Outline ·

[ Standard ] ·

Linear+

Mortgage Loan Package Inquiries, (Strictly NO Promotion Allowed)

|

calvin_kenni

|

Dec 17 2016, 11:05 PM Dec 17 2016, 11:05 PM

|

|

Hello all, may i know what is the maximum joint loan amount that i can get with these salaries

self - 4.5k per month

wife - 4.5k per month

both of us has clean CCRIS/CTOS, each holding credit cards for past 1 year

is it advisable with this kind of income to get a 850k condo?

Thanks

|

|

|

|

|

|

calvin_kenni

|

Dec 18 2016, 11:40 AM Dec 18 2016, 11:40 AM

|

|

QUOTE(lifebalance @ Dec 17 2016, 11:25 PM) Assuming both below 35 35 years loan you can take up to 1.3 mil loan so it's still okay if you want to buy 850k property Interest rate around 4.3 to 4.4% i see so the expected monthly payment will be around 4k? not really sure whether this is a good choice for own stay or not.. |

|

|

|

|

|

calvin_kenni

|

Dec 18 2016, 04:40 PM Dec 18 2016, 04:40 PM

|

|

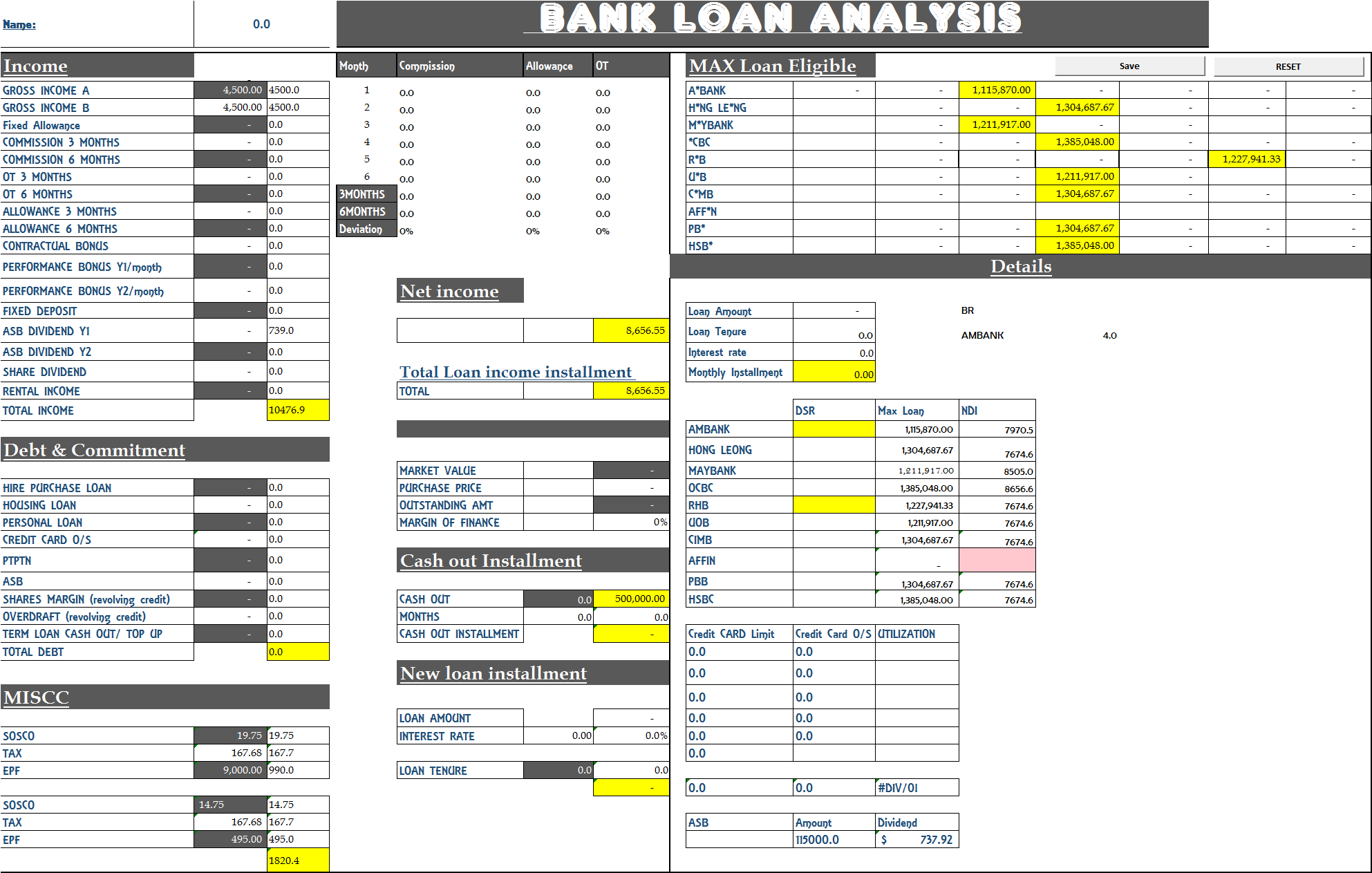

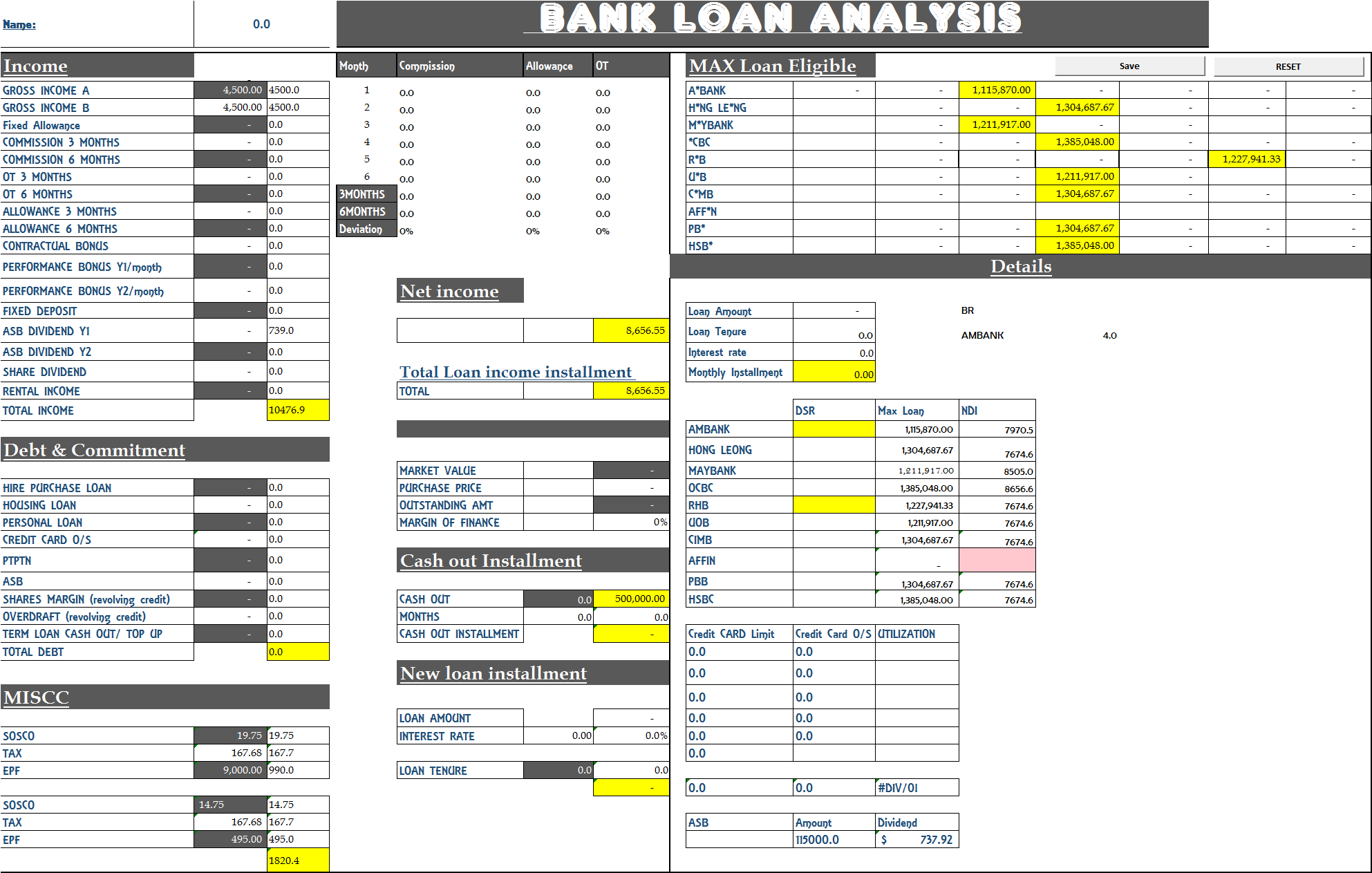

QUOTE(Madgeniusfigo @ Dec 18 2016, 03:26 PM) Dear calvin_kenni, 1. Based on the details given by you, Your max loan eligibility for each bank is as follow: Rm A*BANK 1,115,870.00 H*NG LE*NG 1,304,687.67 M*YBANK 1,211,917.00 *CBC 