I wanna ask question.

1 got 2 credits card. 1 citibank, 1 cimb. Both got outstanding amount around RM 4k (total rm 8k). Now, I got around RM 5k cash to settle the amount in my credit card.

I want to terminate one CC and only use one CC.

My plans are

Plan A

Pay all outstanding amount in Citibank CC and the remaining cash to CIMB CC.

My total credit card outstanding amount is RM 3k (only in CIMB).

I will balance transfer RM 3k to my Citibank and terminate my CIMB cc.

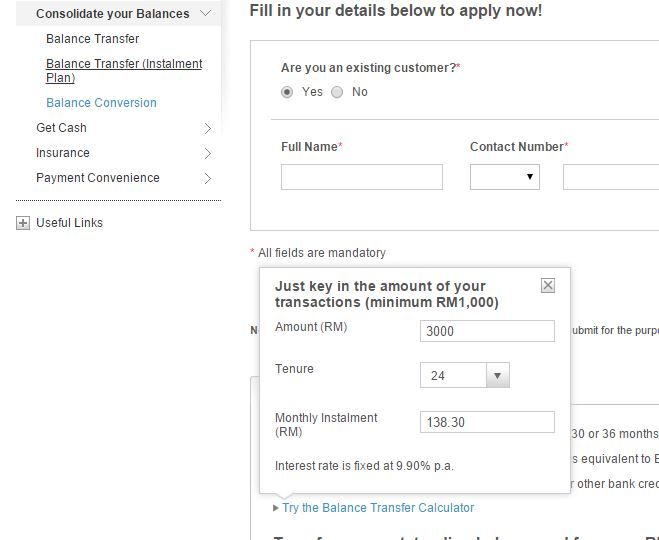

Citibank balance transfer - Flat Interest Rate between 5.32% - 5.81% p.a. which is equivalent to Effective Interest Rate (EIR) of 9.9% p.a.

Actually, I am not sure about difference between flat interest rate and effective interest rate.

I have to pay RM 138.30

Plan B

Pay all outstanding amount in CIMB CC and the remaining cash to Citibank CC.

My total credit card outstanding amount is RM 3k (only in Citibank).

I will do balance conversion RM 3k to my Citibank and terminate my CIMB cc.

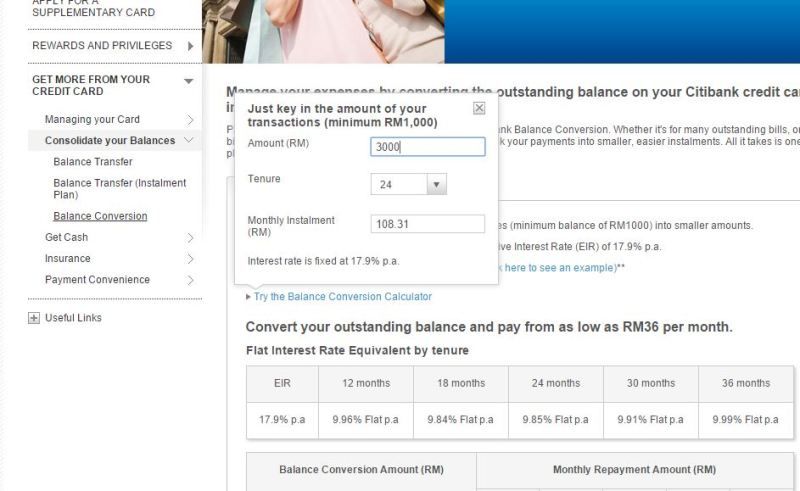

Citibank balance conversion - Flat Interest Rate between 9.84 - 9.99% p.a. for Effective Interest Rate (EIR) of 17.9% p.a.

I have to pay RM 108.31

The interest rate is higher in plan B but why do i need to pay $ lower than plan A?

The reason why i dont want to choose CIMB balance transfer is only max 12 month.

Which plan should i choose? Or u guys got other better plans?

Thank you for your help.

This post has been edited by Prince of Andalus: Jan 19 2016, 02:02 PM

Jan 19 2016, 01:27 PM

Jan 19 2016, 01:27 PM

Quote

Quote

0.0355sec

0.0355sec

0.63

0.63

7 queries

7 queries

GZIP Disabled

GZIP Disabled