Since now developer and also some insurance company? also provide loan, does any expert know whether those packages are better than the one from bank

Mortgage Loan Package Inquiries, (Strictly NO Promotion Allowed)

Mortgage Loan Package Inquiries, (Strictly NO Promotion Allowed)

|

|

May 19 2018, 08:36 AM May 19 2018, 08:36 AM

Return to original view | Post

#1

|

Junior Member

194 posts Joined: Aug 2016 |

Since now developer and also some insurance company? also provide loan, does any expert know whether those packages are better than the one from bank

|

|

|

|

|

|

May 27 2018, 05:50 AM May 27 2018, 05:50 AM

Return to original view | Post

#2

|

Junior Member

194 posts Joined: Aug 2016 |

QUOTE(wild_card_my @ May 26 2018, 04:24 PM) Yes you can. As per MBB's Maxihome page: 1. Does the capping rule apply for cimb semi flex?"Ability to service the interest portion or have monthly instalments commence immediately instead of upon full loan disbursement" http://www.maybank2u.com.my/mbb_info/m2u/p...sonal/LOA-Loans Just make the payment into the loan account through Maybank2U. Just a note: Not all banks and products allow the customers to start paying the installments in full while the loan is still being disbursed. The costs of topping up depends on the bank and your options. Some allow the "redrawing" back to the original loan amount. When it comes to banks taht allow topping up above the original loan amount as per your example, the costs would be additional stamp duty (which is 0.5% of the top up) and valuation fees. In most cases, there will not be a new agreement; however, from my experiences looking at my clients documents, toppping up tend to yirls higher interest rates than the market is currently giving. Yeap, you are referring to this right? https://www.cimbbank.com.my/en/personal/pro.../homeflexi.html You woul dlike to know the flexi charge/limit (if any) of all the other banks. CIMB was among the first to introduce it into the market and the market was furious because people felt like CIMB changed the terms after the contract was signed (they had the legal right to do so, but not the moral right I think). I gave it a shot and looked for the info on MBB at least, but there hasn't been any clause on the flexi limit or chargable fees if you dump in a certain amount of moeny into your loan account. Best resources would be the bank's own site, but like I said, I haven't come across any other than CIMB's. Maybe others can chip in? 2. Besides, any idea how much lower loan interest rate you can get if you are preferred customer ? 3. For a 90% loan of 412000 with mrta I have been offered rate of 4 + 0.6, is this considered a high rate or acceptable rate? This post has been edited by mrKFC: May 27 2018, 05:54 AM |

|

|

May 27 2018, 11:57 PM May 27 2018, 11:57 PM

Return to original view | Post

#3

|

Junior Member

194 posts Joined: Aug 2016 |

QUOTE(wild_card_my @ May 27 2018, 07:55 AM) 1. Not that I know off. The initial uproar was against CIMB's full-flexi loan 70% limit (or minimum, depending on how you are looking at it), the problem is that the loan has a monthly fee that is payable, (which semi-flexi does not have), on top of this fee, if you utilize the "flexiness" of your full-flexi above CIMB's liking they would penalize you for RM40 a month. Again, I haven't heard of the changes affecting semi-flexis Thanks for your reply.2. When I was a Relation Manager (we catered to preferred and prime customers), you can expect 0.1% lower than the mass-market's board rates. In fact, aboce certain mortgage amount (Cant remember), you are automatically tagged as a preferred customer and you can expect a lower rate if your banker knows what he is doing 3. are you sure it is not 4.15 + 0.6%? CIMB's BR is 4.15%, for future references, when quoting rates, it is best to use this format: BR/BLR + (changes), because BR changes all the time Is it a good rate? Are you sure it is not the same rate as your housing loan? For most banks the financing rate for MRTA/other-financing(legal, valuation, stamp duty) is the same as the main rate. Ill be a little honest, CIMB's mortgage rates is not the most competitive in the market. Despite that depending on the time that you took this loan the rate may/may not be competitive; remember, you cannot compare rates that you took 3 months ago to your friend's mortgage that he took 5 years ago. Banks are competitive, they compete at the given time. Don't let me get into the differences in terms of loan amount - they play a big role too when determining the rates. You are right, it's 4.15 + 0.45. My mistake. There's only 1 rate/main rate here. The CIMB banker told me that the rate is not the most competitive but with the "flexiness" that the bank offered i can actually save more when compare to other bank. I applied to them at first because they said for preferred customer the rate should be lower but at the end i dont see the discount. So now I m considering to apply for other bank. |

|

|

May 28 2018, 12:02 AM May 28 2018, 12:02 AM

Return to original view | Post

#4

|

Junior Member

194 posts Joined: Aug 2016 |

QUOTE(lifebalance @ May 27 2018, 11:09 AM) 1. There is no capping for semi flexi facility. Only applicable for the full flexi Do you know the lock in period of MBB or PBB? 2. Not that I know of but you can get your loan approved with 4.47% with MBB or PBB. 3. That would mean 4.6%, still can negotiate for lower or you can try with other banks. Which bank are you being offered right now for 4.6%? CIMB only? Yes, so far I only applied to CIMB bank, 4.15 + 0.45. |

|

|

Jun 12 2020, 09:39 AM Jun 12 2020, 09:39 AM

Return to original view | Post

#5

|

Junior Member

194 posts Joined: Aug 2016 |

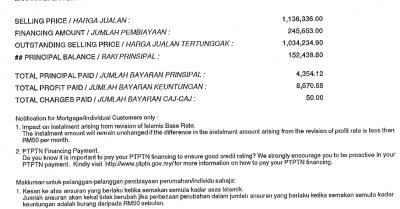

I don't know whether this is the correct place to ask a question regarding loan statement. I have a UOB Islamic financing mortgage and I can't quite understand my annual account statement, image in attachment.

My question is, 1. What is principal balance? The number of total principal paid is only 4354.12, there is no way that the outstanding principal is 152k. 2. How can I understand if my prepayment (early payment) has been used to deduct the principal and the interest? Thank you for all sifu in advance! Attached thumbnail(s)

|

|

|

Jun 12 2020, 09:54 AM Jun 12 2020, 09:54 AM

Return to original view | Post

#6

|

Junior Member

194 posts Joined: Aug 2016 |

QUOTE(lifebalance @ Jun 12 2020, 09:50 AM) Mortgage consultant here Thanks for quick response. But I am still confused, if principal balance means original loan amount that you are still owing to the bank, how come my outstanding selling price is still 1 million?1. Means the original loan amount that you are still owing to the bank. You also serve interest thus not 100% of the monthly installment paid goes to your or Inc following the amortization table. 2. Check your online account if you've made prepayment. If it's semi flexi then you would have manually made the prepayment yourself either by walk in or online transaction. If it's a full flexi loan then the amount in your current account is your prepayment amount. Thanks again |

| Change to: |  0.5335sec 0.5335sec

0.59 0.59

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 12th December 2025 - 06:57 PM |