QUOTE(roarus @ May 26 2019, 04:43 PM)

Perhaps best to clarify with CapTrader support if you have US stock holdings with them - I strongly believe it's still 30% one way or another for us Malaysian tax payers. In the worst case where CapTrader doesn't withhold any tax at all for all their clients, you're liable for filing it appropriately or risk falling under tax evasion with Uncle Sam.

With IB's target demographic and clientele size, I don't foresee that limit being lifted anytime soon.

To be clear, TradeStation Global has zero monthly inactivity/min commission;

IB (if you have <USD100k) on your 4th month onwards whether you trade or not: If your trade commission less than $10 you pay $10. If more, you pay that amount. If you don't do anything, you still pay $10.

TradeStation: You buy something you pay trade/FX commission, you sell something you pay trade/FX commission. You don't do anything, you don't pay anything.

If your habitual trade commission is less than $10 a month or you time the market, then go with TradeStation instead of IB (unless you have a cool USD100k of course)

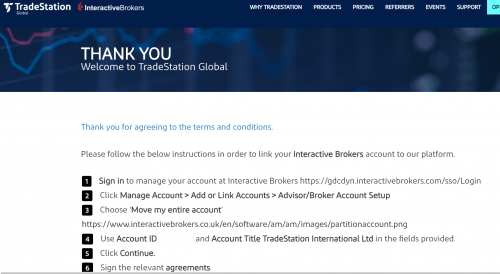

But when I open Tradestation, it keeps sending me back to IB page asking for funding. I show u document later. I'm stuck at this stage. They say must fund IB account to activate first, then only can initiate account linking to Tradestation.

When I call Tradestation IB say how, they say can't bypass IB. I dun paham.

Very mafan compared to my captrader. Terus open je.

May 25 2019, 11:02 PM

May 25 2019, 11:02 PM

Quote

Quote

0.0878sec

0.0878sec

1.00

1.00

7 queries

7 queries

GZIP Disabled

GZIP Disabled