Any bankers here? would like to check my property value...

dilemma now deciding whether want to refinance or not..

I will pm you the property details...

Mortgage Loan Package Inquiries, (Strictly NO Promotion Allowed)

Mortgage Loan Package Inquiries, (Strictly NO Promotion Allowed)

|

|

Apr 15 2015, 10:11 AM Apr 15 2015, 10:11 AM

Return to original view | Post

#1

|

Senior Member

2,006 posts Joined: May 2011 |

Any bankers here? would like to check my property value...

dilemma now deciding whether want to refinance or not.. I will pm you the property details... |

|

|

|

|

|

Apr 27 2015, 01:32 PM Apr 27 2015, 01:32 PM

Return to original view | Post

#2

|

Senior Member

2,006 posts Joined: May 2011 |

|

|

|

Oct 16 2015, 06:27 PM Oct 16 2015, 06:27 PM

Return to original view | Post

#3

|

Senior Member

2,006 posts Joined: May 2011 |

QUOTE(diversity @ Oct 16 2015, 04:30 PM) Hi bro, I also checked my CCRIS but did not notice there is a AA or BB rating. I already checked my CCRIS report. And wala, there's no PTPTN inside. Also clean record, BB rating (second highest). Now I'm trying to boost my points up to AA rating such as more credit allowances (more credit cards & usage) and also placement of FD etc. Also, is it possible to provide me the calculation template for a property of RM370K. Same information as before hehe. Found a unit in Kota Kemuning that I'm interested in. Thanks once again May I know which section of the CCRIS write this rating? |

|

|

Feb 23 2016, 05:09 PM Feb 23 2016, 05:09 PM

Return to original view | Post

#4

|

Senior Member

2,006 posts Joined: May 2011 |

EPF 8% later means we can get higher net income...

does this mean we have more room to borrow more? |

|

|

Mar 14 2016, 03:26 PM Mar 14 2016, 03:26 PM

Return to original view | Post

#5

|

Senior Member

2,006 posts Joined: May 2011 |

let say I am having a joint loan with 1 sibling at Alliance Bank now. Monthly installment 1K.

planning to apply my own house loan. when calculate DSR, Alliance Bank will take 1K or 500 as my commitment? If I apply loan from other banks, other bank will take 1K or 500 as my commitment? This post has been edited by propusers: Mar 14 2016, 03:27 PM |

|

|

Apr 28 2016, 11:44 AM Apr 28 2016, 11:44 AM

Return to original view | Post

#6

|

Senior Member

2,006 posts Joined: May 2011 |

after sign loan agreement, the spread will be fixed for whole tenure?

