QUOTE(Pink Spider @ Feb 5 2015, 01:38 PM)

Yes, current value...currently in my "555 book"....

at the end of each month...when i key in the current NAV...the ROI appears

(i need to update the "extra" units when got distribution)

Fundsupermart.com v8, The MS Excel Masterclass version!

|

|

Feb 5 2015, 01:42 PM Feb 5 2015, 01:42 PM

Return to original view | Post

#281

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

|

|

|

Feb 5 2015, 01:47 PM Feb 5 2015, 01:47 PM

Return to original view | Post

#282

|

Senior Member

8,188 posts Joined: Apr 2013 |

pink i see the CMF price history...the NAV continued to increase the last few days...BUT the FSM site displayed rate dropped to 3.736% vs 3.745% afew days ago....why?

|

|

|

Feb 5 2015, 07:52 PM Feb 5 2015, 07:52 PM

Return to original view | Post

#283

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(polarzbearz @ Feb 5 2015, 05:11 PM) If that's the case, comparing COST OF PURCHASE vs CURRENT VALUE; do you take into account "CASH RETURN ON SELLING"? OMGsssssUsing extreme example where NAV price remains consistent throughout the tenure: I buy RM1000 on 1/1/2015; current value at 1/1/2015= RM1000 and sold RM500 on 10/1/2015; current value at 10/1/2015= RM500 today as of 5/2/20-15; current value still RM500 based on above example, logically the ROI should be zero (we didnt earn or lose anything). But if using your formula; COST OF PURCHASE vs CURRENT VALUE; I will get: -RM1000 / RM500 = -200%, which is wrong. if I use a modified variant CURRENT EARNINGS BASED ON CURRENT VALUE / (COST OF PURCHASE + CASH RETURN ON SELLING), I'll get 0 / (-RM1k + RM500) = 0%, which "looks" correct if 200% is WRONG....DIE-lah...all my computation is wandering how many or what else is WRONG.... must learn to use version 1.6 laio... Attached thumbnail(s)

|

|

|

Feb 6 2015, 10:29 PM Feb 6 2015, 10:29 PM

Return to original view | Post

#284

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(adamdacutie @ Feb 6 2015, 10:18 PM) what a coincident....Three Questions To Ask Before Picking Your Fixed Income Fund.........January 30, 2015 In this week's Idea of the Week, we offer investors some guidelines on how to select a suitable fixed income fund by asking three simple questions http://www.fundsupermart.com.my/main/resea...?articleNo=5486 |

|

|

Feb 7 2015, 10:09 AM Feb 7 2015, 10:09 AM

Return to original view | Post

#285

|

Senior Member

8,188 posts Joined: Apr 2013 |

2015 Bond Investment Strategies......January 22, 2015

In this article, we will discuss how bond-fund investors can better select suitable bond categories to improve their overall portfolio returns.......Author : Fundsupermart.com http://www.fundsupermart.com.hk/hk/main/re...?articleNo=9238 some recommendations in here http://www.fundsupermart.com.my/main/resea...?articleNo=5470 This post has been edited by yklooi: Feb 7 2015, 10:12 AM |

|

|

Feb 7 2015, 10:13 AM Feb 7 2015, 10:13 AM

Return to original view | Post

#286

|

Senior Member

8,188 posts Joined: Apr 2013 |

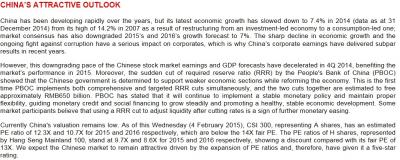

Attractive Markets in 2015.......February 6, 2015

What markets are worth investing in the face of uncertainties? Author : Fundsupermart.com http://www.fundsupermart.com.hk/hk/main/re...?articleNo=9306 |

|

|

|

|

|

Feb 7 2015, 10:23 AM Feb 7 2015, 10:23 AM

Return to original view | Post

#287

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(Pink Spider @ Feb 7 2015, 10:15 AM) I double click got leh... try again... http://www.fundsupermart.com.hk/hk/main/home/index.svdo ELSE...goto FSM HK...under FSM BUZZ |

|

|

Feb 7 2015, 11:57 AM Feb 7 2015, 11:57 AM

Return to original view | Post

#288

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(Pink Spider @ Feb 7 2015, 10:25 AM) because NOW I cannot see already... earlier can see and read...NOW can see the heading ONLY....the rest are no more there. maybe those can see,...can assist...copy and paste some times can see sometimes cannot see this article, so how to investing in the face of uncertainties???? like what as mentioned in the article This post has been edited by yklooi: Feb 7 2015, 12:00 PM |

|

|

Feb 7 2015, 05:47 PM Feb 7 2015, 05:47 PM

Return to original view | Post

#289

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(Pink Spider @ Feb 7 2015, 10:25 AM) article can read now....Attractive Markets in 2015...... February 6, 2015 What markets are worth investing in the face of uncertainties? http://www.fundsupermart.com.hk/hk/main/re...?articleNo=9306 copied into jpeg just incase same problem again... Attached thumbnail(s)

