QUOTE(ck2chan @ Feb 22 2022, 11:59 PM)

One eg is the bank offer only 80% when borrower applied for 90%.The other eg is required borrower to provide a guarantor

Etc....etc....etc.

This post has been edited by mini orchard: Feb 23 2022, 06:18 AM

Mortgage Loan Package Inquiries, (Strictly NO Promotion Allowed)

|

|

Feb 23 2022, 06:11 AM Feb 23 2022, 06:11 AM

Return to original view | Post

#121

|

All Stars

14,511 posts Joined: Sep 2017 |

|

|

|

|

|

|

Feb 23 2022, 11:10 AM Feb 23 2022, 11:10 AM

Return to original view | Post

#122

|

All Stars

14,511 posts Joined: Sep 2017 |

And some can say online calculators are not 100% correct !

Whether the loan process is inmaterial. That is procedure. Generally no bank can force a borrower to accept the loan offer ... this is legal ! In a SnP, no buyer seller can force to sign the agreement if one dont agree to the terms. Deposit paid will be refunded. This post has been edited by mini orchard: Feb 23 2022, 01:25 PM |

|

|

Feb 25 2022, 04:34 PM Feb 25 2022, 04:34 PM

Return to original view | IPv6 | Post

#123

|

All Stars

14,511 posts Joined: Sep 2017 |

QUOTE(theballer @ Feb 25 2022, 02:27 PM) Any thoughts?. None. Usually among UOB , MBB and HLB which of their loan packages are better? If say all offered same rate etc. No bank tnc are the same. Sure have variations. Otherwise why do borrowers compare and borrowing is NOT always about interest rates It depends on the borrower needs. Choose the one that suits borrower among the better. For eg, if UOB tnc suits you, then is better. PBB may suit other borrowers. This post has been edited by mini orchard: Feb 25 2022, 04:36 PM |

|

|

Feb 26 2022, 08:47 AM Feb 26 2022, 08:47 AM

Return to original view | IPv6 | Post

#124

|

All Stars

14,511 posts Joined: Sep 2017 |

QUOTE(gooroojee @ Feb 26 2022, 01:30 AM) There's capping of interest savings for advanced payments at 70% for one bank. Sometime borrowing decision is not difficult to decide if borrower knows what he wants, otherwise every offer is complicated.There's no interest savings for advanced payments to Islamic loans while under construction for one bank. Some banks allow waiver of MRTT or similar, some banks either don't or impose higher rates in lieu. Some bank have stricter early settlement terms, which aren't favourable for flippers. Some banks recognize your loan as AUM and provide you premier banking status. So, see which works for you lor... Even if a wrong decision was made today, borrower can refinance to be in better position for the future. Who knows, one day in the future, the bank may pay customers incentive for monthly instalment paid similar to CC cash back now which is unheard 20 years ago. This post has been edited by mini orchard: Feb 26 2022, 08:49 AM |

|

|

Mar 4 2022, 08:49 AM Mar 4 2022, 08:49 AM

Return to original view | IPv6 | Post

#125

|

All Stars

14,511 posts Joined: Sep 2017 |

QUOTE(direct707 @ Mar 4 2022, 01:58 AM) Refinancing is the same as buying another property. Is only now that buyer and seller is the same person and there is no SnP.If your loan is flexi or semi, you dont have to refinance. Banks allow wirthdrawal of repayment subject to tnc. Refinance also depends on how much cash you need. Any refinancing amount will goes towards settling the outstanding loan first and the balance given to you. Refinancing will incurred legal fees, stamp duty, valuation fee and mrta. If the price of your property doesnt appreciate in market value after valuation, or if repayment is only for few years, refinancing dont benefit you even though your intention is to get lower interest rate. The new tenure is also shorter because of age factor and new monthly repayment can be higher subject loan amount. Refinancing approval also depends on your repayment history. |

