Has anyone use sunway money for foreign remittance? How does it compare to instarem in terms of fees?

All about ETFs / Foreign Brokers, Exchange traded funds

All about ETFs / Foreign Brokers, Exchange traded funds

|

|

Oct 3 2020, 10:32 PM Oct 3 2020, 10:32 PM

Show posts by this member only | IPv6 | Post

#1761

|

Newbie

13 posts Joined: May 2015 |

Has anyone use sunway money for foreign remittance? How does it compare to instarem in terms of fees?

|

|

|

|

|

|

Oct 3 2020, 11:11 PM Oct 3 2020, 11:11 PM

Show posts by this member only | IPv6 | Post

#1762

|

All Stars

24,354 posts Joined: Feb 2011 |

QUOTE(JJkian @ Oct 3 2020, 10:32 PM) Has anyone use sunway money for foreign remittance? How does it compare to instarem in terms of fees? Yes. It's way cheaper than instarem. Don't look at rates. Look at how much you get for every say RM10k. The company which can give you the most foreign currency for the same amount of RM should get your business. |

|

|

Oct 3 2020, 11:35 PM Oct 3 2020, 11:35 PM

Show posts by this member only | IPv6 | Post

#1763

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(JJkian @ Oct 3 2020, 10:32 PM) Has anyone use sunway money for foreign remittance? How does it compare to instarem in terms of fees? yeah pretty good, i just tried it two days back for MYR to SGDtheir disclaimer mention it could take up to 4 days for the remittance but i got it done same day. Done it before 4pm tho |

|

|

Oct 5 2020, 12:14 AM Oct 5 2020, 12:14 AM

Show posts by this member only | IPv6 | Post

#1764

|

Senior Member

1,628 posts Joined: May 2013 |

Hi guys,

I would like to ask advise from you guys. I plan to use my small amount of USD in Paypal to buy ETF, about USD400. If I only buy 1 unit and keep it in long term, probably 5 or 10 years+, will the ETF value grow at least 50% in capital? Or if invest in ETF need to consistently top up to average it down? I have invest using Wahed so plan to buy ETF that focus on distribute dividend. I am thinking of either VIG or VYM or SPYD. Can you guys let me know is there anything wrong with my approach and ETF selection? This post has been edited by rocketm: Oct 5 2020, 12:27 AM |

|

|

Oct 5 2020, 11:53 PM Oct 5 2020, 11:53 PM

Show posts by this member only | IPv6 | Post

#1765

|

Senior Member

1,617 posts Joined: Mar 2020 |

Is direct holding an etf still worth it? now with robo advisors offering etfs in their portfolios.

|

|

|

Oct 6 2020, 09:50 AM Oct 6 2020, 09:50 AM

Show posts by this member only | IPv6 | Post

#1766

|

All Stars

24,354 posts Joined: Feb 2011 |

QUOTE(thecurious @ Oct 5 2020, 11:53 PM) Of course. Robo charges 0.7-1.0%You yourself can buy for say 0.1% which is very significant. Robo is only useful for those who 1) don't know what to buy 2) don't want to to think red streak and thecurious liked this post

