QUOTE(KVReninem @ Jan 29 2015, 04:05 PM)

One video went viral 2 days ago as One new Shopping Complex..ceiling collapsed while raining inside the ComplexSTOCK MARKET DISCUSSION V148, Shale Oil! Bear or bull?

STOCK MARKET DISCUSSION V148, Shale Oil! Bear or bull?

|

|

Jan 29 2015, 04:46 PM Jan 29 2015, 04:46 PM

Return to original view | Post

#141

|

All Stars

23,851 posts Joined: Dec 2006 |

|

|

|

|

|

|

Jan 29 2015, 05:12 PM Jan 29 2015, 05:12 PM

Return to original view | Post

#142

|

All Stars

23,851 posts Joined: Dec 2006 |

QUOTE(apj8188 @ Jan 29 2015, 04:55 PM) Ya exactly ..for those invested in Tambun in early stage might vomit blood cos the stock seemed to be sinking more each time they buy ..but later up 5X...MYEG........another cursing stock few years back....... This post has been edited by SKY 1809: Jan 29 2015, 05:14 PM |

|

|

Jan 29 2015, 05:15 PM Jan 29 2015, 05:15 PM

Return to original view | Post

#143

|

All Stars

23,851 posts Joined: Dec 2006 |

BTW WB made big mistakes too lately is Tesco

This post has been edited by SKY 1809: Jan 29 2015, 05:21 PM |

|

|

Jan 29 2015, 05:25 PM Jan 29 2015, 05:25 PM

Return to original view | Post

#144

|

All Stars

23,851 posts Joined: Dec 2006 |

QUOTE(winc87 @ Jan 29 2015, 05:16 PM) Last time Asiatic ..nobody bought but I bought at rm one plus...that time Plantations were super cold stocks.also super cursing stocksNow Gen PLant..just hard luck for many others to see this good stock many many years later .. This post has been edited by SKY 1809: Jan 29 2015, 05:38 PM |

|

|

Jan 29 2015, 05:42 PM Jan 29 2015, 05:42 PM

Return to original view | Post

#145

|

All Stars

23,851 posts Joined: Dec 2006 |

QUOTE(Babablacksheep @ Jan 29 2015, 05:08 PM) I think you guys going too MICRO on company stock performance. Ya exactly..we do not stop people to buy Nestle too.........good stock no doubt..Building quality sub par doesn't affect much on stock price. Take risk if your modal is small, don't worry :-) But for a small sum of money I put in Jan 2015..60% gain after profit taking .... All u all know January is not a very good month..right This post has been edited by SKY 1809: Jan 29 2015, 05:49 PM |

|

|

Jan 29 2015, 05:45 PM Jan 29 2015, 05:45 PM

Return to original view | Post

#146

|

All Stars

23,851 posts Joined: Dec 2006 |

|

|

|

|

|

|

Jan 29 2015, 06:01 PM Jan 29 2015, 06:01 PM

Return to original view | Post

#147

|

All Stars

23,851 posts Joined: Dec 2006 |

|

|

|

Jan 29 2015, 06:21 PM Jan 29 2015, 06:21 PM

Return to original view | Post

#148

|

All Stars

23,851 posts Joined: Dec 2006 |

QUOTE(kuluuluk @ Jan 29 2015, 06:04 PM) I do appreciate what u share back too ,,like the one Vitrox...though I did not put money into it ...Thank you anyway..and thanks to Glory for his January present..... This post has been edited by SKY 1809: Jan 29 2015, 06:23 PM |

|

|

Jan 29 2015, 06:26 PM Jan 29 2015, 06:26 PM

Return to original view | Post

#149

|

All Stars

23,851 posts Joined: Dec 2006 |

QUOTE(kancs3118 @ Jan 29 2015, 06:20 PM) My mistake is no diversification. About 60% of my portfolio is SymLife and 40% is GOB. This year, need to diversify - maybe Gadang?... Who would expect Oil to fall from 100 to 44 ....... Also, need to invest in myself...start reading up books on value investing and attend KNNCHongNZ (from KLSE i3) online course on investing... It is not a yearly affair but the chain reaction is like dropping an atomic bomb........ One Big Bank in UK now in bad shape due to their loans in this sector plus commodities.......They are the so called Experts..not us This post has been edited by SKY 1809: Jan 29 2015, 06:31 PM |

