QUOTE(Sir_Jim @ Jun 11 2020, 12:12 PM)

Mortgage Loan Package Inquiries, (Strictly NO Promotion Allowed)

Mortgage Loan Package Inquiries, (Strictly NO Promotion Allowed)

|

|

Jun 11 2020, 01:49 PM Jun 11 2020, 01:49 PM

|

Senior Member

1,023 posts Joined: Jun 2019 |

|

|

|

|

|

|

Jun 11 2020, 02:41 PM Jun 11 2020, 02:41 PM

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(digitalz @ Jun 11 2020, 08:33 AM) Hi, age?How much loan can I actually get and what are the best rates currently for the following? What type of loan should we opt for too? Combined nett around 9000. (Property will be joint named) - Commitment around 3k+ Current SPA price - 1m Planning to take around 750k +/- Thanks! commitments? QUOTE(Sir_Jim @ Jun 11 2020, 12:12 PM) Yes it's lifted, however subject to the bank's discretion |

|

|

Jun 11 2020, 02:43 PM Jun 11 2020, 02:43 PM

|

Senior Member

2,030 posts Joined: Oct 2011 |

|

|

|

Jun 11 2020, 02:44 PM Jun 11 2020, 02:44 PM

|

All Stars

10,162 posts Joined: Nov 2014 |

|

|

|

Jun 11 2020, 02:51 PM Jun 11 2020, 02:51 PM

|

Senior Member

2,030 posts Joined: Oct 2011 |

|

|

|

Jun 11 2020, 04:17 PM Jun 11 2020, 04:17 PM

|

Junior Member

210 posts Joined: Oct 2018 |

Hello, my condo under-construction and I am looking for alternative to refinance and cash out for personal purpose

Is this doable and what are the charges I should aware of aside penalty contract from the existing panel bank? |

|

|

|

|

|

Jun 11 2020, 04:35 PM Jun 11 2020, 04:35 PM

|

All Stars

10,162 posts Joined: Nov 2014 |

|

|

|

Jun 11 2020, 04:38 PM Jun 11 2020, 04:38 PM

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(digitalz @ Jun 11 2020, 02:51 PM) Thanks! Yeap.Even with the current market? By the way, the ages of the borrowers would be 32 & 33. Would the number still apply? Based on your expertise - which bank and/or what type of loan should we opt for? (Semi-flexi, full flexi etc?) Semi flexi if you don't plan to make withdrawal often for your prepayments. Otherwise full flexi if you want to treat the housing loan like a savings account. |

|

|

Jun 11 2020, 04:43 PM Jun 11 2020, 04:43 PM

Show posts by this member only | IPv6 | Post

#15609

|

Junior Member

653 posts Joined: Aug 2019 |

QUOTE(lifebalance @ Jun 11 2020, 02:44 PM) Combine net income 9000,each 4500 salary, another one commitment 3k,dsr burst. Another one can get monthly installment loan amount RM3150 . Need to know how many month bonus per year. Better find agent or banker to help u calculate your DSR .This post has been edited by Maiiyowei: Jun 11 2020, 04:50 PM |

|

|

Jun 11 2020, 04:49 PM Jun 11 2020, 04:49 PM

Show posts by this member only | IPv6 | Post

#15610

|

Junior Member

653 posts Joined: Aug 2019 |

QUOTE(digitalz @ Jun 11 2020, 02:51 PM) Thanks! If the person without commitment have net income 4.5k-5k,then can get loan approval for 750k,based on 3.4 interest rate and 35 years loan tenureEven with the current market? By the way, the ages of the borrowers would be 32 & 33. Would the number still apply? Based on your expertise - which bank and/or what type of loan should we opt for? (Semi-flexi, full flexi etc?) |

|

|

Jun 11 2020, 05:18 PM Jun 11 2020, 05:18 PM

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(Maiiyowei @ Jun 11 2020, 04:43 PM) Combine net income 9000,each 4500 salary, another one commitment 3k,dsr burst. Another one can get monthly installment loan amount RM3150 . Need to know how many month bonus per year. Better find agent or banker to help u calculate your DSR . You're wrong. That is not the right way to calculate.I'm the banker / agent btw. |

