QUOTE(alexkos @ May 25 2019, 11:02 PM)

Usd5k lei.All about ETFs / Foreign Brokers, Exchange traded funds

All about ETFs / Foreign Brokers, Exchange traded funds

|

|

May 25 2019, 11:08 PM May 25 2019, 11:08 PM

|

All Stars

24,346 posts Joined: Feb 2011 |

|

|

|

|

|

|

May 25 2019, 11:27 PM May 25 2019, 11:27 PM

Show posts by this member only | IPv6 | Post

#1222

|

Senior Member

2,275 posts Joined: Jun 2010 |

|

|

|

May 25 2019, 11:32 PM May 25 2019, 11:32 PM

|

All Stars

24,346 posts Joined: Feb 2011 |

|

|

|

May 25 2019, 11:45 PM May 25 2019, 11:45 PM

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(alexkos @ May 25 2019, 10:02 PM) i tot cheap ma no meh? cheapter than captrader oh... Interactive Brokers = No min funding, first 3 months waiver on min fee. After that, subject to min $10/month or min $20/month if total asset under $2000. Can choose between fixed or tiered rates for commission based on trading size and volume.so how ah? actually tradestation got caveat one right? must use IB (and pay monthly fee), then can only use tradestation. Then like that, tradestation still cheap meh? TradeStation/CapTrader/other whitelabels = Introducing broker to Interactive Brokers (think buying a MAS ticket but flight is Cathay's), has their own min funding (0 or more), monthly fee (0 or more) and commission charge (marked up from what Interactive Brokers charges them). Behind the scene is all using Interactive Brokers. I assume you want to open TradeStation for the friendlier commission rates? What do you plan to do with your holdings in CapTrader? Leave it there? Sell and buy again in TradeStation? Instead of going through the whole min funding process again with TradeStation why not transfer your over holdings from CapTrader? That way you can keep whatever SXR8 you bought in CapTrader (without paying sell and buy commissions again) and accumulate CSPX USD/GBP from now on in TradeStation. You could hit TradeStation support regarding moving over from CapTrader. Their rep will be happy to give you a call from London. I imagine it'll be an easy process since both are piggybacking on Interactive Brokers. |

|

|

May 25 2019, 11:51 PM May 25 2019, 11:51 PM

Show posts by this member only | IPv6 | Post

#1225

|

Senior Member

2,275 posts Joined: Jun 2010 |

QUOTE(roarus @ May 25 2019, 11:45 PM) Interactive Brokers = No min funding, first 3 months waiver on min fee. After that, subject to min $10/month or min $20/month if total asset under $2000. Can choose between fixed or tiered rates for commission based on trading size and volume. sui...macam legit....comrade will report back with outcomeTradeStation/CapTrader/other whitelabels = Introducing broker to Interactive Brokers (think buying a MAS ticket but flight is Cathay's), has their own min funding (0 or more), monthly fee (0 or more) and commission charge (marked up from what Interactive Brokers charges them). Behind the scene is all using Interactive Brokers. I assume you want to open TradeStation for the friendlier commission rates? What do you plan to do with your holdings in CapTrader? Leave it there? Sell and buy again in TradeStation? Instead of going through the whole min funding process again with TradeStation why not transfer your over holdings from CapTrader? That way you can keep whatever SXR8 you bought in CapTrader (without paying sell and buy commissions again) and accumulate CSPX USD/GBP from now on in TradeStation. You could hit TradeStation support regarding moving over from CapTrader. Their rep will be happy to give you a call from London. I imagine it'll be an easy process since both are piggybacking on Interactive Brokers. |