|

|

Mar 4 2022, 10:02 AM Mar 4 2022, 10:02 AM

Return to original view | IPv6 | Post

#126

|

All Stars

14,511 posts Joined: Sep 2017 |

QUOTE(direct707 @ Mar 4 2022, 09:33 AM) Thank you for the reply. My loan account is flexi. How do I know how much I can withdraw it back? You have to call the bank to check how you can redraw.I am paying this properties for about 5 years now. Int 3.44%. Not benefit me if refinence? The int rate i saw today is below 3%. For 5 years, the reduction in capital repayment is low. In a startup repayment, about 60 to 65% of monthly repayment goes to interest and the balance reducing principal. For every 1000, 400 is to reduce principal and 600 to interest. After 5 years, principal reduce by 24k and interest paid is 36k. The next question is what is the market value of the property at 5th year ? If is lower than outstanding bank loan, then you have to settle the difference during refinancing. Meaning, you wont get more money out from refinancing.but instead have to pay bank to refinance the shortfall. Again, the next question ... do you have the cash to settle the difference ? If you have bought the property with rebates and cashback and no down payment, more likely the value will drop below bank loan outstanding during refinancing. In theory, is better to refinance if interest is lower but again interest rate is not only the deciding factor. Are you prepare to pay cost of refinancing, accept a lower refinancing amount and maintain the same monthly repayment amount because of shorter loan tenure ? Again, your interest should reduce accordingly in tandem with current rate but of course not lower than current new loan rate. Previously my monthly repayment was 2.3k but today is 1.96k because of overall lower rate. This post has been edited by mini orchard: Mar 4 2022, 10:36 AM |

|

|

|

|

|

Mar 4 2022, 02:24 PM Mar 4 2022, 02:24 PM

Return to original view | IPv6 | Post

#127

|

All Stars

14,511 posts Joined: Sep 2017 |

QUOTE(direct707 @ Mar 4 2022, 01:19 PM) Thank you for the highlights. By the way, if I do redraw, the monthly payment will be more? Or same but the period will be longer? I cant be sure as I never do b4. But I think will have a separate account number and do repayment separately.Pls check with your bank. |

|

|

Mar 4 2022, 07:20 PM Mar 4 2022, 07:20 PM

Return to original view | IPv6 | Post

#128

|

All Stars

14,511 posts Joined: Sep 2017 |

QUOTE(chewinggum2 @ Mar 4 2022, 06:13 PM) hi, total newbie here. Generally, everyone should be able to get a loan if he is not blacklisted by a financial institution.how do i know what is my eligibility to get house loan approval? im a sole proprietor in my 30s looking to purchase a new house/condo. The next question is how much can you allocated you monthly 'salary' for the loan. Then only you will roughly know how much you can borrow and what property price range you can buy. When you submit your loan application, bank will assess your eligibility based on other outstanding loans ... HP, PTPTN, CC and PL. If none than is straight forward. In addition, the bank will also consider the market value of the property. If you buy at 500k, and if the bank valuer says is only 460k, then the loan is based on 460k. For first time loan borrower, he can get max 90% of value or lower if you doesnt qualified for 90%. So you have to topup the difference with your savings if property value is lower and loan is less than 90% If you want lower than 90, you pay more downpayment and monthly repayment will be lower. Monthly repayment amount also depends on age. An older borrower will pay a higher monthly repayment. Once everything is confirm, the bank will issue an offer letter with the terms. Is non negotiable .... either you accept or reject. There will be other cost when one purchase a property ..... legal fees, stamp duties, valuation fees (if subsale) and mrta (life insurance for the loan). Remember to allocate some money for that. .... about 5% of purchase price plus the minimum 10% downpayment. Once you take over the property, you will require some money to reno and furnish the place. There is no limit on how much you want spend. Bear in mind that what you spend doesnt mean you will get back when you sell later. Since your income is from the sole prop business, make sure all your financial records and tax payment are in order for the bank to review. Having a monthly epf contributions helps....not pay one or two lump sum in one year. Finally, buy within affordability. The bank can loan you money and they can also auction your property if you dont pay your loan. red_pyjamas liked this post

|

|

|

Mar 6 2022, 06:21 PM Mar 6 2022, 06:21 PM

Return to original view | Post

#129

|

All Stars

14,511 posts Joined: Sep 2017 |

QUOTE(MrBlackie33 @ Mar 6 2022, 05:46 PM) Would like to ask the expert here TA, bank statements and rental tax declaration.Im actually looking to buy a 2nd property for own stay, but in order to prove my 1st property rental income what documents usually required by the banks? is the bank going to take the rental income as full fix monthly income? Up to the bank to assess the risk.....it can reject or partial. Unlikely full. |