|

|

Jun 11 2020, 06:14 PM Jun 11 2020, 06:14 PM

|

Junior Member

653 posts Joined: Aug 2019 |

|

|

|

Jun 11 2020, 08:49 PM Jun 11 2020, 08:49 PM

|

Junior Member

529 posts Joined: May 2020 |

QUOTE(vinceleo @ Jun 11 2020, 01:49 PM) QUOTE(lifebalance @ Jun 11 2020, 02:41 PM) Does it mean that possible to get 90% loan now for 3rd property, subject to risk assessment?May I know which bank already implemented this uplift as my banker said they still maintained it as 70%? |

|

|

|

|

|

Jun 11 2020, 10:43 PM Jun 11 2020, 10:43 PM

Show posts by this member only | IPv6 | Post

#15614

|

Senior Member

1,023 posts Joined: Jun 2019 |

Likelihood banks are still going through the updates give it another week or so

QUOTE(Sir_Jim @ Jun 11 2020, 08:49 PM) |

|

|

Jun 12 2020, 08:29 AM Jun 12 2020, 08:29 AM

|

Junior Member

66 posts Joined: Oct 2012 |

Hi all, would like to get some unbiased advices from sifus here before going to banker. This is our first home buying, 0 experiences in dealing with loan application.

SPA - 722,000 After rebate - 622,508 Completion date - year 2023 Q2 Borrowers background - - Couple, want to get joint mortgage - both working overseas, paying income tax overseas (have solid payslip and income tax statement) - total gross income for both RM21k, direct T/T every month to Mbb from overseas - with good credit card record, savings around 250k - the only loan at the moment: PTPTN - Will have extra income every month (bonus, stock market) Questions are: - malaysian working abroad able to get loan? - Able to get 90% margin? - Semi or full flexi? Which bank is prefered? - My preference: to commit more every month by depositing into linked savings/current account to reduce the principal amount (thus the interest), and being able to withdraw out anytime in case of emergency/investment. Thank you in adv who able to help with my doubts This post has been edited by cheekiat95: Jun 12 2020, 08:51 AM |

|

|

Jun 12 2020, 09:39 AM Jun 12 2020, 09:39 AM

|

Junior Member

194 posts Joined: Aug 2016 |

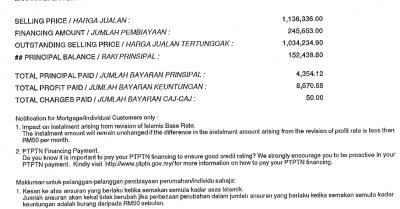

I don't know whether this is the correct place to ask a question regarding loan statement. I have a UOB Islamic financing mortgage and I can't quite understand my annual account statement, image in attachment.

My question is, 1. What is principal balance? The number of total principal paid is only 4354.12, there is no way that the outstanding principal is 152k. 2. How can I understand if my prepayment (early payment) has been used to deduct the principal and the interest? Thank you for all sifu in advance! Attached thumbnail(s)

