QUOTE(Jeck10 @ Jan 29 2015, 09:24 PM)

And what are the average returns we can make? Do I need to know a lot to get like 10% annually?

Unknown to your risk appetite

(which is very personal and subjective)....try reading these links first before you decide that you want to get 10% annually....

Why do you invest?

Investing is not about picking the top-performing asset or the highest ranking fund. The purpose of investing is to make your money work for you. This requires investors to make informed, important and conscious decisions. Here are the questions that you must ask yourself before investing:

https://www.kenangainvestors.com.my/KIB/KIB...vestingFAQ.aspxHowever, before you jump in and start investing your hard-earned money, and thinking of the POSSIBLE RETURNS, there are several important things that you would need to know about yourself first.

•How much do you really need? (Future Planning)

•How much risk can you take? (Risk Level)

•How long are you willing to wait before you see profits? (Time Horizon)

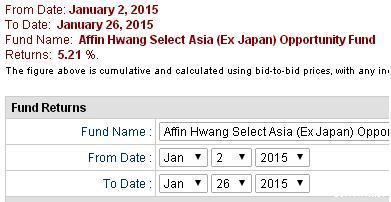

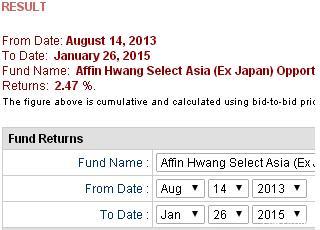

http://www.fundsupermart.com.my/main/schoo...d.svdo?PageID=1attached is a SAMPLE of funds that has a VERY GOOD Records of achieving that 10% annually.

to see more, try goto FSM website...Click at FUNDS INFO then FUNDs SELECTORS

(just be aware that, PAST PERFORMANCE may not be an indicator of future returns and the funds in the sample is ONLY focused in 1 country....which is against the normal wisdom of diversification....because

“You can make many small mistakes but not big mistakes. Diversification is a solution.” – Dr. Tan Chong Koay)

well, jfi, in 2014 at 95% allocated to EQ, my returns is just 2.2%...ha-ha...put into FD can earn more than that......just for your awareness only.

(guess just enhanced believes of this “In normal circumstances, over-diversification will not give you a superior result.” – Dr. Tan Chong Koay)

“Unless you can stand to lose, you should not invest in the stock market. You must learn from losing money.” – Dr. Tan Chong Koay

This post has been edited by yklooi: Jan 29 2015, 10:19 PM Attached thumbnail(s)

Jan 27 2015, 10:02 AM

Jan 27 2015, 10:02 AM

Quote

Quote

0.0553sec

0.0553sec

0.59

0.59

7 queries

7 queries

GZIP Disabled

GZIP Disabled