Outline ·

[ Standard ] ·

Linear+

STOCK MARKET DISCUSSION V148, Shale Oil! Bear or bull?

|

yok70

|

Dec 17 2014, 05:23 PM Dec 17 2014, 05:23 PM

|

|

QUOTE(cherroy @ Dec 17 2014, 05:13 PM) Any commodities generally won't plunge to dirt cheap one, as if it does, it will kill the supply, eventually, supply become less, price recover. We don't need rocket science or crystal ball to know oil price will stable at a level and creeping up over the long term. Just like we won't buy a terrace house with 20K like 70's, Rm1.00 petrol per litres, RM0.50 per bowl of hawker mee. thing is, world's most efficient companies able to dig/produce oil at US$20-$30 or so. That would be pretty dirty low as compare with US$100 our recent normal price, and still another 50% discount to current price. Oil stocks can go lower for another 50% from current price, which means 80% discount or so at their peak price just few months ago. That's pretty hurt already. |

|

|

|

|

|

yok70

|

Dec 17 2014, 05:31 PM Dec 17 2014, 05:31 PM

|

|

QUOTE(TheAccountant @ Dec 17 2014, 05:27 PM) If you are talking about shale oil. Very, very few shale oil companies can actually do that. Most reports say that for Shale to survive in general, you need USD80 at least. And that's pushing it. Yes, it's possible to produce oil at that level. But then, for many oil producing countries, it will hurt their budget severely. Only some shale oil companies (as well as oil companies) needs US$80, some don't. So this low price environment triggers large scale industry consolidation on both companies and countries. This post has been edited by yok70: Dec 17 2014, 05:32 PM |

|

|

|

|

|

yok70

|

Dec 17 2014, 05:54 PM Dec 17 2014, 05:54 PM

|

|

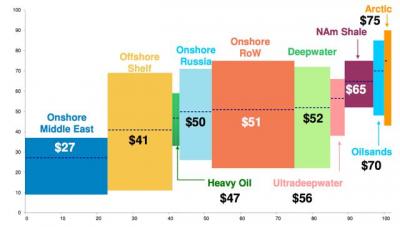

shale oil breakeven price from credit suisse on Sep 2014. This post has been edited by yok70: Dec 17 2014, 05:55 PM Attached thumbnail(s)

|

|

|

|

|

|

yok70

|

Dec 18 2014, 04:36 AM Dec 18 2014, 04:36 AM

|

|

QUOTE(cherroy @ Dec 17 2014, 09:51 PM) Once the profit margin is not encouraging, it will dent future capital investment towards it, eventually resulting in future supply is contained at existing level. While in future if there is increase in demand, the supply may not able to catch up, as you need years ahead for capital investment to increase supply, hence price could soar at that point. Once profit margin is not good, it is a supply destruction factor. This was what had happened when oil price was below USD20 time during 1998~1999. When worldwide economy did recover back then, supply has hard time to meet the demand, hence building a strong bull run afterwards for the rest few years time. True. For an investor, we actually wish oil price can stay at low side for longer time. This will boost profits for many companies except oil related companies. And then, after good consolidation, buy into oil company and wait for the strong recovery to come.  |

|

|

|

|

Dec 17 2014, 05:23 PM

Dec 17 2014, 05:23 PM

Quote

Quote

0.0446sec

0.0446sec

0.19

0.19

7 queries

7 queries

GZIP Disabled

GZIP Disabled