|

|

|

Feb 7 2015, 06:00 PM Feb 7 2015, 06:00 PM

Return to original view | Post

#290

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(x4vior @ Feb 7 2015, 05:48 PM) Hi guys, I'm new here. if you mean this credit systemMay i know if I switch from KGF to Kenanga Bond fund, do i earn the credit points for switching? try this Q: Is credit system applicable to all switching? A: No, Credit system is only applicable to Intra-switch, not for Inter-switch. However, there are certain funds which are not available for Intra-Switch. Please refer to SWITCHING OF FUND FAQ for more information. Q: How do I gain credit? A: When you switch equity fund (2% sales charge) to lower tier fund (0% to 1.5% sales charge); or lower tier funds to 0%, you will obtain credits accordingly. "How are the credits addition calculated?" Example 1: Switch from equity fund 2% to 0% sales charge * Please refer to table above (1) •Switch sell Fund A at sales charge: 2% •Switch buy Fund B at sale charge: 0% •Switching sell units: 10,000 •Indicative Price Fund A: RM1.50 •Current Credit(s): 0 Credits addition is based on Indicative Price x Units. Thus, if you switch Fund A (2%) to Fund B (0%), total switching amount is RM15,000 (RM1.50 x 10,000 units), you will be able to obtain 15,000 credits. So, from 0 credits, you will obtain an addition of 15,000 credits. http://www.fundsupermart.com.my/main/faq/faq.svdo?id=2001#2 This post has been edited by yklooi: Feb 7 2015, 06:11 PM |

|

|

Feb 8 2015, 12:01 AM Feb 8 2015, 12:01 AM

Return to original view | Post

#291

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(powerkid88 @ Feb 7 2015, 11:28 PM) Hi all, I am newbie for investment.... very little knowledge of this investment stuff... Opened account with FSM, anyone can share me some tips regarding investment of Mutual fund. TQ try getting to know yourself first. Ask the right questions Why do you invest? Investing is not about picking the top-performing asset or the highest ranking fund. The purpose of investing is to make your money work for you. This requires investors to make informed, important and conscious decisions. Here are the questions that you must ask yourself before investing: https://www.kenangainvestors.com.my/KIB/KIB...vestingFAQ.aspx before you jump in and start investing your hard-earned money, there are several important things that you would need to know about yourself first. •How much do you really need? (Future Planning) •How much risk can you take? (Risk Level) •How long are you willing to wait before you see profits? (Time Horizon) http://www.fundsupermart.com.my/main/schoo...d.svdo?PageID=1 Before we start, what is your attitude to risk? http://www.eastspringinvestments.com.my/do...20(English).pdf finally from Sui Jau's blog.... The most important advice I would give to anyone who hasn't started (be it man or woman) and is being held back is to starting investing now, but use a small amount. Something you are comfortable with even if you suffer losses. It can be as little as one thousand dollars because that is usually all you need to start investing into a unit trust. Then, as you invest, you will see how markets and such affect your returns and you will be able to learn from your experiences without suffering too much heartache compared to if you placed your entire life savings into the market and lose half of it in a market crash. The key thing is you have to accumulate investing experience. No amount of prior reading up and accumulating of knowledge can compare with actual investing experience which can only be built up by using your own money to invest. You have to experience the emotional pull that comes from market ups and downs and learn how to handle your emotions during those times. And learning from mistakes made is the greatest teacher. |

|

|

Feb 9 2015, 12:06 PM Feb 9 2015, 12:06 PM

Return to original view | Post

#292

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(Kaka23 @ Feb 9 2015, 07:29 AM) Feel good factors creeping back into Malaysian equities Monday, 9 February 2015 http://www.thestar.com.my/Business/Busines...ties/?style=biz |

|

|

Feb 9 2015, 11:36 PM Feb 9 2015, 11:36 PM

Return to original view | Post

#293

|

Senior Member

8,188 posts Joined: Apr 2013 |

Can you write a better company prospectus? Take our quiz and find out Published on Feb 9, 2015 5:15 PM - See more at: http://www.straitstimes.com/news/business/...h.K2h9B10Q.dpuf |