|

|

Mar 6 2022, 09:55 PM Mar 6 2022, 09:55 PM

Return to original view | Post

#130

|

All Stars

14,511 posts Joined: Sep 2017 |

QUOTE(Agent 45 @ Mar 6 2022, 09:17 PM) I want to apply for loan for my 2nd house but there is not much saving in my saving account as usually i put most of my saving into my 1st housing loan semi flexi account to reduce interest. In this case, should i move the extra saving from my house loan account to my saving account or i just need to show my house loan account statement without doing the transfer? All loan approval is based on income and not savings balance. Is your current income able to sustain two loans repayment ? |

|

|

Mar 7 2022, 09:48 AM Mar 7 2022, 09:48 AM

Return to original view | Post

#131

|

All Stars

14,511 posts Joined: Sep 2017 |

QUOTE(alesi616 @ Mar 7 2022, 09:39 AM) How does the bank access the rental tax declaration part? Is it solely looking at the "Pendapatan berkanun sewa" column on the BE tax form? Based on nett taxable figure. After paying all expenses, will the balance enough to cover loan repayment.Because the declared rental is gross rental minus all bank interest, assessment fee, maintenance fee, repair fee etc, these numbers are probably documented in microsoft excel by ownself or worse sometimes not documented as all, do we need to show bank all the interest statements, assessment bil, maintenance fee receipt, etc? The declared figure is deemed that tax payer has deducted all allowable expenses to arrive at a lower taxable income. For example... Yearly rental is 24000 (2k per month) Expenses is 15000 pa including loan interest. Effectively, nett taxable rental income is 9000 ÷ 12 = 750 pm or 37.5% of gross rental. This post has been edited by mini orchard: Mar 7 2022, 10:51 AM |

|

|

Mar 7 2022, 10:24 AM Mar 7 2022, 10:24 AM

Return to original view | Post

#132

|

All Stars

14,511 posts Joined: Sep 2017 |

QUOTE(Agent 45 @ Mar 7 2022, 10:07 AM) my income can cover both loan. which means if i dont have the 10% for deposit in my saving account also fine? will it affect the interest rate? Bank will loan 90% or lower based on market value and or borrower profile. How borrower settle the difference, whether is 10, 15 or whatever figure is up to the borrower.Interest rate is based on many criterias ..... loan amount, tenure, property, bank risk, etc. This post has been edited by mini orchard: Mar 7 2022, 10:31 AM |

|

|

Mar 9 2022, 06:11 AM Mar 9 2022, 06:11 AM

Return to original view | Post

#133

|

All Stars

14,511 posts Joined: Sep 2017 |

QUOTE(renee78 @ Mar 8 2022, 07:12 PM) I want to refinance my home loan under my sister's name. What is your purpose to refinance using your sistet's name ?Is it possible? Current bank is OCBC, they want to charge about 3% to do the transfer. Do any banks do 0 cost transfer? Whether bank charge 0 or 3 is not important. They can package it to make it looks 0. At the end, every bank wants good returns on a loan. As example, banks charge lower rates if borrower include mrta in their loan and vice versa. |

|

|

|

|

|

Mar 9 2022, 09:01 AM Mar 9 2022, 09:01 AM

Return to original view | IPv6 | Post

#134

|

All Stars

14,511 posts Joined: Sep 2017 |

QUOTE(renee78 @ Mar 9 2022, 08:51 AM) I'm leaving Malaysia. You can cont with the loan after leaving the country for short or long term.I understand banks can move costs everywhere, but 3% costs for my bank to do this name change seems very high (Example: that is 15k on a 500k loan). I refinanced another property previously at my own bank with lower interest rates at 0 cost. So that is why I am trying to find another bank that can refinance it at lower cost. Create a Standing Instruction to repay the monthly mortgage. Make sure you have sufficient fund only. At the same time, request a lawyer to do a Power of Attorney (PA) in your sister's name to act on the matter or on all other matters while you are away. I believed the 3% is for legal fees, stamp duty and other related cost in any refinancing. In addition, I think the bank would require you to sign a personal guarantee and also other letters to allow them to auction the property in the event of a default. Remember that any loan under a 3rd party name will reduce her eligibilty if she wants to take her own loan later. Is of no benefit to her unless she has totally no intention to take further loan. In addition, if there is a default no matter whose fault, her name will be blacklisted from any future loan application. This post has been edited by mini orchard: Mar 9 2022, 09:17 AM |

|

|

Mar 11 2022, 01:02 PM Mar 11 2022, 01:02 PM

Return to original view | Post

#135

|

All Stars

14,511 posts Joined: Sep 2017 |

QUOTE(spider_man0809 @ Mar 11 2022, 10:52 AM) Hi all bankers and sifus, Wanna ask my monthly gross pay is rm5k, now I have RM400k first house loan (now outstanding amount in ccris is RM300k as not yet VP), monthly installment will be around Rm2k, but now just only paying progressive interest. Understand that in certain bank, the DSR rate for income above 5k is different, Will I able to get a second housing loan for RM700k houses? Kindly advice.