|

|

|

|

|

|

Oct 6 2020, 10:52 AM Oct 6 2020, 10:52 AM

Show posts by this member only | IPv6 | Post

#1767

|

Senior Member

1,617 posts Joined: Mar 2020 |

|

|

|

Oct 6 2020, 11:29 PM Oct 6 2020, 11:29 PM

Show posts by this member only | IPv6 | Post

#1768

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(rocketm @ Oct 5 2020, 12:14 AM) Hi guys, ur questions are too vast to be answered.I would like to ask advise from you guys. I plan to use my small amount of USD in Paypal to buy ETF, about USD400. If I only buy 1 unit and keep it in long term, probably 5 or 10 years+, will the ETF value grow at least 50% in capital? Or if invest in ETF need to consistently top up to average it down? I have invest using Wahed so plan to buy ETF that focus on distribute dividend. I am thinking of either VIG or VYM or SPYD. Can you guys let me know is there anything wrong with my approach and ETF selection? 5 or 10 years+, will the ETF value grow at least 50% in capital? there are tons of ETFs, bad ones, good ones, look at their performance at yahoo finance and do your own due diligence and decision if invest in ETF need to consistently top up to average it down? to DCA (Dollar cost averaging, consistently top up to average it down/up) or to lump sump is still a dispute i would say if u dont have large capital, just continue DCA, if u have one large capital, for me i would wait a crash to lump sump in, just my own preference I have invest using Wahed so plan to buy ETF that focus on distribute dividend. I am thinking of either VIG or VYM or SPYD. cant relate Wahed with ur intention to go with distributing ETFs but be noted that income distribution of ETFs domiciled in US subjects to 30% withholdings tax. Please do your own research |

|

|

Oct 7 2020, 12:46 AM Oct 7 2020, 12:46 AM

Show posts by this member only | IPv6 | Post

#1769

|

Senior Member

1,628 posts Joined: May 2013 |

QUOTE(tadashi987 @ Oct 7 2020, 12:29 AM) ur questions are too vast to be answered. Thanks for your reply.5 or 10 years+, will the ETF value grow at least 50% in capital? there are tons of ETFs, bad ones, good ones, look at their performance at yahoo finance and do your own due diligence and decision if invest in ETF need to consistently top up to average it down? to DCA (Dollar cost averaging, consistently top up to average it down/up) or to lump sump is still a dispute i would say if u dont have large capital, just continue DCA, if u have one large capital, for me i would wait a crash to lump sump in, just my own preference I have invest using Wahed so plan to buy ETF that focus on distribute dividend. I am thinking of either VIG or VYM or SPYD. cant relate Wahed with ur intention to go with distributing ETFs but be noted that income distribution of ETFs domiciled in US subjects to 30% withholdings tax. Please do your own research I do notice that the withholding tax for dividend received. The dividend based ETF is just my plan to add in to my portfolio since Wahed is more on growth. |

|

|

Oct 7 2020, 01:20 AM Oct 7 2020, 01:20 AM

Show posts by this member only | IPv6 | Post

#1770

|

All Stars

24,354 posts Joined: Feb 2011 |

QUOTE(rocketm @ Oct 7 2020, 12:46 AM) Thanks for your reply. Forget about using wahed. Go buy Ark innovative etf and cxse. You have all the growth you want.I do notice that the withholding tax for dividend received. The dividend based ETF is just my plan to add in to my portfolio since Wahed is more on growth. Cheaper than wahed. Higher returns than wahed. This post has been edited by Ramjade: Oct 7 2020, 01:21 AM |

|

|

Oct 7 2020, 10:16 AM Oct 7 2020, 10:16 AM

Show posts by this member only | IPv6 | Post

#1771

|

Senior Member

1,628 posts Joined: May 2013 |

QUOTE(Ramjade @ Oct 7 2020, 02:20 AM) Forget about using wahed. Go buy Ark innovative etf and cxse. You have all the growth you want. Thanks for your suggestion. I guess you are aiming for growth.Cheaper than wahed. Higher returns than wahed. Does my thought is correct? For dividend type, the dividend will be cut based on economic situation and management discretion, capital appreciation might be little. For growth type, capital appreciation is based on company performance and the perception from the market force but dividend is lower. I have looked at Ark types ETF, all of them goes higher and higher due to momentum and slightly cheaper. But if bubble dot.com appear again, most probably Ark etf will drop a lot. Can I confirm with you that ARKK is consist of all the Ark etfs (ARKQ, ARKW, ARKF and ARKG)? Exchange MYR to USD to invest in ARKK, will the exchange rate added to ARKK is still cheaper and worth? |

