QUOTE(lifebalance @ Mar 8 2023, 08:46 PM)

Nope, doesn't work that way.

Some banks will take as equal split, some others as full commitment.

so most likely is scenario 1), or take full commitment depends on bank. ok thanks

QUOTE(Lonelybird @ Mar 9 2023, 01:43 AM)

Hi Sifus all,

I got my housing loan approved and here is the detail,

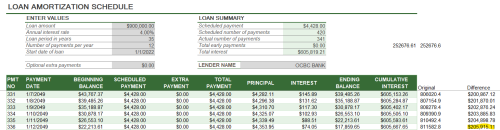

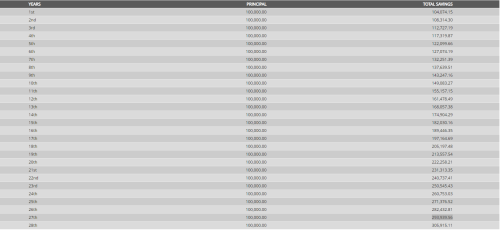

Loan Amount = RM135000 (90% margin of financing)

Loan Tenure = 26 Years

MRTT = RM7568 (26 years)

Interest Rate = 4.20%

Monthly Repayment = RM 748.30

I went to the bank to sign letter offer but i found out that the repayment period is for 348 Months which is 29 years.

When i ask the banker why the monthly repayment calculation is for 26 years?

The banker said 26 years + 3 years grace period for undercon property, so total 29 years. he said every bank got same grace period for undercon property.

My question is the banker really tell the Truth?

Thank you for your answer.

Yes indeed is correct....anyway the repayment period is just for reference only. if its flexi loan when you dump more principal prepayment, the tenure will be shorten alot....

Oct 17 2016, 07:56 PM

Oct 17 2016, 07:56 PM

Quote

Quote

0.0478sec

0.0478sec

0.46

0.46

7 queries

7 queries

GZIP Disabled

GZIP Disabled