Outline ·

[ Standard ] ·

Linear+

Mortgage Loan Package Inquiries, (Strictly NO Promotion Allowed)

|

Brandis

|

Feb 26 2019, 06:25 PM Feb 26 2019, 06:25 PM

|

Getting Started

|

1) Hi, i'm planning to apply for housing loan from MBB soon. What is the best rate available now?

2) Plan to take up flexi loan. what is the maximum amount of money that I can put into the current/loan account so that I can maximise the interest saving?

E.g, I loan for RM300,000, and I park 300k in that account, so is my monthly repayment will just going to reduce the principal with 0% interest? Or there are certain percentage cut off limit?

|

|

|

|

|

|

Brandis

|

Mar 7 2019, 02:15 PM Mar 7 2019, 02:15 PM

|

Getting Started

|

Hi, need some opinion here.

Recently I have applied for loan from MBB and it got approved

The approved amount is 270k with BLR 1.55% and base rate 3.24. So the effective rate would be 4.8%. I think this is way too high as I heard mostly it's about 4.4%.

MRTA was included which total to about 13k++. Not mention for how long. But is it possible to opt for shorter duration for example 15 years because I plan to pay off the mortgage in about 10 years.

My question is what is the usual offered rate from MBB now?

MRTA duration and is it overcharged mine ?

I've been called by the bank agent to sign the LO and just knew about this figure. I think this is not the best that being offered to me right now

Many thanks

|

|

|

|

|

|

Brandis

|

Mar 21 2019, 12:38 AM Mar 21 2019, 12:38 AM

|

Getting Started

|

Getting an offer from MBB 4.5% for 270k loan. The tenure is 35 years. Is this ok?

|

|

|

|

|

|

Brandis

|

Jul 9 2019, 12:34 AM Jul 9 2019, 12:34 AM

|

Getting Started

|

hi..i've just signed a a full flexi loan from maybank

I noticed there's a commitment fee of 1% on unutilized portion of overdraft facilities when the OD limit is in excess of rm250,000.

Can anyone please explain what is this mean? thanks a lot

This post has been edited by Brandis: Jul 9 2019, 12:39 AM

|

|

|

|

|

|

Brandis

|

Jul 9 2019, 12:48 PM Jul 9 2019, 12:48 PM

|

Getting Started

|

QUOTE(lifebalance @ Jul 9 2019, 09:48 AM) if you took OD and the amount borrowed >250k, then it will incur 1% fees on the not-used amount. Means if my loan is 300k and I park 100k in the account, then 1% will be charged for the 100k? |

|

|

|

|

|

Brandis

|

Jul 9 2019, 05:24 PM Jul 9 2019, 05:24 PM

|

Getting Started

|

QUOTE(lifebalance @ Jul 9 2019, 02:23 PM) No, means 200k will be charged 1% still it's not used, 100k will be charged on the interest rate I'm getting more confused now. Let's say if I get a Rm300k full flexi loan from MBB with interest 4.2%. I put in Rm100k to reduce principal amount and save on my interest charge. So now my principal left Rm200k. Therefore only the Rm200k will be charged with interest 4.2%. So where is this commitment fee of 1% come about ? It will be charged on my remaining rm200k too on top of the interest charges ? |

|

|

|

|

|

Brandis

|

Jul 9 2019, 05:43 PM Jul 9 2019, 05:43 PM

|

Getting Started

|

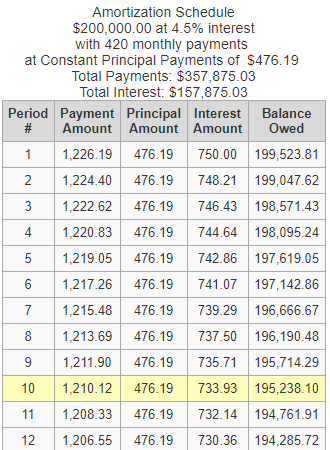

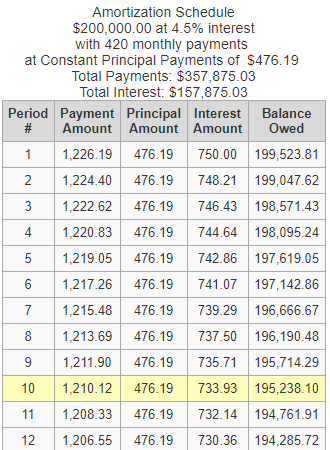

QUOTE(lifebalance @ Jul 9 2019, 05:39 PM) As I said earlier, if your loan is an OD, otherwise the 1% commitment fee is not applicable. the LO given is normally written "if applicable" as it's a template. As for your reasoning above, you're right, there is no mistake on that. Maybank full flexi is based on fixed principal declining interest loan amortization schedule  Which means u pay a monthly installment that pays down a fixed principal amount but reducing interest every month which therefore reduces your monthly installment payable overtime I'm sorry I don't deal with BSN myself, best for you to walk in the branch to enquire Thanks for the explanation. I got a maxihome flexi from MBB. According to the officer, it is an OD. Is there another full flexi plan which is not OD from MBB? |

|

|

|

|

|

Brandis

|

Jul 9 2019, 06:08 PM Jul 9 2019, 06:08 PM

|

Getting Started

|

QUOTE(lifebalance @ Jul 9 2019, 05:49 PM) As to my knowledge, MBB don't have a full flexi that is not based on OD. You may opt for their Semi Flexi if you are looking for non-OD I see... personally I still prefer full flexi. So in theory, if I loan 300k and I dump 300k into the current account, then every month the bank will just deduct the fixed principal amount right? No interest or commitment fee will be charged at all? |

|

|

|

|

|

Brandis

|

Sep 4 2025, 07:35 AM Sep 4 2025, 07:35 AM

|

Getting Started

|

Considering a newly VP project. Checked with several banks like MBB and PBB, but their valuations are much lower than the property's price, so they can only offer around 80% loans. However, Ambank is able to provide a 90% loan.

Here's the offer from Ambank

Loan (90%): 918000

MRTA: 41128 for 25 years

Tenure: 30 years

Rate: 3.8%

Installment: 4470/month

Full flexi

Is this offer good?

I plan to apply to several other banks to see if I can get a better rate.

|

|

|

|

|

Feb 26 2019, 06:25 PM

Feb 26 2019, 06:25 PM

Quote

Quote

0.0583sec

0.0583sec

0.41

0.41

7 queries

7 queries

GZIP Disabled

GZIP Disabled