1,385,048.00 R*B 1,227,941.33 U*B 1,211,917.00 C*MB 1,304,687.67 AFF*N - PB* 1,304,687.67 HSB* 1,385,048.00 2. You have at least credit card in your ccris, hence it would be good for your loan application 3. The best bank to get the highest loan would be HLBB . However, each bank has it's own ball game Different bank will calculate your income and debt accordingly based on each bank's different policy. Hence, I would need to do a due diligence on your profile before suggesting the best bank to proceed with." 4. I would need to check you CCRIS, CTOS and income documentation before giving you any assurance. If everything goes fine, 90% shouldn't be a problem for you." 5. Hence your objective of RM850K++ won't be a problem! 6. the installment for this property will be around RM4000 range, hence it will eat out a huge chunk of your cash flow. If for homestay, it will be a hefty commitment. Just some opinion Cheers  If including the miscellanous fees as below » Click to show Spoiler - click again to hide... « 1. Stamp duty for transfer of ownership title (also known as memorandum of transfer or MOT) = 1% for the first RM100,000; 2% on the next RM400,000, and 3% on the subsequent amount.

2. Sale & Purchase Agreement (SPA) legal fees = 1% for first RM150,000 and 0.7% of remaining value of property within RM1 million

3. Stamping for SPA = Less than a hundred Ringgit

4. SPA legal disbursement fee = A few hundred Ringgit

5. Loan facility agreement legal fees = 1% for first RM150,000 and 0.7% of remaining value of loan within RM1 million

6. Stamp duty for loan = 0.5% of loan amount

7. Loan Facility Agreement legal disbursement fee = A few hundred Ringgit

8. Fee for transfer of ownership title = A few hundred Ringgit

9. Mortgage Reducing Term Insurance (ie. think of it as a life insurance for your home loan) = RM1,000 or more (some banks waive this amount)

10. Government Tax on Agreements = 6% of total lawyer fees

11. Bank processing fee for loan = RM200 for a 850k property, how much extra i need to additionally fork out? thanks |

|

|

|

|

|

calvin_kenni

|

Jan 5 2017, 07:21 AM Jan 5 2017, 07:21 AM

|

|

Oh they even asked for recent tenancy agreement.

I guessed that banks are stricter at giving out loans at difficult times like this.

|

|

|

|

|

|

calvin_kenni

|

Jan 5 2017, 07:26 AM Jan 5 2017, 07:26 AM

|

|

Sifu2 sekalian

I was wondering, the difference of mrta and mlta are well discussed over the net or other threads. Most of them are concentrating about single borrowers only.

