dear,

is it good time to buy property now and wat is loan rate pls advise.

Mortgage Loan Package Inquiries, (Strictly NO Promotion Allowed)

Mortgage Loan Package Inquiries, (Strictly NO Promotion Allowed)

|

|

May 12 2020, 12:31 PM May 12 2020, 12:31 PM

|

Probation

5 posts Joined: Apr 2020 |

dear,

is it good time to buy property now and wat is loan rate pls advise. |

|

|

|

|

|

May 12 2020, 12:35 PM May 12 2020, 12:35 PM

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(burninvincible @ May 11 2020, 03:11 PM) Full addressBuild up Renovations Current loan amount QUOTE(coolguy99 @ May 11 2020, 06:37 PM) You can start paying earlier but do check if the bank allows you to make prepayments during progressive interest period QUOTE(frostfrench @ May 12 2020, 09:18 AM) I am looking to buy a subsale condo unit near my son's school. The question I have is I am not working, my expense are all from my inheritance that I put in investment and FD. What is your inheritance amount ? Will I still be able to secure a mortgage loan? I can put more than half the amount for downpayment. is it true u cannot get a loan if u are not working or have income.? Do you work in a normal job as well ? QUOTE(devinhenry14 @ May 12 2020, 12:31 PM) What’s ur loan amount.Good time to buy because interest rates are low so you can easily secure a loan |

|

|

May 13 2020, 01:28 PM May 13 2020, 01:28 PM

|

Junior Member

188 posts Joined: Jan 2008 |

Hi, anyone here has UOB loan? The base rate till now has not changed ever since BNM reduced the OPR?

Any idea why or they don't plan to reduce the BR? Asked my banker and he is as useless as usual. Called the contact centre and no help at all. This post has been edited by adrianteo: May 13 2020, 01:29 PM |

|

|

May 13 2020, 02:02 PM May 13 2020, 02:02 PM

|

Junior Member

722 posts Joined: Apr 2008 |

QUOTE(xAmdx @ May 12 2020, 11:30 AM) If you had friend or relative who own a company, try to ask them to give you a offer letter from their company stating x amount of salary and what not. Even your financial is strong, they need to have some sort of prove be it you working for others or you have your own business. The latter require more documents. which bank did u get your loan approved?I done the 1st option recently and got my loan approve without submitting any payslips or epf statement. This post has been edited by donhay: May 13 2020, 02:03 PM |

|

|

May 13 2020, 02:09 PM May 13 2020, 02:09 PM

Show posts by this member only | IPv6 | Post

#15445

|

Senior Member

1,023 posts Joined: Jun 2019 |

Banks will definitely reduce OPR to aligns with the announcement question mark is when? AmBank has yet to announce theirs too

QUOTE(adrianteo @ May 13 2020, 01:28 PM) |

|

|

May 13 2020, 02:13 PM May 13 2020, 02:13 PM

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(adrianteo @ May 13 2020, 01:28 PM) Hi, anyone here has UOB loan? The base rate till now has not changed ever since BNM reduced the OPR? UOB is usually slow in updating the rates. You can follow their website for any updates.Any idea why or they don't plan to reduce the BR? Asked my banker and he is as useless as usual. Called the contact centre and no help at all. |

|

|

|

|

|

May 13 2020, 06:38 PM May 13 2020, 06:38 PM

|

Junior Member

232 posts Joined: Jun 2014 |

QUOTE(lifebalance @ May 12 2020, 12:35 PM) Full address for new property, plan to take loan up to 850k over 30-35years, might add on MRTA or others... any idea the best rate now and which bank? how to make the rates even lower, preferred customer?Build up Renovations Current loan amount You can start paying earlier but do check if the bank allows you to make prepayments during progressive interest period What is your inheritance amount ? Do you work in a normal job as well ? What’s ur loan amount. Good time to buy because interest rates are low so you can easily secure a loan |

