QUOTE(davinz18 @ Sep 16 2014, 12:13 AM)

» Click to show Spoiler - click again to hide... «

10 years later, $3,100.

Where's OP?

Gold Investment Corner V8, All About Gold

|

|

Apr 9 2025, 04:46 PM Apr 9 2025, 04:46 PM

|

All Stars

12,268 posts Joined: Oct 2010 |

QUOTE(davinz18 @ Sep 16 2014, 12:13 AM) » Click to show Spoiler - click again to hide... « 10 years later, $3,100. Where's OP? |

|

|

|

|

|

Apr 9 2025, 05:08 PM Apr 9 2025, 05:08 PM

|

All Stars

24,454 posts Joined: Nov 2010 |

shirley bassey/bond - goldfinger - 1964

spandau ballet - gold - 1983 diehard3 - fed reserve heist -1995 guess many unkers here, i will not try to be older. looks correct, younglings won't go for gold, too old fashioned; crypto more sexy. |

|

|

Apr 9 2025, 05:51 PM Apr 9 2025, 05:51 PM

|

All Stars

24,454 posts Joined: Nov 2010 |

shud be of interest to you:

“Given the scale of the rout, that’s raising questions about whether the Federal Reserve might need to respond to stabilise market conditions, and we can even see from fed funds futures that markets are pricing a growing probability of an emergency cut, just as we saw during the Covid turmoil and the height of the GFC in 2008.” https://www.cnbc.com/2025/04/09/us-treasury...l-tariffs-.html China Just FREEZES All... https://www.youtube.com/watch?v=Cijfuy4wBZY |

|

|

Apr 9 2025, 08:03 PM Apr 9 2025, 08:03 PM

|

Senior Member

1,232 posts Joined: Mar 2019 |

|

|

|

Apr 10 2025, 09:45 AM Apr 10 2025, 09:45 AM

|

All Stars

24,454 posts Joined: Nov 2010 |

Date $/oz RM/g RM/$

10.04.25 3088 444.80 4.480 (trump tariffs 90 days pause; china tariff 125%; US 10 yr yield dropped to 4.27% from 4.50% after pause) 03.04.25 3151 454.30 4.480 (trump hefty reciprocal tariffs announced; equities sink, gold price record $3169/oz, RM455/g) 29.03.25 3085 440.22 4.437 (trade tensions mount with apr 2 tariffs approaching; gold price record high $3086/oz, RM440/g) 18.03.25 3015 430.80 4.443 (US airstrikes in yemen; US-Iran tensions; gold new record price $3015/oz, RM430.80/g) 11.03.25 2887 411.20 4.430 (retreat of US-EU equity markets; fed adopts "wait & see" for rate cuts; trump tariffs on china commence) 11.02.25 2919 419.60 4.458 (new trump tariffs on steel, aluminum; gold new high $2921/oz, RM419.8/g) 04.02.25 2817 403.70 4.456 (gold price hit new record high $2830/oz, RM407/g; tariffs on mexico, canada paused 1mth) 21.01.25 2722 392.00 4.477 (Trump2.0 inauguration, markets bracing for tariffs, bond yields falling, $ weakens) 10.01.25 2670 386.00 4.495 ("trump" inflation fears; china central bank continues buying bullion; incr in gold ETFs buying) 19.12.24 2603 376.90 4.503 (fed rate cut 25bps, signals slow down in 2025 cuts; DXY 108.1; carnage in disappointed equity markets) 08.11.24 2700 380.80 4.385 (fed rate cut 25bps) 07.11.24 2662 378.62 4.422 (trump win aftermath) good things come to those who wait. This post has been edited by AVFAN: Apr 10 2025, 09:45 AM |

|

|

Apr 10 2025, 12:17 PM Apr 10 2025, 12:17 PM

Show posts by this member only | IPv6 | Post

#5506

|

Senior Member

1,226 posts Joined: Nov 2012 |

The rebound after tanking at 3k is so fast.