|

|

Oct 7 2020, 10:42 AM Oct 7 2020, 10:42 AM

Show posts by this member only | IPv6 | Post

#1772

|

All Stars

24,354 posts Joined: Feb 2011 |

QUOTE(rocketm @ Oct 7 2020, 10:16 AM) Thanks for your suggestion. I guess you are aiming for growth. Etf end of the day is about selling. Is not for dividends. Does my thought is correct? For dividend type, the dividend will be cut based on economic situation and management discretion, capital appreciation might be little. For growth type, capital appreciation is based on company performance and the perception from the market force but dividend is lower. I have looked at Ark types ETF, all of them goes higher and higher due to momentum and slightly cheaper. But if bubble dot.com appear again, most probably Ark etf will drop a lot. Can I confirm with you that ARKK is consist of all the Ark etfs (ARKQ, ARKW, ARKF and ARKG)? Exchange MYR to USD to invest in ARKK, will the exchange rate added to ARKK is still cheaper and worth? Not all companies cut dividends. Majority or my portfolio , did not cut dividend but in fact increase it. I don't do ETF with exception of maybe CXSE cause no money to buy 1 lot of tencent. Drop, I buy some more. No Ark is the company, They have a few ETFs. You can pick which one you like. Wahed also keep converting money everytime you buy. Whether you make or lose money is usually known when you are finally ready to exit your investment. Converting money must also be smart. Use banks and your expense is more. This post has been edited by Ramjade: Oct 7 2020, 11:02 AM |

|

|

Oct 11 2020, 08:53 PM Oct 11 2020, 08:53 PM

|

|||||||||

Senior Member

4,816 posts Joined: Apr 2007 |

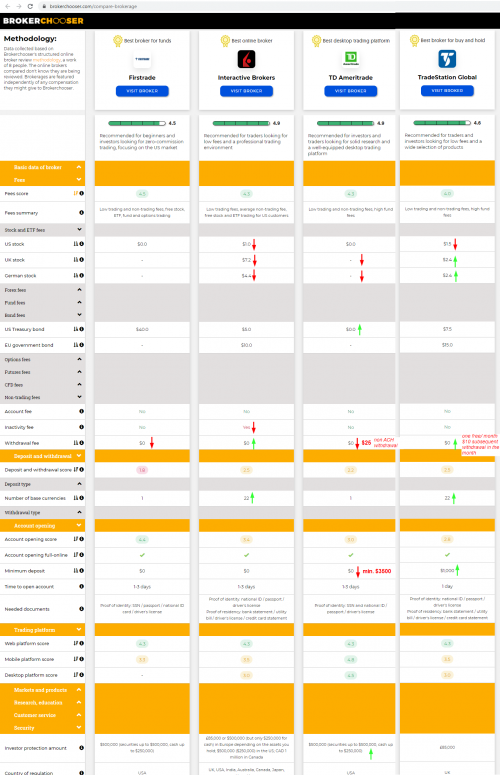

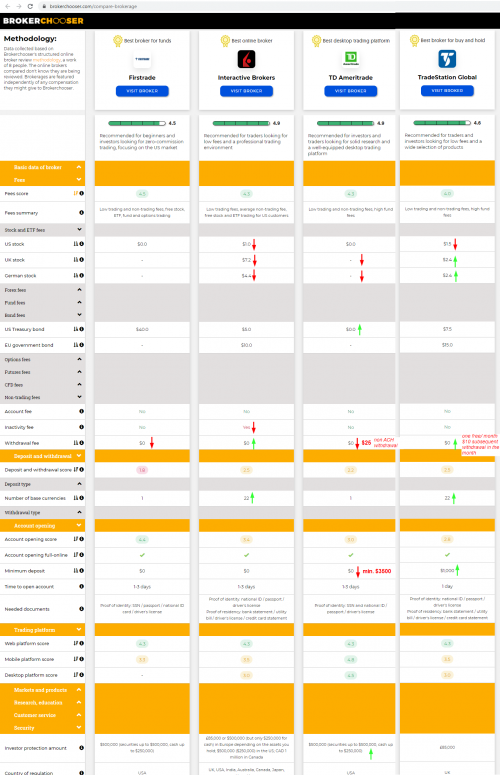

Just started to search for good international broker to buy global/US ETF funds at cheaper rates (than Roboadvisors etc.)