|

|

May 26 2019, 12:40 AM May 26 2019, 12:40 AM

|

Senior Member

9,354 posts Joined: Aug 2010 |

QUOTE(roarus @ May 25 2019, 11:45 PM) Interactive Brokers = No min funding, first 3 months waiver on min fee. After that, subject to min $10/month or min $20/month if total asset under $2000. Can choose between fixed or tiered rates for commission based on trading size and volume. While doing pleasure reading on these whitelabel brokerages, I noticed another great attribute of Captrader :-TradeStation/CapTrader/other whitelabels = Introducing broker to Interactive Brokers (think buying a MAS ticket but flight is Cathay's), has their own min funding (0 or more), monthly fee (0 or more) and commission charge (marked up from what Interactive Brokers charges them). Behind the scene is all using Interactive Brokers. I assume you want to open TradeStation for the friendlier commission rates? What do you plan to do with your holdings in CapTrader? Leave it there? Sell and buy again in TradeStation? Instead of going through the whole min funding process again with TradeStation why not transfer your over holdings from CapTrader? That way you can keep whatever SXR8 you bought in CapTrader (without paying sell and buy commissions again) and accumulate CSPX USD/GBP from now on in TradeStation. You could hit TradeStation support regarding moving over from CapTrader. Their rep will be happy to give you a call from London. I imagine it'll be an easy process since both are piggybacking on Interactive Brokers. https://www.captrader.com/en/payments/tax-information/ This is the important point : Withholding Tax Our customers enjoy the great advantage that the withholding tax is not automatically retained and you can benefit from your entire capital including income and profits. Since your account agreement is concluded with an American company, our customers have this comfortable lead. So,.. there is not going to be any WHT imposed against the US dividends paid-out from US companies. I am wondering how does Captrader then qualify as an intermediary, as well as as a Withholding Agent for US shares ? Tradestation has no mention of WHTs. |

|

|

|

|

|

May 26 2019, 01:55 AM May 26 2019, 01:55 AM

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(Hansel @ May 26 2019, 12:40 AM) While doing pleasure reading on these whitelabel brokerages, I noticed another great attribute of Captrader :- The German translated version adds more detail and confusion at the same time - it appears 30% WHT is still applicable (0% for interest = 0% for capital?), there's some paperwork filing required for reduction. Still, I don't see how one can just buy AAPL and file for tax reduction on the basis of broker/custodian domicile.https://www.captrader.com/en/payments/tax-information/ This is the important point : Withholding Tax Our customers enjoy the great advantage that the withholding tax is not automatically retained and you can benefit from your entire capital including income and profits. Since your account agreement is concluded with an American company, our customers have this comfortable lead. So,.. there is not going to be any WHT imposed against the US dividends paid-out from US companies. I am wondering how does Captrader then qualify as an intermediary, as well as as a Withholding Agent for US shares ? Tradestation has no mention of WHTs. In any case, Irish domiciled funds like CSPX and IWDA would already handle the withholding of taxes automatically. » Click to show Spoiler - click again to hide... « |

|

|

May 26 2019, 06:06 AM May 26 2019, 06:06 AM

Show posts by this member only | IPv6 | Post

#1228

|

All Stars

24,346 posts Joined: Feb 2011 |

QUOTE(roarus @ May 25 2019, 11:45 PM) Interactive Brokers = No min funding, first 3 months waiver on min fee. After that, subject to min $10/month or min $20/month if total asset under $2000. Can choose between fixed or tiered rates for commission based on trading size and volume. Source saying interactive broker need to maintain only USD2k? If USD2k is bloody cheap.TradeStation/CapTrader/other whitelabels = Introducing broker to Interactive Brokers (think buying a MAS ticket but flight is Cathay's), has their own min funding (0 or more), monthly fee (0 or more) and commission charge (marked up from what Interactive Brokers charges them). Behind the scene is all using Interactive Brokers. I assume you want to open TradeStation for the friendlier commission rates? What do you plan to do with your holdings in CapTrader? Leave it there? Sell and buy again in TradeStation? Instead of going through the whole min funding process again with TradeStation why not transfer your over holdings from CapTrader? That way you can keep whatever SXR8 you bought in CapTrader (without paying sell and buy commissions again) and accumulate CSPX USD/GBP from now on in TradeStation. You could hit TradeStation support regarding moving over from CapTrader. Their rep will be happy to give you a call from London. I imagine it'll be an easy process since both are piggybacking on Interactive Brokers. Everyone knows IB need USD100k. Unless of course they change the rules. This post has been edited by Ramjade: May 26 2019, 06:08 AM |

|

|

May 26 2019, 08:11 AM May 26 2019, 08:11 AM

|

Senior Member

9,354 posts Joined: Aug 2010 |

QUOTE(roarus @ May 26 2019, 01:55 AM) The German translated version adds more detail and confusion at the same time - it appears 30% WHT is still applicable (0% for interest = 0% for capital?), there's some paperwork filing required for reduction. Still, I don't see how one can just buy AAPL and file for tax reduction on the basis of broker/custodian domicile. Tq roarus,... I referred to the above bolded paragraph from the German translation.In any case, Irish domiciled funds like CSPX and IWDA would already handle the withholding of taxes automatically. » Click to show Spoiler - click again to hide... « That means ALMOST ALL of our capital is credited back to us upon payout,.. EXCEPT for dividend payouts under *Exception. Then upon filing for personal tax returns in the following year, we will declare the withheld taxes as accrued capital income. But will this accrued capital income be refunded to us ?? What does this mean : ...the custody compound is not located in Germany. |

