QUOTE(~~5ive~~ @ Sep 22 2022, 09:44 PM)

Thanks for getting back.

So my understanding is if the property value appreciated then you can choose to have higher loan amount and get quick cash from the refinance. Vice versa, if property value depreciated, then you might have to top up extra cash from your own pocket.

On cost involved, anyone kind enough to share what is the estimated cost to expect? I assume it is x amount of fixed costs on stamping & valuation etc, and maybe x% based on loan value or property value? These will be super helpful to me to run some calculation and see solely from interest rate perspective is it worthwhile to go for that.

Another question i have is does flexi loan typically come with higher interest rate, compare to conventional loan?

Or the rate is varies mainly due to different banks offering, rather than the loan structure itself.

Thanks

Refinancing cost ...

1. Legal fees for new loan agreement

2. Stamping fee

3. Valuation fee

4. Exit fee for existing loan agreement, if applicable

5. New mrta or topup mlta premium

Check the estimated cost here ...

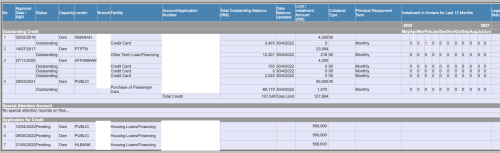

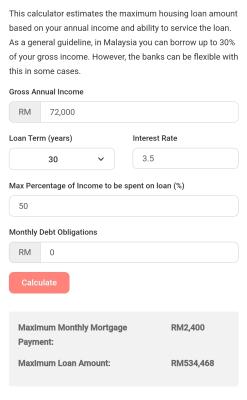

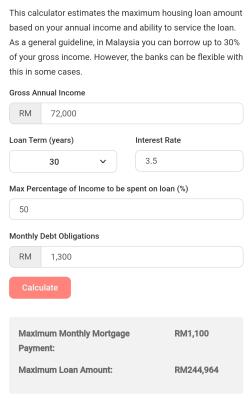

https://www.lowpartners.com/malaysia-law-fi...uty-calculator/Property value appreciation doesnt mean one will receive higher refinancing. Current income qualification and debt obligations will determine whether one qualify for a higher loan. Monthly repayment will also increase not only because of higher loan borrowing but also due to age factor with shorter tenure.

Loan packages from banks come with their own tnc. There is no such saying that which bank or loan is the best. Banks are lending to make profit. Borrower must study the tnc to suit own needs

If borrower can benefit from the refinancing and meet new debt obligations, go ahead.

This post has been edited by mini orchard: Sep 23 2022, 05:47 AM

May 14 2022, 09:41 AM

May 14 2022, 09:41 AM

Quote

Quote

0.5569sec

0.5569sec

0.93

0.93

7 queries

7 queries

GZIP Disabled

GZIP Disabled