Correct me if I am wrong, but what are the exact differences (if present), with regards to mrta/mlta, should the loan is taken up by a joint party? (eg husband and wife)

|

|

|

|

|

|

calvin_kenni

|

Jun 2 2022, 04:25 PM Jun 2 2022, 04:25 PM

|

|

Hi, wanted to ask whether this is a good deal for the current market

Current approval for my 2nd property:

Conventional loan - HLB

List price: 1,610,800

Financing: 1,407,839

MOF 87.4%

Tenure 35 years

BR 2.88% + SR 0.17%

ELR 3.05% without MRTA

Questions

1. Is this a good deal?

2. Shall i try for other financier of the project like PBB, Ambank, Alliance, HSBC

This post has been edited by calvin_kenni: Jun 2 2022, 04:26 PM

|

|

|

|

|

|

calvin_kenni

|

Jun 2 2022, 05:47 PM Jun 2 2022, 05:47 PM

|

|

QUOTE(lifebalance @ Jun 2 2022, 05:03 PM) Any chance that other banks might provide higher mof? Want as much as cash flow actually. |

|

|

|

|

|

calvin_kenni

|

Jun 4 2022, 11:22 AM Jun 4 2022, 11:22 AM

|

|

QUOTE(Reversse @ May 30 2022, 05:41 PM) Just got an offer from RHB. Is it a good offer? And should I wait for others? As I heard from my lawyer that RHB is troublesome when it comes to releasing the payment to Vendor. RHB (100% loan) 3.2 450K 35 Years Personally I have a loan with RHB. Yes the fund dispursement is slower compared to other banks. But nth to be worried of. They often still release the funds eventually |

|

|

|

|

|

calvin_kenni

|

Jun 6 2022, 08:55 PM Jun 6 2022, 08:55 PM

|

|

QUOTE(HungryBunny93 @ Jun 6 2022, 08:13 PM) Dear Sifus/Daigors, First time homebuyer wanna ask some stuff on bank loans. Was looking at a nearly completed project with almost fully signed SPAs, trying to get a loan rejected unit but the property agent request me to get the bank LOA first. Questions: 1) Safe to give all the documents to the agent and they apply on behalf for the LOA? 2) Agent say only a few banks able to give loans, cause almost all units fully signed for the project so the quota used up for some banks, true? 3) Should I take the hassle and apply myself after getting the required forms from the agents? Many thanks if anyone could help to clear my doubts! why not find out who's the end financier for the project and ask the agent to give you the number of the bankers? so that your personal documents all directly sent to the banker itself? usually legit banker will have name card with appropriate company emails like tom.cruise@cimb.com.my |

|

|

|

|

|

calvin_kenni

|

Jul 5 2022, 08:05 PM Jul 5 2022, 08:05 PM

|

|

QUOTE(lifebalance @ Jul 5 2022, 06:53 PM) Insurance must be the same as the loan tenure otherwise the insurance coverage will fall faster than the loan I am in similar dilemma, for me it's either get full tenure coverage for the mrta vs not to get at all. The other option is to ensure that can settle the loan before the mrta lapse, but rather unlikely to do so. |

|

|

|

|

|

calvin_kenni

|

Jul 7 2022, 08:23 AM Jul 7 2022, 08:23 AM

|

|

QUOTE(calvin_kenni @ Jul 5 2022, 08:05 PM) I am in similar dilemma, for me it's either get full tenure coverage for the mrta vs not to get at all. The other option is to ensure that can settle the loan before the mrta lapse, but rather unlikely to do so. hi, i'm getting a joint loan Bank R SPA 1,645,000.00 MOF 90%= 1,480,500.00 MRTA= 32,126.86 (sum insured each applicant 740,250 20 years) total loan= 1,512,626.86 installment= 5,907.00 loan tenure= 35 years interest= 3.05% (2.75+0.3 - before OPR hike) questions - which is the more sensible choice? 1. Appeal for minimum MRTA to keep the ELR at minimum 2. do or die, just increase the MRTA to 35 years for better protection 3. keep as such it is, just ensure to pay off the property after 20 years but at risk of low cash reserve many thanks |