|

|

|

|

|

Feb 10 2015, 05:25 AM Feb 10 2015, 05:25 AM

Return to original view | Post

#294

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(moon0610 @ Feb 10 2015, 01:37 AM) Hi all, this is my first time here Don't Let The High Fund Price Deter You [27 Apr 2012] ...Author : Fundsupermart.com Wish to seek advice from u all on CIMB Global Titan Fund. I'm interested in this fund, as i do not have any funds in global market (currently malaysia & asia pacific). Checked the price history via FSM and it's at 0.744. Do you guys think it is too high to go in at the moment? Appreciate any advice & opinion. Thanks! When it comes to shopping, we usually make our intuitive judgments about the value of goods by their prices. However, this principle does NOT apply to fund shopping. It is a common misconception for investors to believe that a lower fund price makes a fund more "attractive" while a higher fund price means the fund is "expensive". In fact, whether a fund is expensive depends strictly on the valuation of its underlying assets. The unit or the Net Asset Value (NAV) price of the fund bears little significance. NAV is the price per unit of the fund. The calculation of NAV equals total assets minus liabilities, and divided by the number of units. The following example illustrates this: Fund's total net asset value (NAV, or fund size) = $10 billion Total number of units issued = 1 billion units NAV (fund price) per unit = $10 billion / 1 billion = $10 per unit Whether a Fund Is Expensive Depends on Its Underlying Assets Make Reference to Valuation Indicators Thus, investors should never judge if a fund is cheap or expensive based on its fund price. Instead, investors should be aware of the valuations of the underlying markets which the fund invests in. Investors might like to read our monthly Overall Market Summary and Earnings Growth Forecast for equity markets under our coverage to aid them in finding value. When market fundamentals (such as attractive estimated PE ratios and strong earnings growth) and economic outlook are both supportive, it still makes good sense to invest in a fund even though its unit price is high. http://www.fundsupermart.com.my/main/resea...?articleNo=2288 Cimb Global Titans = invests in the global titans market of the US, Europe and Japan with an exposure to the Malaysian equities market to balance any short -term volatilities. if you want a more global funds try others. Find them in the FSM website/Funds Info/Funds selector/Geographical sector...select Global.... read their fund factsheets to see where your monies will most probably be allocated to. This post has been edited by yklooi: Feb 10 2015, 06:11 AM |

|

|

Feb 10 2015, 03:03 PM Feb 10 2015, 03:03 PM

Return to original view | Post

#295

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Feb 10 2015, 11:33 PM Feb 10 2015, 11:33 PM

Return to original view | Post

#296

|

Senior Member

8,188 posts Joined: Apr 2013 |

when Oil prices drops...M'sian RM dropped,

now when Oil prices increase...M'sian RM also dropped.... Ringgit falls most in Asia with oil reversal .....Published: February 10, 2015 - See more at: http://www.themalaymailonline.com/money/ar...h.ghp5uCCC.dpuf |

|

|

Feb 11 2015, 04:19 PM Feb 11 2015, 04:19 PM

Return to original view | Post

#297

|

Senior Member

8,188 posts Joined: Apr 2013 |

How Did EPF-Approved Funds Perform In 2014?

We recap the overall performance of EPF-approved funds in 2014. Author : iFAST Research Team... February 11, 2015 http://www.fundsupermart.com.my/main/resea...?articleNo=5522 |

|

|

Feb 11 2015, 04:38 PM Feb 11 2015, 04:38 PM

Return to original view | Post

#298

|

Senior Member

8,188 posts Joined: Apr 2013 |

OPEC producers cut oil prices to Asia in battle for share

PUBLISHED ON FEB 11, 2015 - See more at: http://www.straitstimes.com/news/business/...h.9bKMe24u.dpuf |

|

|

Feb 11 2015, 10:14 PM Feb 11 2015, 10:14 PM

Return to original view | Post

#299

|

Senior Member

8,188 posts Joined: Apr 2013 |

Fear of the Foreign

Author : Aberdeen International Fund Managers Ltd....February 2015 Investors are on edge. We’re barely into the New Year and markets have been left shaken by the Swiss franc’s biggest ever one-day move; an election win for a populist party that’s demanding to renegotiate Greece’s relationship with the European Union; more evidence of a slowdown in China; and worries that cheap oil reflects weak global demand rather than a turf war between producers. Against this uncertain backdrop investors are looking again to central bankers for coordinated action, yet policymakers look set to move in opposite directions. http://www.fundsupermart.com.hk/hk/main/re...?articleNo=9326 |

|

|

Feb 13 2015, 02:45 AM Feb 13 2015, 02:45 AM

Return to original view | Post

#300

|

Senior Member

8,188 posts Joined: Apr 2013 |

The Most-Promising Emerging and Frontier Markets, Ranked

South Korea, China and the Gulf Nations lead our annual ranking of developing markets -- amid a rout that has hit two of the BRIC countries. Even with major nations like Russia and Brazil hobbled by low commodities prices, scandal and sanctions, Mobius concludes, growth rates -- and share prices -- in developing markets will outpace those in the U.S., Europe and Japan in 2015. look at the lists... India is ranked?... Malaysia is ranked?... CIMB GTF? http://www.bloomberg.com/news/articles/201...merging-markets Attached thumbnail(s)

|

|

Topic ClosedOptions

|

| Change to: |  0.0595sec 0.0595sec

0.32 0.32

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 2nd December 2025 - 12:47 PM |