|

|

May 26 2019, 11:31 AM May 26 2019, 11:31 AM

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(Ramjade @ May 26 2019, 06:06 AM) Source saying interactive broker need to maintain only USD2k? If USD2k is bloody cheap. More like maintaining AUM >$2000, otherwise you'll be slapped with min commission $20 instead of the regular $10Everyone knows IB need USD100k. Unless of course they change the rules.  https://www.interactivebrokers.com/en/index.php?f=4969 |

|

|

May 26 2019, 11:33 AM May 26 2019, 11:33 AM

Show posts by this member only | IPv6 | Post

#1231

|

All Stars

24,346 posts Joined: Feb 2011 |

QUOTE(roarus @ May 26 2019, 11:31 AM) More like maintaining AUM >$2000, otherwise you'll be slapped with min commission $20 instead of the regular $10 Still need USD100k.  https://www.interactivebrokers.com/en/index.php?f=4969 QUOTE We do not charge any account maintenance fee for any account that meets the following criteria: Greater than 100,000 USD in average equity for a calendar month or 10 USD in commissions generated in a calendar month. This post has been edited by Ramjade: May 26 2019, 11:35 AM |

|

|

May 26 2019, 02:05 PM May 26 2019, 02:05 PM

Show posts by this member only | IPv6 | Post

#1232

|

Senior Member

2,275 posts Joined: Jun 2010 |

So how ah? Anyone use Tradestation and pay zero commission using IB platform?

|

|

|

May 26 2019, 02:18 PM May 26 2019, 02:18 PM

Show posts by this member only | IPv6 | Post

#1233

|

All Stars

24,346 posts Joined: Feb 2011 |

|

|

|

|

|

|

May 26 2019, 02:51 PM May 26 2019, 02:51 PM

Show posts by this member only | IPv6 | Post

#1234

|

Senior Member

2,275 posts Joined: Jun 2010 |

wow wow wow...

myr cimb to sgd 1k need RM3112.80 meanwhile, myr to sgd via instarem only RM3060.70 apu......macam eat a lot oh..... instarem eat 0.45% cimb myr-sgd fast transfer eat 2.15%! wah kantoi lo like that myr -) sgd via cimb fast transfer already 2% commission, no need talk tradestation sgd -> eur/gbp already.... This post has been edited by alexkos: May 26 2019, 02:57 PM |

|

|

May 26 2019, 03:37 PM May 26 2019, 03:37 PM

Show posts by this member only | IPv6 | Post

#1235

|

All Stars

24,346 posts Joined: Feb 2011 |

QUOTE(alexkos @ May 26 2019, 02:51 PM) wow wow wow... Cimb MY - > SG yes the price is ridiculous. myr cimb to sgd 1k need RM3112.80 meanwhile, myr to sgd via instarem only RM3060.70 apu......macam eat a lot oh..... instarem eat 0.45% cimb myr-sgd fast transfer eat 2.15%! wah kantoi lo like that myr -) sgd via cimb fast transfer already 2% commission, no need talk tradestation sgd -> eur/gbp already.... Cimb SG - > MY sometimes can be cheaper than Transferwise, sometimes Transferwise cheaper than Cimb Sg |

|

|

May 26 2019, 04:43 PM May 26 2019, 04:43 PM

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(Hansel @ May 26 2019, 08:11 AM) Tq roarus,... I referred to the above bolded paragraph from the German translation. Perhaps best to clarify with CapTrader support if you have US stock holdings with them - I strongly believe it's still 30% one way or another for us Malaysian tax payers. In the worst case where CapTrader doesn't withhold any tax at all for all their clients, you're liable for filing it appropriately or risk falling under tax evasion with Uncle Sam.That means ALMOST ALL of our capital is credited back to us upon payout,.. EXCEPT for dividend payouts under *Exception. Then upon filing for personal tax returns in the following year, we will declare the withheld taxes as accrued capital income. But will this accrued capital income be refunded to us ?? What does this mean : ...the custody compound is not located in Germany. QUOTE(Ramjade @ May 26 2019, 11:33 AM) With IB's target demographic and clientele size, I don't foresee that limit being lifted anytime soon.QUOTE(alexkos @ May 26 2019, 02:05 PM) To be clear, TradeStation Global has zero monthly inactivity/min commission;IB (if you have <USD100k) on your 4th month onwards whether you trade or not: If your trade commission less than $10 you pay $10. If more, you pay that amount. If you don't do anything, you still pay $10. TradeStation: You buy something you pay trade/FX commission, you sell something you pay trade/FX commission. You don't do anything, you don't pay anything. If your habitual trade commission is less than $10 a month or you time the market, then go with TradeStation instead of IB (unless you have a cool USD100k of course) |