|

|

|

|

|

|

Apr 10 2025, 01:23 PM Apr 10 2025, 01:23 PM

Show posts by this member only | IPv6 | Post

#5507

|

Senior Member

1,232 posts Joined: Mar 2019 |

Here’s a list of 23 plausible excuses, one for each year from 2002 to 2024, to justify why you didn’t buy gold over the past 23 years. 2002: I was too busy trying to figure out if Y2K was still going to happen. 2003: I thought the Iraq War would tank the economy, so I held off on investments. 2004: I spent all my money on a flip phone to look cool. 2005: I was convinced Hurricane Katrina meant we’d all be bartering with canned goods instead. 2006: I got distracted by the hype around the first YouTube videos. 2007: I was saving up for a Wii instead—priorities! 2008: The financial crisis hit, and I thought gold was just jewelry, not an investment. 2009: I was too broke from the recession to even think about gold. 2010: I figured the world would end in 2012, so why bother? 2011: Gold prices peaked, and I didn’t want to buy at the top like a sucker. 2012: I was stockpiling for the Mayan apocalypse instead. 2013: I got caught up in the Bitcoin craze and forgot about gold. 2014: I thought oil prices crashing meant gold was next. 2015: I was too busy binge-watching Netflix’s new shows. 2016: The election chaos made me think cash under the mattress was safer. 2017: I spent my money on overpriced avocado toast instead. 2018: I was waiting for the trade war with China to settle down first. 2019: I thought the economy was too good—gold seemed boring. 2020: I was hoarding toilet paper during the pandemic, not gold. 2021: I got distracted by meme stocks like GameStop. 2022: Inflation scared me, but I spent my cash on gas instead. 2023: I was too busy arguing about AI taking over the world. 2024: I figured I’d wait for gold to hit an even $2,000 per ounce—missed it again! 2025:? |

|

|

Apr 10 2025, 01:56 PM Apr 10 2025, 01:56 PM

|

Senior Member

1,961 posts Joined: Jun 2010 |

Hi. would like to ask about the Poh Kong Bunga Raya gold bar buy-sell spread. Lets say I buy 10g - RM5,300. how much can get if sell?

Thanks |

|

|

Apr 10 2025, 02:16 PM Apr 10 2025, 02:16 PM

|

Senior Member

3,623 posts Joined: Apr 2019 |

|

|

|

Apr 10 2025, 02:18 PM Apr 10 2025, 02:18 PM

Show posts by this member only | IPv6 | Post

#5510

|

Junior Member

431 posts Joined: Apr 2010 |

|

|

|

Apr 10 2025, 02:25 PM Apr 10 2025, 02:25 PM

|

Junior Member

164 posts Joined: Sep 2022 |

|

|

|

Apr 10 2025, 02:30 PM Apr 10 2025, 02:30 PM

|

All Stars

24,454 posts Joined: Nov 2010 |

QUOTE(alandhw @ Apr 10 2025, 01:56 PM) Hi. would like to ask about the Poh Kong Bunga Raya gold bar buy-sell spread. Lets say I buy 10g - RM5,300. how much can get if sell? all these gold shops sell at a common agreed "list" price, currently at RM515/g for 999.9 gold.Thanks https://www.pohkong.com.my/collections/shop...ldbar-and-coins there may be workmanship cost in the selling price. (e.g. 10g x 515 +150 = 5300) when u sell back to them it is calc on prevailing price less 10-20% depending on shop. small bars & coins, jewelry, u can buy at these shops. bigger bars, larger amounts, u get much better price with the bullion traders. |