|

|

|

Mar 11 2022, 02:22 PM Mar 11 2022, 02:22 PM

Return to original view | Post

#136

|

All Stars

14,511 posts Joined: Sep 2017 |

QUOTE(OptimusStar @ Mar 11 2022, 02:08 PM) Hi All, MrtaI planning to buy a property for 688K loan amount. However i am trying to figure out what is the cheapest way to cover the insurance. I dont want to have a loan more than 700K. Any advise ? Check your premium here ..... https://www.etiqa.com.my/getonline/calculator-mrta-ltfi This post has been edited by mini orchard: Mar 11 2022, 02:48 PM |

|

|

Mar 15 2022, 01:38 PM Mar 15 2022, 01:38 PM

Return to original view | Post

#137

|

All Stars

14,511 posts Joined: Sep 2017 |

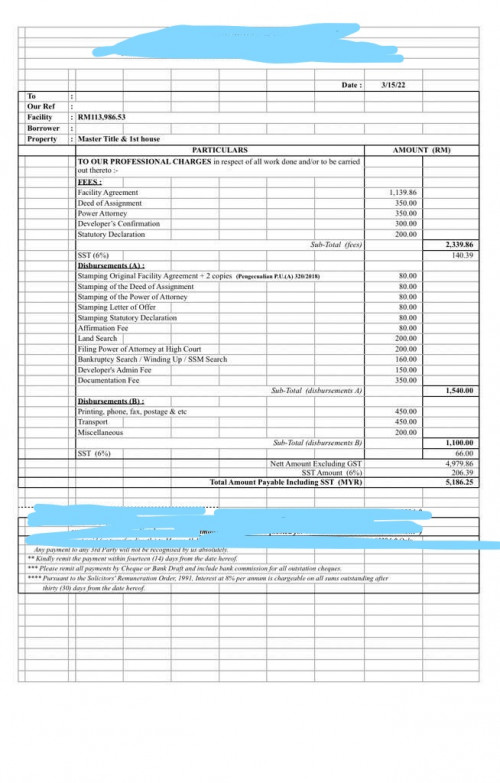

QUOTE(eDwanD @ Mar 15 2022, 01:20 PM) Deal all sifu, If you have not sign the loan agreement, I suggest you check with other banks.I had apply loan for my 1st house which cost 120k. And i get quotation of loan agreement legal fees from bank as below,  I just curiosity about this legal fees is reasonable or not? Thank you for your feedback |

|

|

Mar 17 2022, 05:53 PM Mar 17 2022, 05:53 PM

Return to original view | Post

#138

|

All Stars

14,511 posts Joined: Sep 2017 |

|

|

|

Mar 21 2022, 05:08 AM Mar 21 2022, 05:08 AM

Return to original view | Post

#139

|

All Stars

14,511 posts Joined: Sep 2017 |

QUOTE(Evilliving44 @ Mar 21 2022, 03:31 AM) Hi guys. My relative is intending to sell her property to me. And the proceeds will go to me as we are intending to use the funds for her medical treatment as we are afraid that she may go at any moment. My question is if I park the funds into my savings account with the bank that I have the loan with, will that be an issue? Will bank authorities or BNM question that money source? Nothing to worry as long you can prove the money trial.Else, lets say we park the funds at my sibling account, will that be an issue as well? Because ultimately I am the one shouldering the loan, I would want to see that money in good hands. Money from the sale will goes to the seller. Thereafter the seller decides what to do with the money. |

|

|

Mar 25 2022, 08:04 AM Mar 25 2022, 08:04 AM

Return to original view | Post

#140

|

All Stars

14,511 posts Joined: Sep 2017 |

|

| Change to: |  0.5658sec 0.5658sec

0.24 0.24

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 3rd December 2025 - 03:31 AM |