|

|

Jan 30 2015, 09:06 AM Jan 30 2015, 09:06 AM

Return to original view | Post

#150

|

All Stars

23,851 posts Joined: Dec 2006 |

Hovid moves so fast........Penta also

This post has been edited by SKY 1809: Jan 30 2015, 09:19 AM |

|

|

Jan 30 2015, 10:52 AM Jan 30 2015, 10:52 AM

Return to original view | Post

#151

|

All Stars

23,851 posts Joined: Dec 2006 |

QUOTE(kancs3118 @ Jan 30 2015, 09:06 AM) Hi Guys, Symlife could be another Asiatic where I bought at rm 1 plus ....then later ..long time wait .....then came ...rm 10..Recently, i just posted a few comments about SymLife in KLSE i3. Link as shown below. http://klse.i3investor.com/servlets/stk/1538.jsp Can you guys hop over to see the logic of my posting? Scared if i missed something. THanks. U have to believe that u cannot get dirt cheap LANDS like what u say about the lands in Greater KL......and it takes time to develop the lands due to land conversions and so on.. I think it is better for property companies to consolidate their cashflow at the moment than going all out to build .......Art of War says u do not have to attack all the time... just wait for the opportunity to come .. Anyway...many experts say this year is the year of consolidation for properties across......and people listen... I am not an expert on properties either...but there is always something called long term........I believe .. Well, similarly... People sapu O ^ G stocks know OIL would not jump back to 100 buck anytime soon...and would happen somewhere in the future......this is what they believe ...... Finally..patience is the name of the Game.. This post has been edited by SKY 1809: Jan 30 2015, 11:01 AM |

|

|

Jan 30 2015, 11:28 AM Jan 30 2015, 11:28 AM

Return to original view | Post

#152

|

All Stars

23,851 posts Joined: Dec 2006 |

|

|

|

Jan 30 2015, 12:00 PM Jan 30 2015, 12:00 PM

Return to original view | Post

#153

|

All Stars

23,851 posts Joined: Dec 2006 |

Well WB first investment is Coke Cola n dropped 40% after he bought..

Now the story going around is he turns 40us $ into ten millions us $ from Coke Cola ....... Google for the real story Sounds good :- BTW double storey market price is 700K to 800K there..... " don't forget the land bought for Sungai Long at SymLife's books are dirt cheap. They can easily do charity by selling double storey terrace houses at Sungai Long at RM550K. come and think of it - many people are concerned about whether property developers can survive this soft market.... but then, the way i think of it - Symlife's balance sheet is strong (based on the BenGraham net assets valuation performed). And then, the lands that they carry in their balance sheet are very cheap - assuming if management are the laid back type of people - they just need to break even quarter in and quarter out. Based on Q2'15, sales revenue of RM50K per quarter is enough to break even liaw. Furthermore, management has not yet even start to tap into the potential of Sungai Long. They kind of enjoy entering into JVs with other developers and working on miscellaneous projects." Your Statements This post has been edited by SKY 1809: Jan 30 2015, 12:40 PM |

|

|

|

|

|

Jan 30 2015, 03:45 PM Jan 30 2015, 03:45 PM

Return to original view | Post

#154

|

All Stars

23,851 posts Joined: Dec 2006 |

QUOTE(kancs3118 @ Jan 30 2015, 03:27 PM) just wanna validate something .... i heard rumors that the oil price at the pump will drop from RM1.9x to RM1.5x . True boh? Pls Be Ready for Saturday midnight as at 1-Feb, petrol prices expected to be down.Below not confirmed price wef 01-FEB -2015 RON95 = RM1.60 may be not so much drop RON97 = RM1.90 |

|

|

Feb 3 2015, 07:44 PM Feb 3 2015, 07:44 PM

Return to original view | Post

#155

|

All Stars

23,851 posts Joined: Dec 2006 |

QUOTE(kuluuluk @ Feb 3 2015, 06:20 PM) Depends on what car you are driving and the recommended compression ratio by the manufacturer. Yes most car can take in 95 and 97 but how efficient does the combustion happens in your car. Again yes, it might give you a better feel physiology, maybe by 4% extra power? Even the frugal WB would have agreed with u.........To me every cents counts as the 4% don't mean a thing to me as long as my car has enough power to move up hill. Oh just my 2 cents. Use the $$ for investment or family.... better Live a simple life. “I just naturally want to do things that make sense. In my personal life too, I don’t care what other rich people are doing. I don’t want a 405 foot boat just because someone else has a 400 foot boat.” -- Warren Buffett Keeping up with the Joneses is the worst epidemic among those who should never contemplate that notion in the first place. Less is more. |