|

|

May 26 2019, 05:38 PM May 26 2019, 05:38 PM

|

Senior Member

2,275 posts Joined: Jun 2010 |

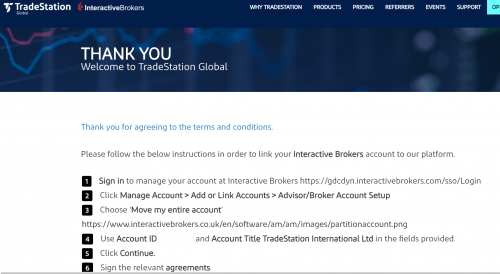

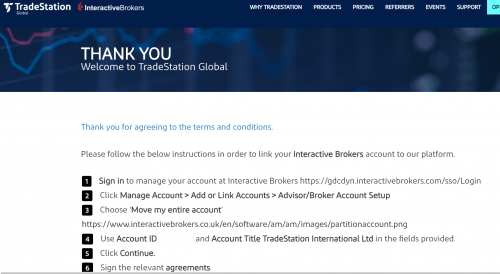

QUOTE(roarus @ May 26 2019, 04:43 PM) Perhaps best to clarify with CapTrader support if you have US stock holdings with them - I strongly believe it's still 30% one way or another for us Malaysian tax payers. In the worst case where CapTrader doesn't withhold any tax at all for all their clients, you're liable for filing it appropriately or risk falling under tax evasion with Uncle Sam. But when I open Tradestation, it keeps sending me back to IB page asking for funding. I show u document later. I'm stuck at this stage. They say must fund IB account to activate first, then only can initiate account linking to Tradestation. With IB's target demographic and clientele size, I don't foresee that limit being lifted anytime soon. To be clear, TradeStation Global has zero monthly inactivity/min commission; IB (if you have <USD100k) on your 4th month onwards whether you trade or not: If your trade commission less than $10 you pay $10. If more, you pay that amount. If you don't do anything, you still pay $10. TradeStation: You buy something you pay trade/FX commission, you sell something you pay trade/FX commission. You don't do anything, you don't pay anything. If your habitual trade commission is less than $10 a month or you time the market, then go with TradeStation instead of IB (unless you have a cool USD100k of course) When I call Tradestation IB say how, they say can't bypass IB. I dun paham. Very mafan compared to my captrader. Terus open je. |

|

|

May 26 2019, 05:46 PM May 26 2019, 05:46 PM

Show posts by this member only | IPv6 | Post

#1238

|

All Stars

24,346 posts Joined: Feb 2011 |

QUOTE(alexkos @ May 26 2019, 05:38 PM) But when I open Tradestation, it keeps sending me back to IB page asking for funding. I show u document later. I'm stuck at this stage. They say must fund IB account to activate first, then only can initiate account linking to Tradestation. Please read the FAQ. Everything in the FAQ. You need to fund IB with USD5K. Then they will give you username and password. Username and password can be used on both IB and trade station. When I call Tradestation IB say how, they say can't bypass IB. I dun paham. Very mafan compared to my captrader. Terus open je. Difference is going tradestation way means you won't get pure IB even if you login via IB. Hope is clear. |

|

|

May 26 2019, 05:47 PM May 26 2019, 05:47 PM

Show posts by this member only | IPv6 | Post

#1239

|

Senior Member

2,275 posts Joined: Jun 2010 |

u see, i stuck at step 1. Call tradestation, they ask me to call IB. But I don't remember have an active IB account. Tak mungkin captrader? then login IB (register one anyway), then bla bla bla say must funding....now can't login at all... apu.... This post has been edited by alexkos: May 26 2019, 05:48 PM pur er liked this post

|

|

|

May 26 2019, 05:55 PM May 26 2019, 05:55 PM

|

All Stars

24,346 posts Joined: Feb 2011 |

QUOTE(alexkos @ May 26 2019, 05:47 PM)  u see, i stuck at step 1. Call tradestation, they ask me to call IB. But I don't remember have an active IB account. Tak mungkin captrader? then login IB (register one anyway), then bla bla bla say must funding....now can't login at all... apu.... |

| Change to: |  0.0323sec 0.0323sec

0.26 0.26

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 8th December 2025 - 12:36 AM |