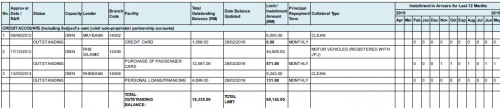

As per my last post, I was intended to change MLTA (no cash value) to MRTA that tied together with mortgage loan offered by CIMB.

After further studied, I decided to stick with MLTA since it's only roughly rm50 difference per month between the packages and the flexibility of MLTA compared to MRTA

Now banker is helping me to appeal BLR rate then I can proceed to sign the loan offer letter

Done some survey, seems there are some minority cases where bank canceled the bank loan offer in last minute, some even after loan agreement

Hope nothings go wrong with my case and I want to get this settle down quick, with steady mind of course

And thanks guys for the advice given earlier

QUOTE(Joe_Longgo @ May 9 2019, 10:45 AM)

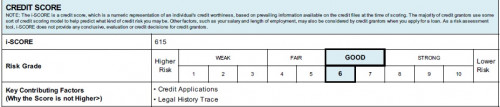

After 12 months, CTOS still keep record? I have bad records somewhere Jan-March last year. But working on to improve it in the last 13 months. Havent purchase the latest CTOS report. CRISS is alright, not sure CTOS

I couldn't answer you since I did not clear my CTOS and one of the bank approved me and I am happy to proceed with it..

Apr 2 2019, 06:58 PM

Apr 2 2019, 06:58 PM

Quote

Quote

0.0503sec

0.0503sec

0.76

0.76

7 queries

7 queries

GZIP Disabled

GZIP Disabled