So far shortlisted between this two

This post has been edited by polarzbearz: Oct 18 2020, 04:08 PM |

|||||||||

|

|

|

|

|

Oct 12 2020, 07:42 AM Oct 12 2020, 07:42 AM

|

|||||||||

Senior Member

6,230 posts Joined: Jun 2006 |

QUOTE(polarzbearz @ Oct 11 2020, 08:53 PM) Just started to search for good international broker to buy global/US ETF funds at cheaper rates (than Roboadvisors etc.) tradestation-global have to pay commissionSo far shortlisted between this two

This post has been edited by dwRK: Oct 12 2020, 07:42 AM |

|||||||||

|

|

Oct 18 2020, 04:07 PM Oct 18 2020, 04:07 PM

|

Senior Member

4,816 posts Joined: Apr 2007 |

QUOTE(dwRK @ Oct 12 2020, 07:42 AM) My bad, looked wrongly $1.5 / per US order Also found this website that compares broker - not bad. Between TD Ameritrade and TradeStation Global both seems to be strong contender. There's also IBKR but the inactivity/minimum commissions are really oof  This post has been edited by polarzbearz: Oct 18 2020, 05:01 PM |

|

|

Oct 18 2020, 07:00 PM Oct 18 2020, 07:00 PM

Show posts by this member only | IPv6 | Post

#1776

|

All Stars

24,354 posts Joined: Feb 2011 |

QUOTE(polarzbearz @ Oct 18 2020, 04:07 PM) My bad, looked wrongly You can consider trading212 but I only know how to fund it. I have no idea how to withdraw it without incurring huge bank fees.$1.5 / per US order Also found this website that compares broker - not bad. Between TD Ameritrade and TradeStation Global both seems to be strong contender. There's also IBKR but the inactivity/minimum commissions are really oof  |

|

|

Oct 18 2020, 11:21 PM Oct 18 2020, 11:21 PM

Show posts by this member only | IPv6 | Post

#1777

|

Senior Member

1,042 posts Joined: Jan 2003 |

Friendly warning: Do not put all your equity allocation into ARKx funds - they're highly volatile and subject to bigger drawdowns than S&P 500 index

I personally hold ARKK half for shits and giggles, to see if Tesla really can hit 7000 mark + whether the Organavo's 3D printed organs will be available in my lifetime |

|

|

Oct 18 2020, 11:30 PM Oct 18 2020, 11:30 PM

Show posts by this member only | IPv6 | Post

#1778

|

All Stars

24,354 posts Joined: Feb 2011 |

QUOTE(roarus @ Oct 18 2020, 11:21 PM) Friendly warning: Do not put all your equity allocation into ARKx funds - they're highly volatile and subject to bigger drawdowns than S&P 500 index Those who cannot tahan the roller coaster better don't buy. Those who can, will be rewarded handsomely.I personally hold ARKK half for shits and giggles, to see if Tesla really can hit 7000 mark + whether the Organavo's 3D printed organs will be available in my lifetime |

|

|

Oct 27 2020, 12:20 PM Oct 27 2020, 12:20 PM

Show posts by this member only | IPv6 | Post

#1779

|

Newbie

5 posts Joined: Sep 2011 |

Anyone here tried using Etoro for buying ETFs? the zero-commission seems promising although they do charge a spread fee

|

|

|

Oct 28 2020, 08:39 AM Oct 28 2020, 08:39 AM

Show posts by this member only | IPv6 | Post

#1780

|

Junior Member

73 posts Joined: Dec 2007 |

|

| Change to: |  0.0242sec 0.0242sec

1.15 1.15

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 12:00 PM |