|

|

May 13 2020, 09:31 PM May 13 2020, 09:31 PM

|

Senior Member

1,124 posts Joined: Jan 2003 |

QUOTE(adrianteo @ May 13 2020, 01:28 PM) Hi, anyone here has UOB loan? The base rate till now has not changed ever since BNM reduced the OPR? http://br.my/uob/index.htmAny idea why or they don't plan to reduce the BR? Asked my banker and he is as useless as usual. Called the contact centre and no help at all. keep track here, UOB always slow when reduce rate, but very fast when raise rate |

|

|

May 13 2020, 09:45 PM May 13 2020, 09:45 PM

|

All Stars

10,162 posts Joined: Nov 2014 |

|

|

|

May 13 2020, 09:57 PM May 13 2020, 09:57 PM

|

Junior Member

232 posts Joined: Jun 2014 |

|

|

|

May 14 2020, 06:46 PM May 14 2020, 06:46 PM

|

Junior Member

371 posts Joined: Dec 2007 |

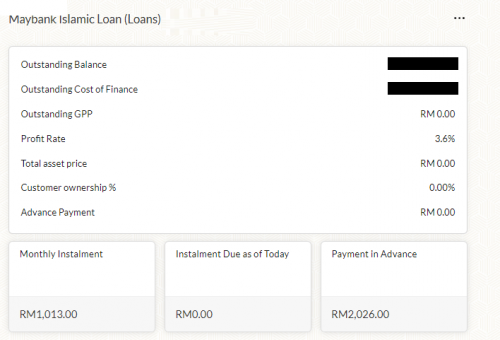

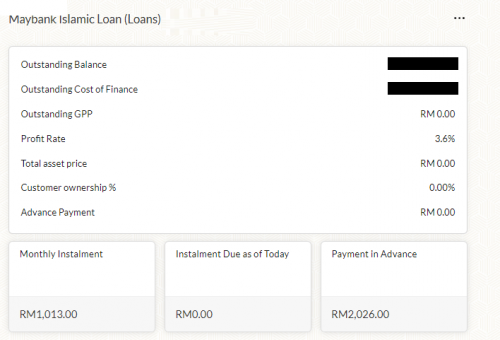

hi, can i know if the Islamic loan in the image above will allows me to deduct the interest if I'm paying extra for my monthly repayment? Knowing that this is the semi-flexi loan and it will incur rm25 transaction fee if i proceed with redrawing the money. Why am I not allow increase the monthly payment from browser M2U. |

|

|

May 14 2020, 11:01 PM May 14 2020, 11:01 PM

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(junfu1988 @ May 14 2020, 06:46 PM)  hi, can i know if the Islamic loan in the image above will allows me to deduct the interest if I'm paying extra for my monthly repayment? Knowing that this is the semi-flexi loan and it will incur rm25 transaction fee if i proceed with redrawing the money. Why am I not allow increase the monthly payment from browser M2U. The monthly installment is based on your original loan amount, tenure and interest rate. It can't be altered unless you refinance or restructure the loan. |

|

|

May 15 2020, 11:41 AM May 15 2020, 11:41 AM

|

Junior Member

426 posts Joined: Jan 2003 From: somewhere over the rainbow |

Are banks still giving out loans?

I have a condo with 30% it's market value left on my home loan with CIMB. Before MCO, I applied to top-up my loan another 30% with CIMB so I can purchase another property (for a total loan amount of 60% the market value of my current condo). Filled the forms and submitted the required documents. Then MCO happened. And everything just stopped. I made a report after a couple of weeks of no news and "MCO excuses" by the bank officer (even though their branch remained open). I've even received two apology letters from CIMB for my unresolved report. Could it be banks (or CIMB) are no longer giving out loans in this uncertain time? |