Or it will still fluctuate? |

|

|

|

|

|

Sep 13 2016, 10:34 AM Sep 13 2016, 10:34 AM

Return to original view | Post

#7

|

Senior Member

2,006 posts Joined: May 2011 |

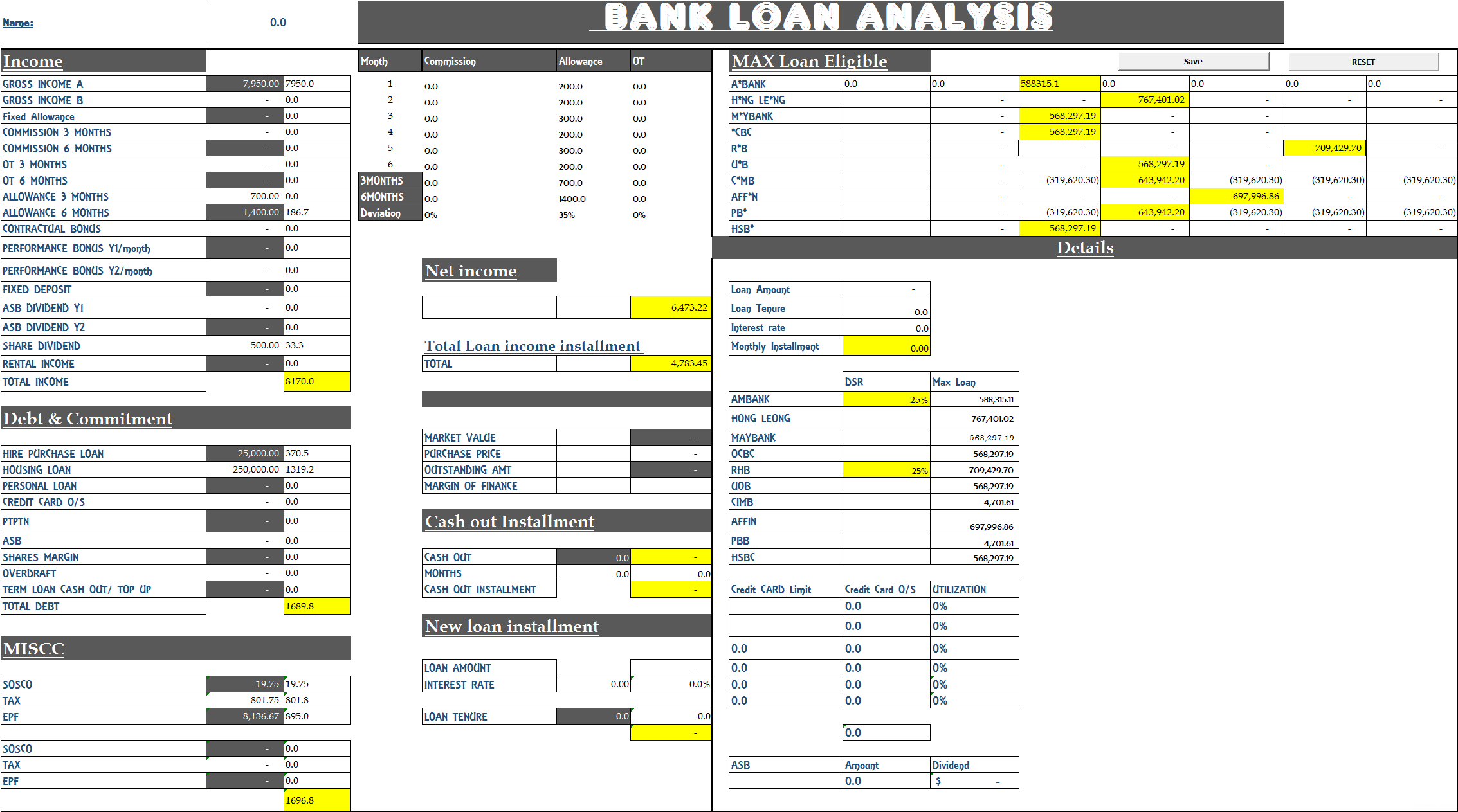

QUOTE(lifebalance @ Sep 11 2016, 01:16 PM) Hi there 1. Max 960k, share income can't consider unless it's ASB more than a year 2. 35 years or 70 yr old whichever comes first 3. 4.3% if loan amount above 500k QUOTE(Madgeniusfigo @ Sep 11 2016, 03:21 PM) Dear Hi lifebalance and Madgeniusfigo,1. Based on the details given by you, Your max loan eligibility for each bank is as follow: Rm A*BANK 588,315.11 H*NG LE*NG 767,401.02 M*YBANK 568,297.19 *CBC 568,297.19 R*B 709,429.70 U*B 568,297.19 C*MB 4,701.61 AFF*N 697,996.86 The best bank to get the highest loan would be HLBB. However, each bank has it's own ball game Different bank will calculate your income and debt accordingly based on each bank's different policy. Hence, I would need to do a due diligence on your profile before suggesting the best bank to proceed with." I would need to check you CCRIS, CTOS and income documentation before giving you any assurance. If everything goes fine, 90% shouldn't be a problem for you."  4. Max loan tenure is 35 years, if your age is less than 36 years old. (70 - *your age) = loan tenure (max 35 years) 3. RM530k range of interest rate 90% is 4.3-4.45% Rm1.3M range of interest rate 90% is 4.2-4.4% Cheers thank you for the info. May I know islamic loan normally have lower interest rate than non-islamic loan? |

|

|

Feb 13 2017, 03:30 PM Feb 13 2017, 03:30 PM

Return to original view | Post

#8

|

Senior Member

2,006 posts Joined: May 2011 |

|

|

|

May 1 2017, 04:12 PM May 1 2017, 04:12 PM

Return to original view | Post

#9

|

Senior Member

2,006 posts Joined: May 2011 |

May I know whether share margin quota approve from share investment bank like Maybank / Hong Leong will be counted as commitment?