|

|

|

|

|

calvin_kenni

|

Jul 8 2022, 06:44 PM Jul 8 2022, 06:44 PM

|

|

QUOTE(weihong96 @ Jul 8 2022, 05:47 PM) Typo on PBB MRTA: RM23587 What the mrta break down? Both applicant? Full tenure? |

|

|

|

|

|

calvin_kenni

|

Jul 21 2022, 04:03 PM Jul 21 2022, 04:03 PM

|

|

QUOTE(Sonnet Porky @ Jul 21 2022, 04:02 PM) I've just got a banker telling me that I can get a lower interest rate if I sign up for a credit card from them as well, is this a common practice nowadays? I can cancel the card after approval but it's annoying. The banker also said take up Islamic loan to avoid the 5 years loan lock-in that only conventional loans have, is it true? Ah I got the same offer from c**b in order to qualify for lower interest rate Apparently its a trend now |

|

|

|

|

|

calvin_kenni

|

Aug 9 2022, 08:05 PM Aug 9 2022, 08:05 PM

|

|

QUOTE(JBLang @ Aug 9 2022, 03:03 PM) Hi I got a maybank semi-flexi mortgage loan for my first home and now I'm planning to buy a second home. I wonder if I apply another loan with maybank, would they offer a better interest rate? Consider the loan amount is higher if I choose to loan with maybank again. Maybank nowadays very choosy on their customers, rarely give high mof. But their rates are unbeatable and lowest in the market though. |

|

|

|

|

|

calvin_kenni

|

Aug 11 2022, 09:33 PM Aug 11 2022, 09:33 PM

|

|

QUOTE(smon80 @ Aug 11 2022, 08:05 PM) Guys, I plan to purchase shop lot at 1.35m. Down payment 20%. How much income I need to support for max term loan. I will join name with my wife. Currently I have one house loan of 700k. Monthly repayment 3.1k. Rent out at 2.6k. bro if your monthly commitments are not so tight, just try apply the loan je. if kena reject, then that's the harsh reality, either increase your income or hunt for lower price |

|

|

|

|

|

calvin_kenni

|

Dec 26 2022, 12:33 AM Dec 26 2022, 12:33 AM

|

|

QUOTE(ashkip @ Dec 25 2022, 09:30 PM) May I know what is the usual/normal rate for mortgage loan? This is joint loan application for our first home. Current DSR is 25%, if agreed to take up the mortgage loan, our DSR will be 40%. Both of our CTOS is excellent, 752 and 750 respectively. No arrears. Both are permanent jobs. Nope. Included into the loan. Btw guys, fyi, current banker (Muamalat Bank) was arranged by developer. If I want to approach the other bank to finance my mortgage loan, what document do I need? bro if undercon project, find the end financier banks for the project first, higher chances to get approval - same documents u sent for muamalat initially, though some banks may require more statements/proof of savings |

|

|

|

|

|

calvin_kenni

|

Jun 21 2024, 11:30 AM Jun 21 2024, 11:30 AM

|

|

QUOTE(ccschua @ Jun 21 2024, 11:04 AM) current I found Standard charter offering refinance @ 3.95% with zero costs. my current mortgage rate with maybank islamic is 4.3 % should I switch actually when they say zero cost, but how to actually build a table to show your net loan/savings in a tabular form before and after all the hassles of switching? |

|

|

|

|

Dec 17 2016, 11:05 PM

Dec 17 2016, 11:05 PM

Quote

Quote

0.2384sec

0.2384sec

0.62

0.62

7 queries

7 queries

GZIP Disabled

GZIP Disabled