|

|

|

|

|

May 15 2020, 01:05 PM May 15 2020, 01:05 PM

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(panafone @ May 15 2020, 11:41 AM) Are banks still giving out loans? I have a condo with 30% it's market value left on my home loan with CIMB. Before MCO, I applied to top-up my loan another 30% with CIMB so I can purchase another property (for a total loan amount of 60% the market value of my current condo). Filled the forms and submitted the required documents. Then MCO happened. And everything just stopped. I made a report after a couple of weeks of no news and "MCO excuses" by the bank officer (even though their branch remained open). I've even received two apology letters from CIMB for my unresolved report. Could it be banks (or CIMB) are no longer giving out loans in this uncertain time? Probably just the officer that you're dealing with. Unfortunately top up loans you have to deal with your branch. Can't assist you on that. |

|

|

May 15 2020, 04:17 PM May 15 2020, 04:17 PM

Show posts by this member only | IPv6 | Post

#15455

|

Senior Member

1,023 posts Joined: Jun 2019 |

Was told delay due to officers on rotation not to mention the layer of approvals requirement internal for CIMB

QUOTE(panafone @ May 15 2020, 11:41 AM) Are banks still giving out loans? I have a condo with 30% it's market value left on my home loan with CIMB. Before MCO, I applied to top-up my loan another 30% with CIMB so I can purchase another property (for a total loan amount of 60% the market value of my current condo). Filled the forms and submitted the required documents. Then MCO happened. And everything just stopped. I made a report after a couple of weeks of no news and "MCO excuses" by the bank officer (even though their branch remained open). I've even received two apology letters from CIMB for my unresolved report. Could it be banks (or CIMB) are no longer giving out loans in this uncertain time? |

|

|

May 15 2020, 11:31 PM May 15 2020, 11:31 PM

Show posts by this member only | IPv6 | Post

#15456

|

Senior Member

1,382 posts Joined: Jan 2011 From: Lahad datu |

|

|

|

May 16 2020, 10:18 AM May 16 2020, 10:18 AM

Show posts by this member only | IPv6 | Post

#15457

|

All Stars

17,499 posts Joined: Feb 2006 From: KL |

QUOTE(Timothy500 @ May 16 2020, 08:08 AM) Hello , I have a question. better call them and ask?My loan was 4.15% on December 2019. Throughout 2020, bnm has reduced 1% in total. Hence , now my loan is 3.15%. However, I found that MBB still urging me to pay monthly instalment 3305. (Which is same as 4.15 rate) Does my extra instalment deduct principal? Or do they simply put extra payment into prepayment ? |

|

|

May 16 2020, 11:48 AM May 16 2020, 11:48 AM

Show posts by this member only | IPv6 | Post

#15458

|

Senior Member

1,023 posts Joined: Jun 2019 |

The norm is reducing installment in tandem with interest rate reduction but no harm to maintain the same installment if you can afford it as eventually will reduce the principal. Best to also check with your banker/branch to confirm

QUOTE(Timothy500 @ May 16 2020, 08:08 AM) Hello , I have a question. My loan was 4.15% on December 2019. Throughout 2020, bnm has reduced 1% in total. Hence , now my loan is 3.15%. However, I found that MBB still urging me to pay monthly instalment 3305. (Which is same as 4.15 rate) Does my extra instalment deduct principal? Or do they simply put extra payment into prepayment ? |

|

|

May 16 2020, 05:22 PM May 16 2020, 05:22 PM

|

Senior Member

1,542 posts Joined: Jan 2005 From: Seri Kembangan |

Any good refinace package or top up loan in market now?

|

|

|

May 16 2020, 11:00 PM May 16 2020, 11:00 PM

Show posts by this member only | IPv6 | Post

#15460

|

Junior Member

400 posts Joined: Jun 2011 |

Is it worthwhile to do refinancing now? The interest rate environment is so low now. Is it possible to lock in the low rates with Islamic loans?

|

| Change to: |  0.3891sec 0.3891sec

0.18 0.18

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 8th December 2025 - 02:49 AM |