|

|

Apr 10 2025, 02:46 PM Apr 10 2025, 02:46 PM

Show posts by this member only | IPv6 | Post

#5513

|

Junior Member

543 posts Joined: Apr 2006 |

|

|

|

|

|

|

Apr 10 2025, 02:49 PM Apr 10 2025, 02:49 PM

Show posts by this member only | IPv6 | Post

#5514

|

Senior Member

1,226 posts Joined: Nov 2012 |

|

|

|

Apr 10 2025, 03:04 PM Apr 10 2025, 03:04 PM

|

Senior Member

1,407 posts Joined: May 2010 |

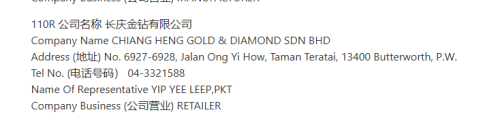

QUOTE(AVFAN @ Apr 10 2025, 02:30 PM) all these gold shops sell at a common agreed "list" price, currently at RM515/g for 999.9 gold. not all jewelry shop selling same pricehttps://www.pohkong.com.my/collections/shop...ldbar-and-coins there may be workmanship cost in the selling price. (e.g. 10g x 515 +150 = 5300) when u sell back to them it is calc on prevailing price less 10-20% depending on shop. small bars & coins, jewelry, u can buy at these shops. bigger bars, larger amounts, u get much better price with the bullion traders. this shop below give competitive price overall https://chiangheng.com/ |

|

|

Apr 10 2025, 03:13 PM Apr 10 2025, 03:13 PM

|

All Stars

24,454 posts Joined: Nov 2010 |

QUOTE(Iceman74 @ Apr 10 2025, 03:04 PM) not all jewelry shop selling same price this one is indeed cheaper, possibly not part of the assoc or something.this shop below give competitive price overall https://chiangheng.com/ pohkong, sk, tomei, all same now at 515/g. |

|

|

Apr 10 2025, 03:16 PM Apr 10 2025, 03:16 PM

|

Senior Member

1,407 posts Joined: May 2010 |

QUOTE(AVFAN @ Apr 10 2025, 03:13 PM) this one is indeed cheaper, possibly not part of the assoc or something. already check them out... they are part of the association.pohkong, sk, tomei, all same now at 515/g. the conditions of the association don't mention any fixed price at all. Those in bold have higher overhead due to setting up in mall and advertisement at first i was like you, I tot price of gold are fixed amongst jewelry shop but was introduce by friend, can get cheaper there. after doing research, there is no such thing of fixed price among jewelry shop https://fgjam.org.my/member-four/  This post has been edited by Iceman74: Apr 10 2025, 03:26 PM AVFAN liked this post

|

|

|

Apr 10 2025, 03:47 PM Apr 10 2025, 03:47 PM

|

Senior Member

1,961 posts Joined: Jun 2010 |

QUOTE(alandhw @ Apr 10 2025, 01:56 PM) Hi. would like to ask about the Poh Kong Bunga Raya gold bar buy-sell spread. Lets say I buy 10g - RM5,300. how much can get if sell? I just check with Poh Kong, the selling price is 10g - RM4,399. so the spread is around 17%Thanks Wonder how can make money with such a high spread rate |

|

|

Apr 10 2025, 03:49 PM Apr 10 2025, 03:49 PM

|

Senior Member

1,961 posts Joined: Jun 2010 |

|

|

|

Apr 10 2025, 03:53 PM Apr 10 2025, 03:53 PM

|

Senior Member

1,407 posts Joined: May 2010 |

QUOTE(alandhw @ Apr 10 2025, 03:47 PM) I just check with Poh Kong, the selling price is 10g - RM4,399. so the spread is around 17% I stop buying any gold from any of those famous shop as much as possible. Wonder how can make money with such a high spread rate If jewellery, then no choice as some of them unique design. Last year brought 1 for my son 21st key chain from Wah Chan and get super discount tim. BTW even they from same company, different outlet might have different pricing too. Found out this went brought the key as my friend brought same item but different locations This post has been edited by Iceman74: Apr 10 2025, 05:33 PM |

| Change to: |  0.0182sec 0.0182sec

0.29 0.29

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 8th December 2025 - 12:41 AM |