|

|

|

Jun 12 2020, 09:50 AM Jun 12 2020, 09:50 AM

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(cheekiat95 @ Jun 12 2020, 08:29 AM) Hi all, would like to get some unbiased advices from sifus here before going to banker. This is our first home buying, 0 experiences in dealing with loan application. Mortgage consultant hereSPA - 722,000 After rebate - 622,508 Completion date - year 2023 Q2 Borrowers background - - Couple, want to get joint mortgage - both working overseas, paying income tax overseas (have solid payslip and income tax statement) - total gross income for both RM21k, direct T/T every month to Mbb from overseas - with good credit card record, savings around 250k - the only loan at the moment: PTPTN - Will have extra income every month (bonus, stock market) Questions are: - malaysian working abroad able to get loan? - Able to get 90% margin? - Semi or full flexi? Which bank is prefered? - My preference: to commit more every month by depositing into linked savings/current account to reduce the principal amount (thus the interest), and being able to withdraw out anytime in case of emergency/investment. Thank you in adv who able to help with my doubts 1. Yes 2. Yes 3. Semi if you don't plan to withdraw often on prepayment u made to the loan account Full flexi if you want to treat your housing loan as saving account without being charged per transaction. Depends on your preference on the bank. Usually ppl refer to the rates and then the tnc 4. Either semi or full is fine for you then QUOTE(mrKFC @ Jun 12 2020, 09:39 AM) I don't know whether this is the correct place to ask a question regarding loan statement. I have a UOB Islamic financing mortgage and I can't quite understand my annual account statement, image in attachment. 1. Means the original loan amount that you are still owing to the bank. My question is, 1. What is principal balance? The number of total principal paid is only 4354.12, there is no way that the outstanding principal is 152k. 2. How can I understand if my prepayment (early payment) has been used to deduct the principal and the interest? Thank you for all sifu in advance! You also serve interest thus not 100% of the monthly installment paid goes to your or Inc following the amortization table. 2. Check your online account if you've made prepayment. If it's semi flexi then you would have manually made the prepayment yourself either by walk in or online transaction. If it's a full flexi loan then the amount in your current account is your prepayment amount. |

|

|

Jun 12 2020, 09:54 AM Jun 12 2020, 09:54 AM

|

Junior Member

194 posts Joined: Aug 2016 |

QUOTE(lifebalance @ Jun 12 2020, 09:50 AM) Mortgage consultant here Thanks for quick response. But I am still confused, if principal balance means original loan amount that you are still owing to the bank, how come my outstanding selling price is still 1 million?1. Means the original loan amount that you are still owing to the bank. You also serve interest thus not 100% of the monthly installment paid goes to your or Inc following the amortization table. 2. Check your online account if you've made prepayment. If it's semi flexi then you would have manually made the prepayment yourself either by walk in or online transaction. If it's a full flexi loan then the amount in your current account is your prepayment amount. Thanks again |

|

|

Jun 12 2020, 10:14 AM Jun 12 2020, 10:14 AM

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(mrKFC @ Jun 12 2020, 09:54 AM) Thanks for quick response. But I am still confused, if principal balance means original loan amount that you are still owing to the bank, how come my outstanding selling price is still 1 million? Yours is an Islamic loan, selling price is based on the maximum 12% ceiling rate calculation. Ignore it unless the interest does goes to 12% then that's the amount you will be paying to the bank.Thanks again |

|

|

Jun 12 2020, 11:15 AM Jun 12 2020, 11:15 AM

|

Senior Member

1,383 posts Joined: Sep 2012 |

QUOTE(cheekiat95 @ Jun 12 2020, 08:29 AM) Hi all, would like to get some unbiased advices from sifus here before going to banker. This is our first home buying, 0 experiences in dealing with loan application. IMO full flex suits you more if you plan to withdraw/transfer anytime you want since semi flex most probably need withdraw OTC.SPA - 722,000 After rebate - 622,508 Completion date - year 2023 Q2 Borrowers background - - Couple, want to get joint mortgage - both working overseas, paying income tax overseas (have solid payslip and income tax statement) - total gross income for both RM21k, direct T/T every month to Mbb from overseas - with good credit card record, savings around 250k - the only loan at the moment: PTPTN - Will have extra income every month (bonus, stock market) Questions are: - malaysian working abroad able to get loan? - Able to get 90% margin? - Semi or full flexi? Which bank is prefered? - My preference: to commit more every month by depositing into linked savings/current account to reduce the principal amount (thus the interest), and being able to withdraw out anytime in case of emergency/investment. Thank you in adv who able to help with my doubts |

| Change to: |  0.0285sec 0.0285sec

0.96 0.96

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 10th December 2025 - 05:08 AM |