Let assume this case. I have get approval of 100,000 margin from hong leong investment bank. And I have already used 30,000 from the margin to buy shares. Q1. Will this appear in CCRIS? Q2. How do banks evaluate this borrowing? Use 100k or 30k as commitment? Or certain percentage of 100k/30k? Q3. Is it different bank has different method to calculate? If yes, can explain the bank method that you most experience with? This post has been edited by propusers: May 1 2017, 04:12 PM |

|

|

Jul 30 2018, 01:33 PM Jul 30 2018, 01:33 PM

Return to original view | Post

#10

|

Senior Member

2,006 posts Joined: May 2011 |

I already have 2 housing loans. For 3rd loan, it is a under development residential property under commercial title, can get 70% or 90% loan?

This post has been edited by propusers: Jul 30 2018, 01:34 PM |

|

|

Mar 2 2019, 12:26 PM Mar 2 2019, 12:26 PM

Return to original view | Post

#11

|

Senior Member

2,006 posts Joined: May 2011 |

if I have share margin account with 200k limit, but already sold all the shares and clear the margin... the share margin account is 0 debt now...

will the 200k limit (with 0 debt) affect the loan application? if yes, in general, how many % of 200k will be added to my DSR commitment part? 200k x 5% / 12 = 833.33? |

|

|

Mar 24 2019, 01:48 PM Mar 24 2019, 01:48 PM

Return to original view | Post

#12

|

Senior Member

2,006 posts Joined: May 2011 |

QUOTE(Klc903 @ Mar 20 2019, 07:28 PM) Any sifu here can advice me on which package should i take? It is a Bank staff loan come with 2 packages: Package A - fixed rate of 3.5% with 10 years of lock in period Package B - variable rate (BLR minus 4%) without lock in period QUOTE(Klc903 @ Mar 20 2019, 07:37 PM) package A - 3.5%package B - 3.1% i will take B because 0.4% interest saving is my personal preference... plus B without lock in period... |

|

|

Mar 24 2019, 01:53 PM Mar 24 2019, 01:53 PM

Return to original view | Post

#13

|

Senior Member

2,006 posts Joined: May 2011 |

QUOTE(gocawesome @ Mar 23 2019, 08:42 AM) Hi, any sifu here can advice me on which package should i take? may i know what is cash back meaning here? do you mean refinance your current house and get more cash from higher loan amount?House nett price = RM 323047 BANK A: Full Flexi Islamic Tenure 35 years No lock in period Interest (BR 4.25% + 0.4% = 4.65%) Monthly installment = RM 1906.23 Total loan approved = RM 395000 inclusive GMRTT (RM 22200) GMRTT (RM 22200, i believe it is one time pay, correct me if i'm wrong) Cashback = RM 395000 - 22200 - 323047 = RM 49753 BANK B: Full Flexi Conventional Tenure 35 years 3 years lock in period Interest (BR 3.9% + 0.55% = 4.45%) Monthly installment = RM 1624 Total loan approved = RM 345335 inclusive CLTA (RM 8593) CLTA (RM 8593, covered for 18 years) Cashback = RM 345335 - 8593 - 323047 = RM 13695 |

|

|

May 7 2021, 09:01 AM May 7 2021, 09:01 AM

Return to original view | Post

#14

|

Senior Member

2,006 posts Joined: May 2011 |

QUOTE(christeen @ May 6 2021, 04:46 PM) Hi all, need advice on loan offer as below: may I know what is "Full flexi capped 70%" meaning?1) Bank A - Loan amount: around RM610k - MRTA (10 years): RM5955 - Semi flexi - Rate: 2.95% (BR 1.77% + 1.20%) - Tenure: 34 years 2) Bank B - Loan amount: around RM610k - MRTA (10 years): RM5280 - Full flexi capped 70% - Rate: 2.9% (BR 2.63% + 0.27%) - Tenure: 33 years 1. Put extra 10k in current account and only 7k can reduce interest? or 2. Maximum 610k x 70% = 427k capped can reduce interest? so, if put 427k, all 427k can reduce interest. This post has been edited by propusers: May 7 2021, 09:02 AM |

| Change to: |  0.0457sec 0.0457sec

0.42 0.42

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 3rd December 2025 - 09:05 AM |