|

|

Feb 4 2015, 11:42 AM Feb 4 2015, 11:42 AM

Return to original view | Post

#156

|

All Stars

23,851 posts Joined: Dec 2006 |

|

|

|

Feb 5 2015, 01:40 PM Feb 5 2015, 01:40 PM

Return to original view | Post

#157

|

All Stars

23,851 posts Joined: Dec 2006 |

Klarman: What I’ve learned from Warren Buffett

Warren Buffett As Warren Buffett was a student of Benjamin Graham, today we are all students of Warren Buffett. He has become wealthy and famous from his investing. He is of great interest, however, not because of these things but in spite of them. He is, first and foremost, a teacher, a deep thinker who shares in his writings and speeches the depth, breadth, clarity, and evolution of his ideas. He has provided generations of investors with a great gift. Many, including me, have had our horizons expanded, our assumptions challenged, and our decision-making improved through an understanding of the lessons of Warren Buffett. 1. Value investing works. Buy bargains. 2. Quality matters, in businesses and in people. Better quality businesses are more likely to grow and compound cash flow; low quality businesses often erode and even superior managers, who are difficult to identify, attract, and retain, may not be enough to save them. Always partner with highly capable managers whose interests are aligned with yours. 3. There is no need to overly diversify. Invest like you have a single, lifetime "punch card" with only 20 punches, so make each one count. Look broadly for opportunity, which can be found globally and in unexpected industries and structures. 4. Consistency and patience are crucial. Most investors are their own worst enemies. Endurance enables compounding. Read MoreBuffett: Buying in Western Europe, eyeing Russia 5. Risk is not the same as volatility; risk results from overpaying or overestimating a company's prospects. Prices fluctuate more than value; price volatility can drive opportunity. Sacrifice some upside as necessary to protect on the downside. 6. Unprecedented events occur with some regularity, so be prepared. 7. You can make some investment mistakes and still thrive. 8. Holding cash in the absence of opportunity makes sense. 9. Favour substance over form. It doesn't matter if an investment is public or private, fractional or full ownership, or in debt, preferred shares, or common equity 10. Candour is essential. It's important to acknowledge mistakes, act decisively, and learn from them. Good writing clarifies your own thinking and that of your fellow shareholders. 11. To the extent possible, find and retain like-minded shareholders (and for investment managers, investors) to liberate yourself from short-term performance pressures. 12. Do what you love, and you'll never work a day in your life. |

|

|

Feb 5 2015, 03:42 PM Feb 5 2015, 03:42 PM

Return to original view | Post

#158

|

All Stars

23,851 posts Joined: Dec 2006 |

wow Penta

|

|

|

Feb 5 2015, 05:03 PM Feb 5 2015, 05:03 PM

Return to original view | Post

#159

|

All Stars

23,851 posts Joined: Dec 2006 |

|

|

|

Feb 25 2015, 02:18 PM Feb 25 2015, 02:18 PM

Return to original view | Post

#160

|

All Stars

23,851 posts Joined: Dec 2006 |

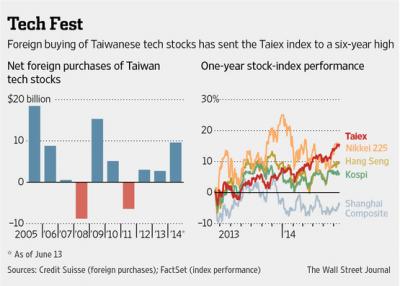

Well, 0128 is just a small proxy to the chart below .............Talex Index.maybe Apple linked or Inari cloned

( It owns 57.9% equity interest in Ares Green Technology Corp which is listed on Taiwan Stock Exchange and provides cleaning services to electronic / semiconductor manufacturers. Ares Green Tech has performed well in recent months and is expected to boast the group's overall results.) Foreign investors say Taiwan's performance index to hit 10,000 points Goldman Sachs expects the index to hit 10,500 points, while Credit Suisse and Citigroup forecast the market to reach the 10,000 mark. As such, analysts predict steady performance and expect that more foreign capital will flow in as the market re-opens today. Xiao recommends textile, semiconductor and Apple concept stocks for their higher profitability, and dividends are safer bets. This post has been edited by SKY 1809: Feb 25 2015, 02:20 PM Attached thumbnail(s)

|

|

Topic ClosedOptions

|

| Change to: |  0.0597sec 0.0597sec

0.57 0.57

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 11th December 2025 - 09:26 AM |