Unit Holders and/or future Unit Holders (i.e. those who apply for units in the Fund prior to the conversion of the Fund into a multi-class fund) to be issued units in this Class MYR after the conversion of the Fund into a multi-class fund; (d) To authorise the Manager to change the base currency of the Fund to United States Dollar; and read more http://www.cimb-principal.com.my/News-@-No...ncome_Fund.aspx |

|

|

Feb 24 2015, 01:55 PM Feb 24 2015, 01:55 PM

Return to original view | Post

#317

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(David83 @ Feb 24 2015, 01:38 PM) Sushi & body combat lovers..... too RAW and Heart and Blood pressure builder for "OLD" uncle... http://www.ambankgroup.com/en/AmInvest/Ind...ter/INSIGHT.pdf This post has been edited by yklooi: Feb 24 2015, 01:58 PM Attached thumbnail(s)

|

|

|

Feb 24 2015, 04:55 PM Feb 24 2015, 04:55 PM

Return to original view | Post

#318

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(heaven.33 @ Feb 24 2015, 04:27 PM) read some of the Beginner's FAQ...click and read the articleshttp://www.fundsupermart.com.my/main/faq/introduction.tpl |

|

|

Feb 26 2015, 07:34 AM Feb 26 2015, 07:34 AM

Return to original view | Post

#319

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(cybermaster98 @ Feb 25 2015, 11:18 PM) Can I use my CNY 0.8% token for purchasing Aberdeen Islamic World Equity? If I make my purchase tomorrow morning, will I be in time? Also, can I use my 1% referral token together with this? I suppose no right? Please find the detail as below:- Cash & EPF investment RM88,888, the expiry date is 3pm, 27 February 2015 for this promotion. Condition for promotion 1) All Funds in Fundsupermart.com is entitle for above promotion EXCEPT Affin-Hwang funds 2) The final sales charge will be reflected in the buying process before you enter password to confirm order. Please be informed that you need to inform us immediately or before 3pm if the sale charge is not auto adjusted to 0.8% when you create the purchase order online. 3) This offer is not applicable for INTRA or INTER fund switching. 4) The limitation of this promotion is up to RM88,888 only, if you create purchase order more than this amount. The sale charge will revise back to normal sale charge. I think this applies too..... Q: For those funds that are under promotion, will I be entitled to extra discount? A: No, the discount only applies to FSM Normal Sales Charge. It does not apply to funds which are under promotion. Either the promotion sales charge or the Rewards Program discount will be given, whichever is the lower sales charge. |

|

|

Feb 26 2015, 08:09 AM Feb 26 2015, 08:09 AM

Return to original view | Post

#320

|

Senior Member

8,188 posts Joined: Apr 2013 |

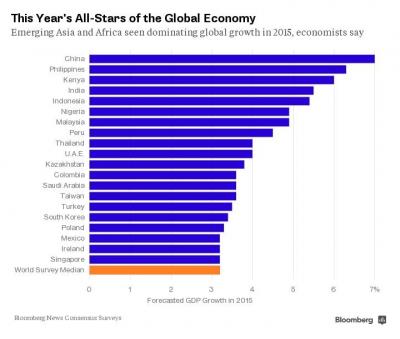

The 20 Fastest-Growing Economies This Year The world is expected to grow 3.2 percent in 2015 and 3.7 percent next year after expanding 3.3 percent in each of the past two years, according to a Bloomberg survey of economists. China, the Philippines, Kenya, India and Indonesia, which together make up about 16 percent of global gross domestic product, are all forecast to grow more than 5 percent in 2015. By comparison, the U.S. and U.K., which combined account for about a quarter of global growth, are expected to grow 3.1 percent and 2.6 percent this year, respectively. The euro area probably will expand just 1.2 percent as European Central Bank President Mario Draghi deals with a fragile Greece and embarks on a bond-purchase program to stimulate the region's growth. Emerging markets in Asia and Africa still reign supreme: They're at the top of global growth projections over the next two years. http://www.bloomberg.com/news/articles/201...omies-this-year A good striker should anticipate and position himself to take advantage of the coming ball to SCORE when it comes. Not be where the ball had just been. This post has been edited by yklooi: Feb 26 2015, 08:13 AM Attached thumbnail(s)

|

|

Topic ClosedOptions

|

| Change to: |  0.0509sec 0.0509sec

0.83 0.83

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 2nd December 2025 - 11:14 AM |